Bulletin Daily Paper 32813 by Western Communications, Inc Form

Understanding the Arkansas Sales Tax Form

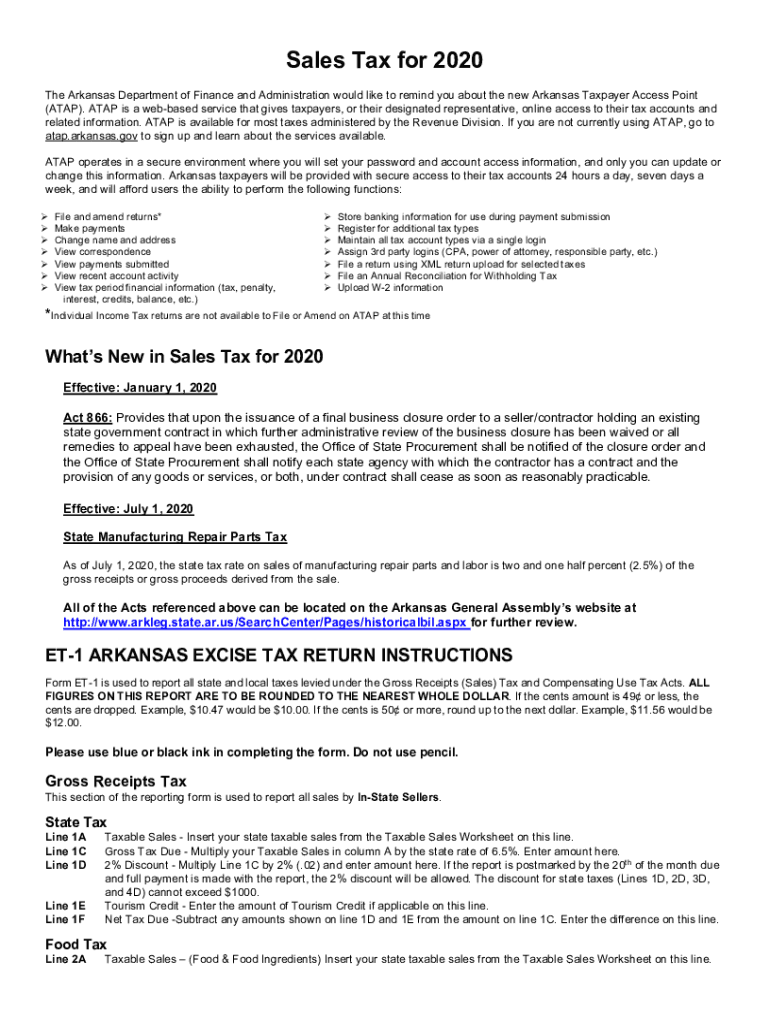

The Arkansas sales tax form, also known as the Arkansas sales and use tax form ET-1, is essential for businesses operating in Arkansas. This form is used to report and remit sales tax collected from customers. It is important for compliance with state tax regulations and helps ensure that businesses contribute to local and state revenue. Understanding the details of this form can help business owners avoid penalties and ensure accurate reporting.

Steps to Complete the Arkansas Sales Tax Form

Filling out the Arkansas sales tax form ET-1 involves several straightforward steps:

- Gather necessary information, including your business name, address, and sales tax permit number.

- Calculate the total sales made during the reporting period, including taxable and non-taxable sales.

- Determine the total sales tax collected from customers.

- Complete the form by entering the required information in the designated fields.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Arkansas Sales Tax Form

Timely filing of the Arkansas sales tax form is crucial to avoid penalties. The filing deadlines vary based on the frequency of your tax reporting. Most businesses are required to file monthly, with forms due on the 20th of the month following the reporting period. Some smaller businesses may qualify for quarterly or annual filing. It is important to check with the Arkansas Department of Revenue for specific deadlines relevant to your business.

Form Submission Methods for the Arkansas Sales Tax Form

Businesses can submit the Arkansas sales tax form ET-1 through various methods:

- Online submission via the Arkansas Department of Revenue's website, which is the most efficient method.

