Tax Check Authorization, Waiver, and Request to Release Form

What is the Tax Check Authorization, Waiver, and Request to Release

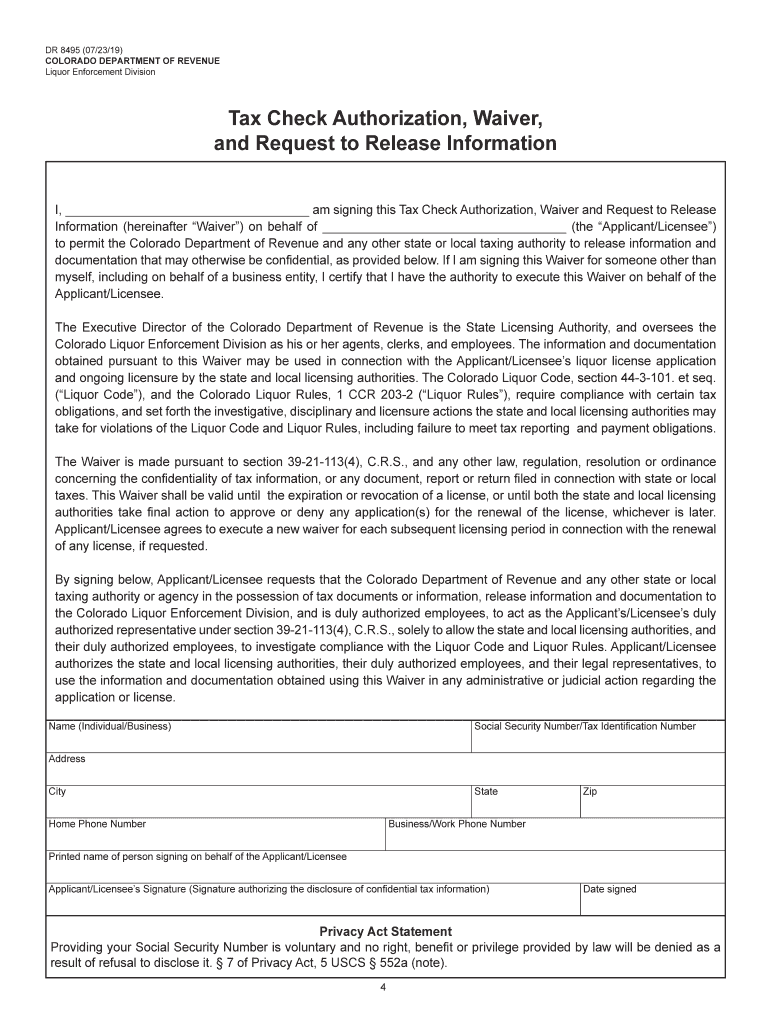

The Tax Check Authorization, Waiver, and Request to Release is a crucial form used in the state of Colorado. It allows individuals or businesses to authorize the release of their tax information to a third party. This form is particularly important for those seeking to obtain financing, legal assistance, or other services that require verification of tax compliance. By completing this form, taxpayers can ensure that their tax records are accessible to authorized parties while maintaining compliance with state regulations.

Steps to Complete the Tax Check Authorization, Waiver, and Request to Release

Completing the Tax Check Authorization, Waiver, and Request to Release involves several key steps:

- Gather necessary information, including your personal identification details and tax identification number.

- Clearly specify the third party to whom you are granting access to your tax information.

- Indicate the purpose for which the tax information is being requested.

- Sign and date the form to validate your authorization.

- Submit the completed form to the appropriate tax authority or the designated third party.

Ensuring that all information is accurate and complete will help prevent delays in processing your request.

Legal Use of the Tax Check Authorization, Waiver, and Request to Release

The legal use of the Tax Check Authorization, Waiver, and Request to Release is governed by state laws that protect taxpayer information. This form must be filled out correctly to ensure that the authorization is valid. It is essential to understand that the release of tax information without proper authorization can lead to legal consequences. Therefore, using this form in compliance with Colorado state regulations is crucial for protecting both the taxpayer's rights and the interests of the third party involved.

