Sales & Use TaxDepartment of Revenue Colorado Gov Form

Understanding the dor dr1192 Tools

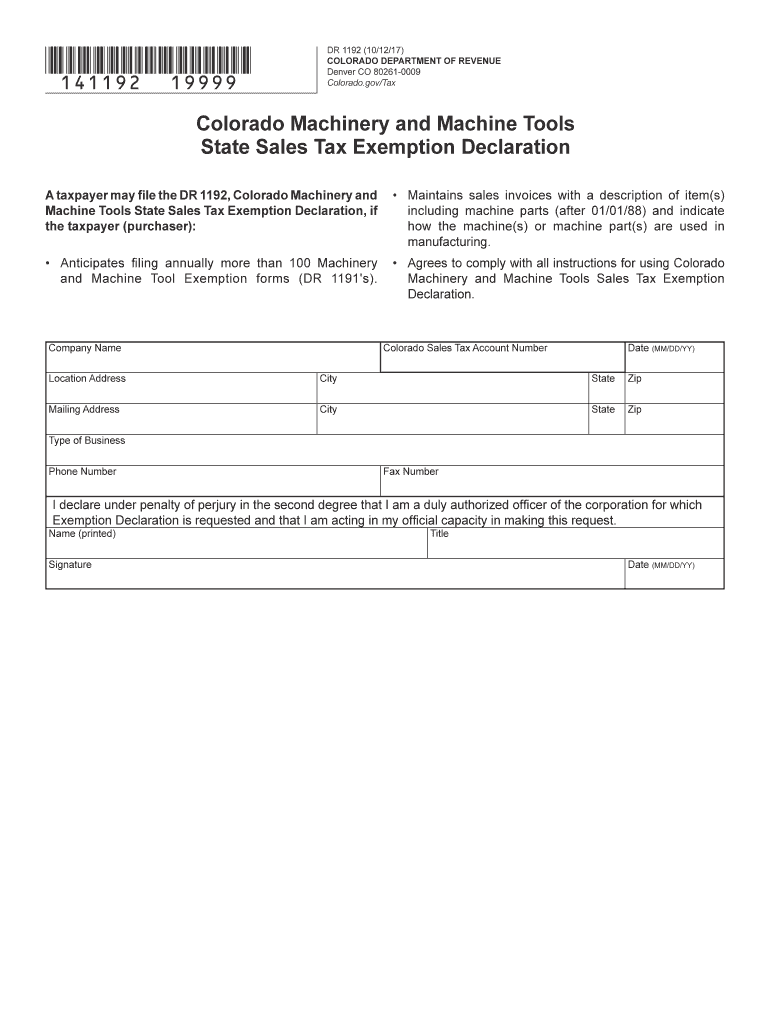

The dor dr1192 tools are essential for individuals and businesses in Colorado that need to navigate the state's sales and use tax requirements. This form is primarily used for reporting and remitting sales tax collected on taxable sales. Understanding how to properly utilize these tools can streamline the process of compliance and ensure that all necessary information is accurately submitted to the Colorado Department of Revenue.

Steps to Complete the dor dr1192 Tools

Completing the dor dr1192 tools involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant sales data, including total sales and any exempt transactions. Next, fill out the form by entering the required information, such as your business details and the amounts of sales tax collected. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form electronically or via mail, depending on your preference and the guidelines provided by the Colorado Department of Revenue.

Legal Use of the dor dr1192 Tools

The dor dr1192 tools are legally recognized for reporting sales and use tax in Colorado. To ensure that your submissions are legally valid, it is important to adhere to the guidelines set forth by the Colorado Department of Revenue. This includes maintaining accurate records of all transactions and ensuring that the form is completed in accordance with state laws. Using a reliable eSigning solution can further enhance the legal standing of your submissions by providing a secure method for signing and submitting documents electronically.

Required Documents for dor dr1192 Tools

When preparing to use the dor dr1192 tools, certain documents are essential. You will need records of all sales transactions, including invoices and receipts, to accurately report sales tax. Additionally, any documentation related to tax-exempt sales should be gathered. This ensures that you can substantiate your claims and comply with state regulations. Keeping organized records will facilitate a smoother completion process and support your submissions if needed for audits.

Penalties for Non-Compliance with dor dr1192 Tools

Failure to comply with the requirements associated with the dor dr1192 tools can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to understand the deadlines for filing and remitting taxes to avoid these consequences. Regularly reviewing your compliance status and ensuring timely submissions can help mitigate risks associated with non-compliance.

Examples of Using the dor dr1192 Tools

Utilizing the dor dr1192 tools can vary based on the type of business and the nature of sales. For instance, a retail store may use the form to report sales tax collected from customers, while an online business may need to account for sales made across state lines. Each scenario requires careful consideration of applicable tax rates and exemptions. Familiarizing yourself with these examples can enhance your understanding of how to effectively use the dor dr1192 tools in your specific situation.

Quick guide on how to complete sales ampamp use taxdepartment of revenue coloradogov

Effortlessly prepare Sales & Use TaxDepartment Of Revenue Colorado gov on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage Sales & Use TaxDepartment Of Revenue Colorado gov on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to edit and eSign Sales & Use TaxDepartment Of Revenue Colorado gov with ease

- Obtain Sales & Use TaxDepartment Of Revenue Colorado gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Sales & Use TaxDepartment Of Revenue Colorado gov while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is dr1192 and how does it relate to airSlate SignNow?

dr1192 refers to a specific feature set within airSlate SignNow that enhances document signing efficiency. This designation helps users identify and utilize tools designed to streamline their eSigning processes, ensuring that business transactions are completed swiftly and securely.

-

How much does airSlate SignNow cost, and is it worth it for businesses using dr1192?

The pricing for airSlate SignNow is competitive, with various plans available to fit different business needs. For companies that require efficient eSigning solutions like dr1192, the investment proves worthwhile, as it enhances productivity and reduces paper consumption.

-

What features does dr1192 offer within airSlate SignNow?

dr1192 encompasses a range of features designed to simplify the document signing experience. Key functionalities include customizable templates, advanced security protocols, and real-time tracking, all aimed at ensuring your documents are managed efficiently and securely.

-

What are the benefits of using airSlate SignNow with dr1192?

Utilizing airSlate SignNow with dr1192 brings numerous benefits, such as faster turnaround times for document approvals and improved collaboration among team members. Additionally, it signNowly cuts down on the time and resources spent on traditional paper-based signing processes.

-

Can airSlate SignNow with dr1192 integrate with other software tools?

Yes, airSlate SignNow, including the capabilities of dr1192, offers various integrations with popular software platforms. This ensures seamless workflows between your signing processes and other business applications, enhancing overall efficiency and effectiveness.

-

Is dr1192 suitable for all types of businesses?

Absolutely, dr1192 is designed to cater to businesses of all sizes and industries. Whether you're a small startup or a large corporation, airSlate SignNow's capabilities can be adapted to meet your unique document management needs.

-

How secure is airSlate SignNow when using dr1192?

Security is a top priority for airSlate SignNow, especially with dr1192 features. The platform employs robust encryption, secure cloud storage, and compliance with industry standards, ensuring that your documents are protected from unauthorized access and bsignNowes.

Get more for Sales & Use TaxDepartment Of Revenue Colorado gov

- Income withholding for support welcome to texas form

- Income withholding for support child support form

- Case 305 cv 00596 rnc document 50 filed 122205 page 1 of 22 form

- Case 218 cv 00058 dgc document 3 filed 101719 page 1 of 7 form

- Csf claim form revised 4 12 19 csf claim form revised 4 12 19

- The complaint names as defendants bayer corporation form

- Form 751 instructions

- Rc65 e form

Find out other Sales & Use TaxDepartment Of Revenue Colorado gov

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation