How To Add Sign in Banking

Make the most out of your eSignature workflows with airSlate SignNow

Extensive suite of eSignature tools

Robust integration and API capabilities

Advanced security and compliance

Various collaboration tools

Enjoyable and stress-free signing experience

Extensive support

Keep your eSignature workflows on track

Our user reviews speak for themselves

Ways to incorporate sign in banking

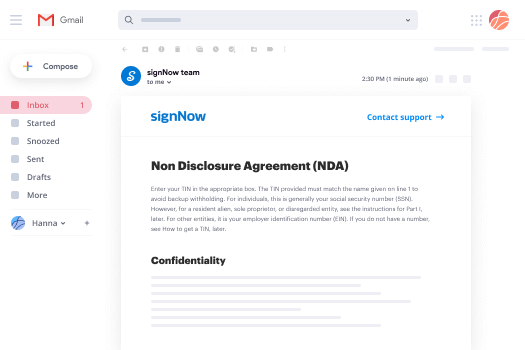

If you are seeking an effective method to manage paperwork in your banking tasks, understanding how to incorporate sign in banking is vital. airSlate SignNow offers a streamlined platform that enables users to eSign and oversee documents effectively, ensuring a fluid workflow for any banking requirements. Here’s a detailed guide to help you get going with airSlate SignNow.

Ways to incorporate sign in banking with airSlate SignNow

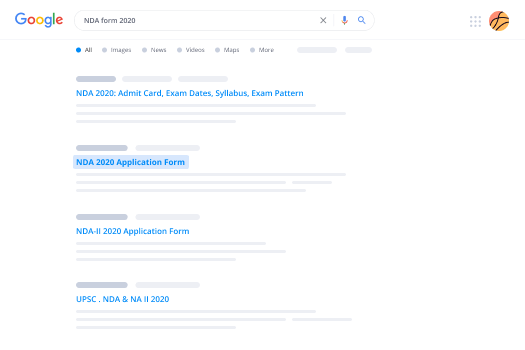

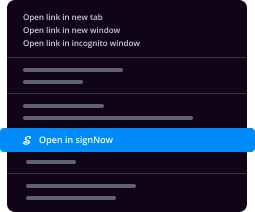

- Launch your internet browser and head to the airSlate SignNow site.

- Set up a complimentary trial account or log in if you already possess an account.

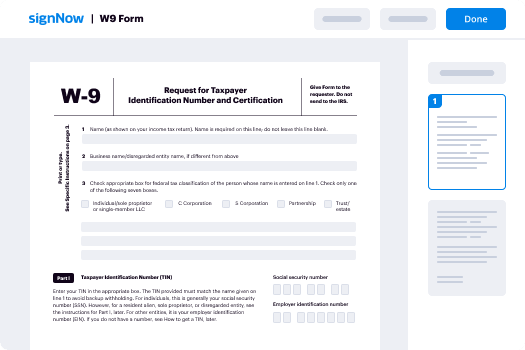

- Select the document you intend to sign or share for signature and upload it.

- To enhance future tasks, change your document into a template for repeated use.

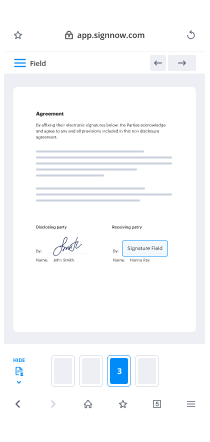

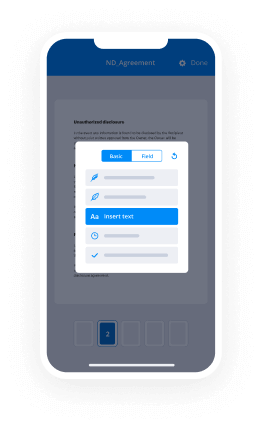

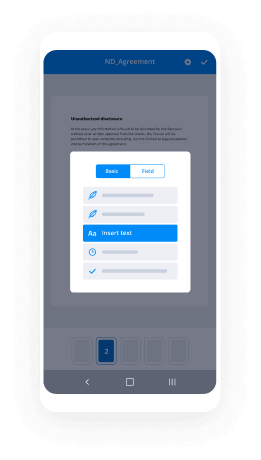

- Access your uploaded document and make necessary modifications by adding fillable fields or inserting needed information.

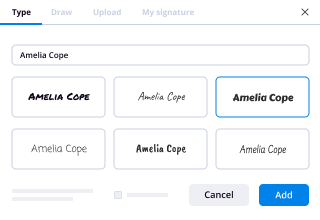

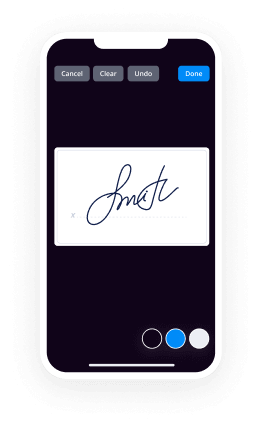

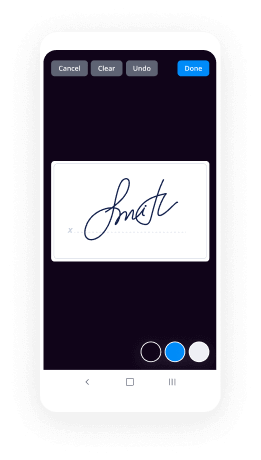

- Sign your document and include signature fields for your recipients.

- Click 'Continue' to set up and send an electronic signature invitation.

By adhering to these steps, you can take advantage of the benefits of airSlate SignNow for your banking necessities. This platform not only simplifies the signing procedure but also improves document management efficiency.

Prepared to transform your document workflows? Initiate your free trial with airSlate SignNow today and discover the convenience of electronic signatures customized for your banking operations.

How it works

Rate your experience

-

Best ROI. Our customers achieve an average 7x ROI within the first six months.

-

Scales with your use cases. From SMBs to mid-market, airSlate SignNow delivers results for businesses of all sizes.

-

Intuitive UI and API. Sign and send documents from your apps in minutes.

A smarter way to work: —how to industry sign banking integrate

FAQs

-

What is airSlate SignNow and how does it help in banking?

airSlate SignNow is an intuitive eSignature solution designed for businesses, including those in the banking sector. It simplifies document signing and management, making it easy to add sign-in features for banking documents. This efficiency enhances workflow and ensures compliance, demonstrating a solid understanding of how to add sign in banking.

-

How do I get started with airSlate SignNow for banking purposes?

To get started with airSlate SignNow for banking, simply sign up for an account on our website. After registration, you can explore our features and learn how to add sign in banking to your documents. Our user-friendly interface guides you through the setup process, ensuring a smooth transition.

-

What features does airSlate SignNow offer for banking applications?

airSlate SignNow offers a variety of features tailored for banking applications, such as customizable templates and secure eSigning. Understanding how to add sign in banking is made easy with our comprehensive tools that enhance document management and security. This ensures that all sensitive information is handled with the utmost care.

-

Is airSlate SignNow cost-effective for banking businesses?

Yes, airSlate SignNow is a cost-effective solution for banking businesses looking to streamline their document processes. With various pricing plans available, you can choose the one that best fits your needs while learning how to add sign in banking efficiently. This affordability makes it accessible for organizations of all sizes.

-

Can airSlate SignNow integrate with other banking software?

Absolutely! airSlate SignNow can seamlessly integrate with various banking software and platforms. This integration allows users to understand how to add sign in banking within their existing systems, enhancing overall productivity and efficiency while maintaining secure document workflows.

-

What are the security measures in place for banking documents with airSlate SignNow?

Security is paramount when dealing with banking documents, and airSlate SignNow prioritizes this with advanced encryption and compliance measures. When you learn how to add sign in banking, you can be assured that your documents are protected against unauthorized access. Our platform adheres to industry standards to ensure your data remains safe.

-

How does airSlate SignNow improve customer experience in banking?

By utilizing airSlate SignNow, banks can signNowly enhance their customer experience through faster document processing. Customers benefit from the ability to easily sign documents online, allowing your team to focus on more critical tasks. Learning how to add sign in banking not only improves efficiency but also fosters customer satisfaction.

Trusted esignature solution— what our customers are saying

Get legally-binding signatures now!

Frequently asked questions

How do you make a document that has an electronic signature?

How do i sign a pdf file?

How to attain an electronic signature?

Find out other How To Add Sign in Banking

- Narrow amp anderson street apartments crhava org form

- Hud hardship exemption form

- 7 day notice with cure clay county clerk of the circuit court form

- Magistrate court bad checks faqs chatham county courts form

- Stipulation and consent to e filing form

- Superior court forms skagit county washington

- Echocardiography requisition please book at form

- Appointment requisitionnorthwest form

- Fax completed requisition to form

- Cbc eligibility form assessor report be completed

- Maintenance contract hometalents net form

- Maintenance contract 424639953 form

- Application for government regional officers housing groh new form

- A07 nursing or midwifery english language requirements form

- Application for government regional officers housing groh form

- Application for transfer and mutual exchange public housing form

- Club risk assessment form japfest

- Club risk assessment form we ask all clubs that ar

- Your cooperation by fully completing the requested information

- Special olympics application form