- Mailing a paper form to the appropriate address provided by the Department of Revenue.

- In-person submission at local Department of Revenue offices, which may be necessary for certain situations.

Penalties for Non-Compliance with the Arkansas Sales Tax Form

Failure to file the Arkansas sales tax form on time or inaccuracies in reporting can lead to significant penalties. Common penalties include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid sales tax, increasing the total amount owed.

- Potential legal action for persistent non-compliance, which can affect business operations.

Key Elements of the Arkansas Sales Tax Form

When completing the Arkansas sales tax form, several key elements must be accurately reported:

- Business information, including name, address, and tax identification number.

- Gross sales amount and breakdown of taxable versus non-taxable sales.

- Total sales tax collected during the reporting period.

- Any exemptions or deductions that apply to your sales.

Eligibility Criteria for Filing the Arkansas Sales Tax Form

To file the Arkansas sales tax form, businesses must meet certain eligibility criteria:

- Hold a valid Arkansas sales tax permit issued by the Arkansas Department of Revenue.

- Engage in taxable sales within the state of Arkansas.

- Maintain accurate records of all sales transactions to support the information reported on the form.

Quick guide on how to complete bulletin daily paper 32813 by western communications inc

Effortlessly prepare Bulletin Daily Paper 32813 By Western Communications, Inc on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an optimal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Bulletin Daily Paper 32813 By Western Communications, Inc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Bulletin Daily Paper 32813 By Western Communications, Inc effortlessly

- Locate Bulletin Daily Paper 32813 By Western Communications, Inc and click Get Form to commence.

- Utilize the available tools to complete your form.

- Emphasize crucial sections of your documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Bulletin Daily Paper 32813 By Western Communications, Inc while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Arkansas excise tax form ET 1 form?

The Arkansas excise tax form ET 1 form is a document required for reporting and paying excise taxes in the state of Arkansas. Businesses must complete this form accurately to ensure compliance with state tax regulations. Utilizing airSlate SignNow can streamline the process of filling out and submitting the Arkansas excise tax form ET 1 form.

-

How can I fill out the Arkansas excise tax form ET 1 form electronically?

Filling out the Arkansas excise tax form ET 1 form electronically is simple with airSlate SignNow. Our platform provides user-friendly tools to complete and e-sign forms securely. Once filled, you can directly submit the Arkansas excise tax form ET 1 form to the relevant authorities.

-

Is there a cost associated with using airSlate SignNow for the Arkansas excise tax form ET 1 form?

Yes, using airSlate SignNow involves minimal costs that are signNowly lower than traditional document management solutions. Our pricing plans are designed to be cost-effective while providing comprehensive features for handling the Arkansas excise tax form ET 1 form and other documents seamlessly.

-

Can I store my completed Arkansas excise tax form ET 1 form in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage where you can save your completed Arkansas excise tax form ET 1 form. This feature allows for easy retrieval and ensures that your important documents are safe and accessible whenever you need them.

-

What features does airSlate SignNow offer for handling the Arkansas excise tax form ET 1 form?

airSlate SignNow offers a range of features specifically designed to simplify the management of the Arkansas excise tax form ET 1 form, including e-signature, document templates, and real-time collaboration. These tools enhance efficiency and ensure your documents are processed quickly and accurately.

-

Are there integrations available to assist with the Arkansas excise tax form ET 1 form?

Yes, airSlate SignNow integrates with various applications to enhance your workflow, making it easier to manage the Arkansas excise tax form ET 1 form. You can connect with accounting software and project management tools to streamline the filing and tracking process.

-

What benefits does using airSlate SignNow provide for businesses filing the Arkansas excise tax form ET 1 form?

Using airSlate SignNow to handle the Arkansas excise tax form ET 1 form offers several benefits including increased efficiency, reduced paperwork, and enhanced compliance. Our user-friendly platform helps businesses complete the form quickly while maintaining accuracy, thus saving time and resources.

Get more for Bulletin Daily Paper 32813 By Western Communications, Inc

Find out other Bulletin Daily Paper 32813 By Western Communications, Inc

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form