California Tax Exempt Form 2015

What is the California Tax Exempt Form

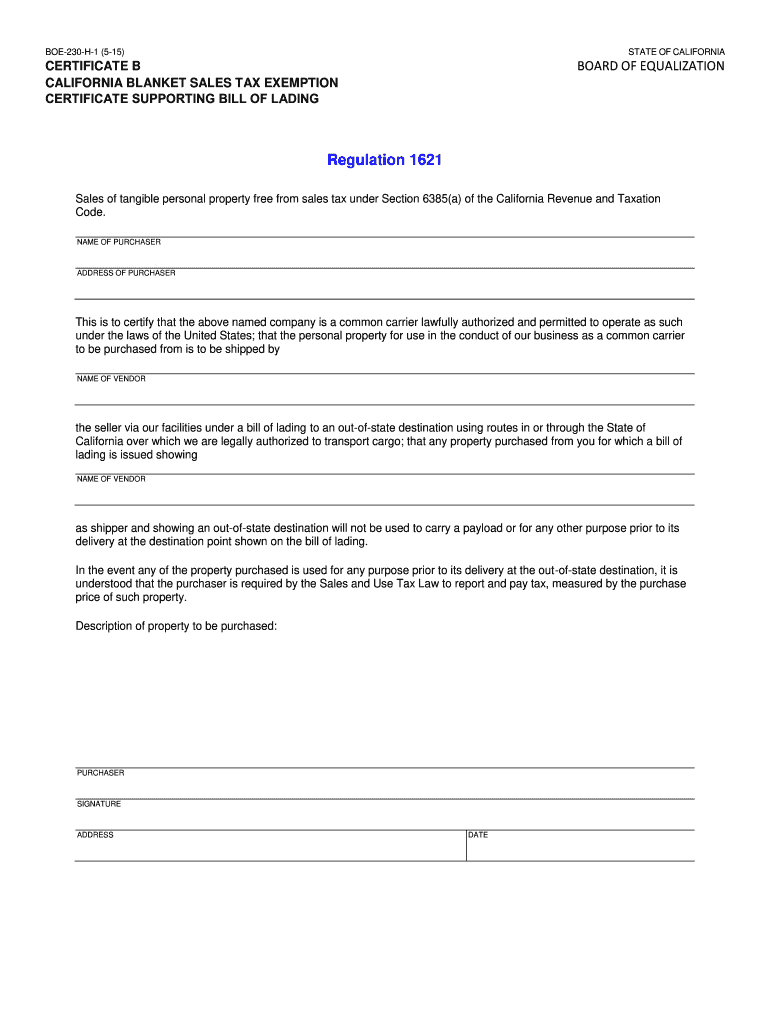

The California tax exempt form, often referred to as the CA exemption certificate, is a document that allows qualifying entities to purchase goods or services without paying sales tax. This form is primarily used by organizations that are exempt from sales tax, including non-profits, government agencies, and certain educational institutions. By providing this certificate to vendors, these entities can ensure compliance with state tax regulations while minimizing their tax burden.

How to use the California Tax Exempt Form

To effectively use the California tax exemption certificate, an eligible entity must complete the form accurately and present it to the seller at the time of purchase. The seller will retain the certificate as proof of the tax-exempt status. It is essential to ensure that the information on the form is current and that the entity meets the eligibility criteria set forth by the state. Misuse of the form can lead to penalties and tax liabilities.

Steps to complete the California Tax Exempt Form

Completing the California tax exempt form involves several key steps:

- Obtain the correct version of the CA exemption certificate from the California Department of Tax and Fee Administration (CDTFA) website.

- Fill in the required fields, including the name of the exempt organization, address, and reason for exemption.

- Provide the seller's information and the date of the transaction.

- Sign and date the form to validate it.

Once completed, the form should be presented to the seller to facilitate the tax-exempt purchase.

Legal use of the California Tax Exempt Form

The legal use of the California tax exemption certificate is governed by state tax laws. Entities must ensure they are eligible for exemption and that their use of the form aligns with the specific purposes outlined by the California Department of Tax and Fee Administration. Misrepresentation or improper use of the form can result in legal consequences, including fines and back taxes.

