D2l2jhoszs7d12 Cloudfront NetstateCACertificate a California Sales Tax Exemption Certificate 2017-2026

Understanding the California Sales Tax Exemption Certificate

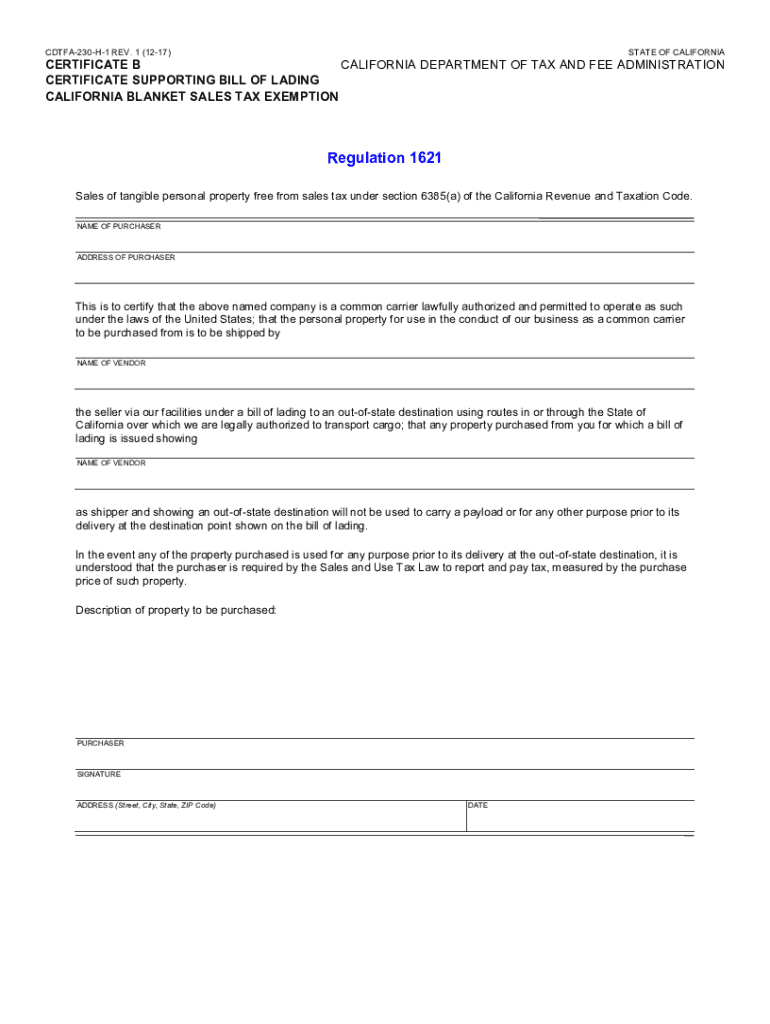

The California Sales Tax Exemption Certificate is a crucial document for businesses and individuals seeking to exempt certain purchases from sales tax. This certificate allows eligible purchasers to buy items without paying sales tax, provided the items are intended for specific uses, such as resale or for use in manufacturing. Understanding the purpose and legal implications of this certificate is essential for compliance with state tax regulations.

Steps to Complete the California Sales Tax Exemption Certificate

Completing the California Sales Tax Exemption Certificate involves a few straightforward steps:

- Download the appropriate form from the California Department of Tax and Fee Administration (CDTFA) website.

- Fill in the required information, including the purchaser's name, address, and the reason for the exemption.

- Specify the type of property being purchased and ensure it aligns with the exemption criteria.

- Sign and date the certificate to validate its authenticity.

Once completed, the certificate should be provided to the seller at the time of purchase.

Legal Use of the California Sales Tax Exemption Certificate

The legal use of the California Sales Tax Exemption Certificate is governed by state law. It is important to use this certificate only for qualifying purchases. Misuse of the certificate can result in penalties, including fines and back taxes owed. Sellers should retain a copy of the certificate for their records to demonstrate compliance during audits.

Eligibility Criteria for the California Sales Tax Exemption Certificate

To qualify for the California Sales Tax Exemption Certificate, purchasers must meet specific criteria:

- The purchaser must be engaged in a business that sells tangible personal property.

- The items purchased must be for resale or for use in manufacturing or other exempt activities.

- The purchaser must provide valid documentation to support their claim for exemption.

Understanding these criteria helps ensure that the exemption is applied correctly and legally.

Examples of Using the California Sales Tax Exemption Certificate

Here are some common scenarios where the California Sales Tax Exemption Certificate may be utilized:

- A retailer purchasing inventory for resale.

- A manufacturer buying raw materials to produce goods.

- A nonprofit organization acquiring supplies for exempt purposes.

These examples illustrate how the certificate can facilitate tax savings for eligible entities.

Required Documents for the California Sales Tax Exemption Certificate

When applying for or using the California Sales Tax Exemption Certificate, certain documents may be required:

- Proof of business registration or incorporation.

- Documentation supporting the nature of the business and the intended use of the purchased items.

- Any additional forms required by the CDTFA for specific exemptions.

Having these documents ready can streamline the process and ensure compliance with state regulations.

Quick guide on how to complete d2l2jhoszs7d12cloudfrontnetstatecacertificate a california sales tax exemption certificate

Effortlessly Prepare D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents rapidly and without interruptions. Handle D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and eSign D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate with Ease

- Obtain D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate and click on Get Form to initiate.

- Utilize the provided tools to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Edit and eSign D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d2l2jhoszs7d12cloudfrontnetstatecacertificate a california sales tax exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the d2l2jhoszs7d12cloudfrontnetstatecacertificate a california sales tax exemption certificate

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

The best way to create an e-signature for a PDF file on Android devices

People also ask

-

What is a tax exempt certificate?

A tax exempt certificate is a document that allows businesses to purchase goods or services without paying sales tax. This certificate is essential for saving money and managing tax compliance effectively. By using airSlate SignNow, you can process tax exempt certificates efficiently and securely.

-

How can airSlate SignNow help with tax exempt certificate management?

airSlate SignNow streamlines the process of managing tax exempt certificates by providing an intuitive platform for document creation and electronic signatures. This simplifies obtaining signatures and ensures that your tax exempt certificates are stored securely. With automated workflows, you can track and manage these certificates effectively.

-

Is there a cost associated with using airSlate SignNow for tax exempt certificates?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features specifically designed for managing tax exempt certificates. By investing in our solution, you gain access to tools that simplify tax compliance and improve operational efficiency. Review our pricing model for more information on our offerings.

-

What features does airSlate SignNow provide for tax exempt certificates?

With airSlate SignNow, you have access to essential features for tax exempt certificates, including document templates, eSignature functionality, and secure storage options. These features empower businesses to automate and expedite the process of obtaining and managing these certificates. Enhanced collaboration tools also make it easy to share and review tax exempt documents.

-

Can I integrate airSlate SignNow with other platforms for managing tax exempt certificates?

Absolutely! airSlate SignNow provides seamless integrations with various software and business applications, allowing you to manage tax exempt certificates alongside your existing workflows. This integration capability helps enhance productivity and ensures a cohesive workflow between systems. Check out our integration options to find the best fit for your needs.

-

How secure is the data when using airSlate SignNow for tax exempt certificates?

Security is a top priority for airSlate SignNow. When managing tax exempt certificates, we use advanced encryption and secure cloud storage to protect your sensitive documents. Additionally, we comply with industry standards to ensure that your data remains safe and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for tax exempt certificates?

Using airSlate SignNow for your tax exempt certificate needs provides numerous benefits, including reduced processing times, cost savings, and improved compliance with tax laws. Our easy-to-use interface allows users to quickly create, sign, and manage certificates without the hassle of traditional paperwork. This efficiency helps businesses focus on what they do best.

Get more for D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate

- Hawaii motion for issuance of garnishee summons after judgment form

- Hawaii hawaii garnishee order form

- Hawaii sample notices resolutions stock ledger and certificate form

- Hawaii order for name change form

- Hi satisfaction mortgage form

- Iowa buyers notice of intent to vacate and surrender property to seller under contract for deed form

- Iowa contract land form

- Notice default form 481379478

Find out other D2l2jhoszs7d12 cloudfront netstateCACertificate A California Sales Tax Exemption Certificate

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now