Key Elements of the Tax Check Authorization, Waiver, and Request to Release

Several key elements must be included in the Tax Check Authorization, Waiver, and Request to Release to ensure its effectiveness:

- Taxpayer Information: Full name, address, and tax identification number.

- Authorized Party: The name and contact information of the individual or organization receiving the tax information.

- Purpose of Request: A clear statement outlining why the tax information is needed.

- Signature: The taxpayer's signature and date to confirm authorization.

Including these elements will help streamline the process and ensure compliance with legal requirements.

Who Issues the Form

The Tax Check Authorization, Waiver, and Request to Release is issued by the Colorado Department of Revenue. This state agency is responsible for managing tax-related documents and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the Department of Revenue's website or through authorized tax professionals. It is important to use the most current version of the form to avoid any issues during the submission process.

Form Submission Methods

There are several methods available for submitting the Tax Check Authorization, Waiver, and Request to Release:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the Colorado Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate tax authority. Ensure that you send it to the correct address to avoid delays.

- In-Person: Taxpayers may also choose to deliver the form in person at a local Department of Revenue office.

Choosing the most convenient submission method will help facilitate a timely response to your request.

Quick guide on how to complete tax check authorization waiver and request to release

Effortlessly Complete Tax Check Authorization, Waiver, And Request To Release on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the essential tools to create, edit, and eSign your documents quickly and without holdups. Handle Tax Check Authorization, Waiver, And Request To Release on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Tax Check Authorization, Waiver, And Request To Release with Ease

- Find Tax Check Authorization, Waiver, And Request To Release and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate creating new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and eSign Tax Check Authorization, Waiver, And Request To Release to guarantee outstanding communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the colorado 8495 printable template and how can it be used?

The colorado 8495 printable template is a customizable document that allows users to create and send forms for electronic signatures. It streamlines the signing process, making it easy to collect approvals from multiple parties while maintaining compliance.

-

How much does the colorado 8495 printable template cost?

The colorado 8495 printable template is part of airSlate SignNow's subscription plan, which offers various pricing tiers to suit different business needs. By choosing the right plan, you can access the template along with additional features at an affordable price.

-

What features are included with the colorado 8495 printable template?

The colorado 8495 printable template includes features such as e-signature capabilities, customizable fields, and secure document storage. These functionalities enhance the overall user experience and ensure that your documents are handled efficiently.

-

What are the benefits of using the colorado 8495 printable template?

Using the colorado 8495 printable template saves time and reduces paperwork by enabling electronic signatures. It enhances transaction efficiency and secures document integrity, making it an excellent choice for businesses looking to optimize their document management processes.

-

Can I integrate the colorado 8495 printable template with other tools?

Yes, the colorado 8495 printable template seamlessly integrates with various applications and platforms. This integration capability allows you to streamline workflows and sync data across your existing tools for a more cohesive business operation.

-

Is the colorado 8495 printable template mobile-friendly?

Absolutely! The colorado 8495 printable template is fully optimized for mobile devices, allowing users to send and sign documents on the go. This versatility ensures that you can manage your signing processes anytime and anywhere, enhancing convenience.

-

How secure is the colorado 8495 printable template?

Security is a top priority for airSlate SignNow, and the colorado 8495 printable template comes with built-in security features. This includes encryption, secure access controls, and compliance with industry standards to keep your documents and data safe.

Get more for Tax Check Authorization, Waiver, And Request To Release

- Application for homestead classification ramsey county co ramsey mn form

- You must own and occupy the property on either january 2 or december 1 and the application must be returned to your assessors form

- Form lic9151 ampquotproperty ownerlandlord notification family

- Lic 9151 form

- Lic 700 form

- Accident and illness report form ct

- Provider information page in

- A mammogram is an of your breast form

Find out other Tax Check Authorization, Waiver, And Request To Release

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form