Eligibility Criteria

To qualify for the California tax exemption certificate, entities must meet specific eligibility criteria. Generally, these include:

- Being a recognized non-profit organization, such as a charity or educational institution.

- Being a government entity or agency.

- Engaging in specific activities that are exempt under California tax laws.

It is crucial for applicants to review the detailed requirements provided by the CDTFA to ensure compliance.

Who Issues the Form

The California tax exemption certificate is issued by the California Department of Tax and Fee Administration (CDTFA). This state agency is responsible for administering sales and use tax laws in California, including overseeing the issuance and management of tax exemption certificates. Organizations seeking to obtain the form must adhere to the guidelines established by the CDTFA.

Quick guide on how to complete california tax exempt form

Complete California Tax Exempt Form seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage California Tax Exempt Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign California Tax Exempt Form effortlessly

- Find California Tax Exempt Form and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight essential sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign California Tax Exempt Form and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california tax exempt form

Create this form in 5 minutes!

People also ask

-

What is a California tax exemption certificate?

A California tax exemption certificate is a document that allows certain organizations to make purchases without paying sales tax. This certificate is typically issued to nonprofit organizations, government entities, and other qualifying groups. By using this certificate, eligible buyers can save money on tax-exempt purchases. Understanding this certificate is essential for compliance and budgeting purposes.

-

How can I obtain a California tax exemption certificate?

To obtain a California tax exemption certificate, you must complete the appropriate application form provided by the California Department of Tax and Fee Administration. Depending on your organization type, additional documentation may be required to prove your eligibility for tax exemption. Once submitted and approved, you'll receive your certificate. This process ensures that you have the necessary documentation to make tax-exempt purchases.

-

What types of organizations are eligible for a California tax exemption certificate?

Eligible organizations for a California tax exemption certificate include nonprofit organizations, religious institutions, and government agencies. Educational institutions may also qualify for tax exemption. It's important to review the specific requirements listed by the state to ensure your organization meets the necessary criteria for obtaining a certificate.

-

How does airSlate SignNow integrate with my California tax exemption practices?

airSlate SignNow streamlines the process of managing and sending documents related to California tax exemption certificates. With its secure eSigning features, businesses can quickly obtain necessary signatures for tax exemption documents. The platform’s integration capabilities also allow for easy coordination with accounting systems to maintain accurate records of tax-exempt purchases.

-

Are there any fees associated with obtaining a California tax exemption certificate?

Generally, there are no fees for obtaining a California tax exemption certificate through the state's application process. However, organizations may incur costs related to preparing necessary documentation or legal assistance if needed. Utilizing airSlate SignNow can help minimize costs associated with the document-signing process by providing an affordable solution for managing your tax exemption certificates.

-

What are the benefits of using airSlate SignNow for California tax exemption certificates?

Using airSlate SignNow for California tax exemption certificates offers multiple benefits, including time efficiency and cost savings. The platform allows users to quickly create, send, and eSign necessary documents securely. Additionally, its user-friendly interface can help teams collaborate more effectively, ensuring all tax exemption processes are properly managed and recorded.

-

Can airSlate SignNow help me stay compliant with California tax exemption regulations?

Yes, airSlate SignNow assists organizations in staying compliant with California tax exemption regulations by providing a secure platform to manage and store tax-related documents. The tool also helps ensure that all necessary signatures are obtained and that documents are readily accessible for audits or review. With airSlate SignNow, businesses can maintain an organized approach to compliance.

Get more for California Tax Exempt Form

- Form 901instructions trade or service mark application the

- Instructions for completing the business californiaforms samples and fees california secretary of statebusiness entities

- This form can be submitted electronically californiathis form can be submitted electronically californiareferencethis form can

- Before submitting the completed form you should consult with a private attorney for advice about your specific

- Bea events cmo elegir a tus damas de honor o quotbridesmaidsquot form

- Limited liability company llc cancellation requirements instructions for completing the certificate of limited liability form

- Printable trademark application form in california

- Authorization to release medical information c ohio bwc

Find out other California Tax Exempt Form

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy