1040 X Form Alabama

What is the 1040 X Form Alabama

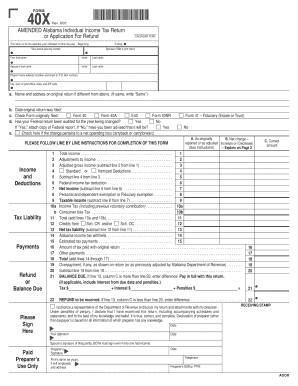

The 1040 X Form Alabama is an amended tax return form used by taxpayers in Alabama to correct errors on their original 1040 tax return. This form allows individuals to make adjustments to their income, deductions, credits, and filing status. It is essential for ensuring that taxpayers accurately report their financial information and comply with state tax laws.

How to use the 1040 X Form Alabama

To use the 1040 X Form Alabama, taxpayers must first complete the form by providing the necessary information regarding the changes being made. This includes detailing the original amounts from the initial return and the corrected amounts. After completing the form, it must be signed and submitted to the Alabama Department of Revenue. It is important to keep a copy of the amended return for personal records.

Steps to complete the 1040 X Form Alabama

Completing the 1040 X Form Alabama involves several steps:

- Obtain the 1040 X Form Alabama from the Alabama Department of Revenue website or other authorized sources.

- Fill in your personal information, including name, address, and Social Security number.

- Indicate the tax year for which you are amending your return.

- Provide the original amounts from your initial return in the designated fields.

- Enter the corrected amounts and explain the reasons for the amendments in the provided space.

- Sign and date the form before submission.

Legal use of the 1040 X Form Alabama

The legal use of the 1040 X Form Alabama is crucial for maintaining compliance with state tax regulations. This form must be filed within three years of the original return's due date or within two years of the date the tax was paid, whichever is later. Proper use of the form ensures that any changes to tax liability are documented and accepted by the Alabama Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 X Form Alabama are critical for avoiding penalties. Generally, the amended return must be filed within three years from the original return's due date. Taxpayers should also be aware of any specific deadlines related to the tax year they are amending, as these can vary. It is advisable to check the Alabama Department of Revenue's official guidelines for the most accurate dates.

Form Submission Methods (Online / Mail / In-Person)

The 1040 X Form Alabama can be submitted through various methods. Taxpayers may choose to file the form online using the Alabama Department of Revenue's e-filing system, which provides a convenient option for many. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submissions may also be accepted at designated offices, depending on local regulations.

Quick guide on how to complete 1040 x form alabama

Complete 1040 X Form Alabama seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hassles. Manage 1040 X Form Alabama on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and eSign 1040 X Form Alabama effortlessly

- Locate 1040 X Form Alabama and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign 1040 X Form Alabama to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1040 x form Alabama and how is it used?

The 1040 x form Alabama is a tax amendment form used to correct errors on your original Alabama state tax return. This form allows you to provide accurate information for the state tax authorities, ensuring compliance and avoiding potential penalties. This is vital for residents or businesses that want to rectify past tax submissions efficiently.

-

How can airSlate SignNow help me with the 1040 x form Alabama?

airSlate SignNow simplifies the process of signing and sending your 1040 x form Alabama electronically. With our user-friendly platform, you can quickly prepare your amendment form, sign it, and send it to the appropriate tax offices. This not only saves time but also enhances the accuracy of your submission.

-

What features does airSlate SignNow offer for managing the 1040 x form Alabama?

Our platform provides features such as secure e-signature capabilities, document tracking, and templates specifically for the 1040 x form Alabama. These tools ensure your amendments are submitted correctly and promptly, keeping your business operations running smoothly. Additionally, you benefit from comprehensive support throughout the process.

-

Is there a cost associated with using airSlate SignNow for the 1040 x form Alabama?

Yes, while airSlate SignNow offers various pricing plans, the investment is minimal compared to the time and resources saved in managing your 1040 x form Alabama. Our competitive pricing is designed to be cost-effective for businesses of all sizes, enhancing your efficiency without breaking the bank.

-

Are there any integrations available with airSlate SignNow for handling the 1040 x form Alabama?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications and platforms. This means you can easily import or export your 1040 x form Alabama data from other software, enhancing your workflow without disruption and ensuring all necessary information is accessible.

-

What benefits can I expect from using airSlate SignNow for my 1040 x form Alabama?

Using airSlate SignNow for your 1040 x form Alabama offers numerous benefits, including improved accuracy in document submissions and enhanced security for sensitive information. Furthermore, our service increases your efficiency by allowing quick edits and easy e-signatures, all while maintaining compliance with state regulations.

-

How long does it take to process the 1040 x form Alabama with airSlate SignNow?

The processing time for the 1040 x form Alabama can vary depending on the complexities of your amendments and the state’s processing times. However, using airSlate SignNow accelerates the initial submission process signNowly, ensuring your documents are sent promptly and allowing you to track their status easily.

Get more for 1040 X Form Alabama

- Application to discharge form

- B check if a form fill out and sign printable pdf

- Form 749 revised 9 2014 personalized license plate application mvc not for motorcycles submit all original or replacement

- Submit all original or replacement applications to the form

- Application for firefighter license plates oklahoma ok form

- Firefighter plate application iowa fire chiefs form

- Affidavit for issuance of title for a proportionally registered form

- Farm endorsement application x oregongov form

Find out other 1040 X Form Alabama

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now