Small Business Self Certification Form

What is the Small Business Self Certification Form

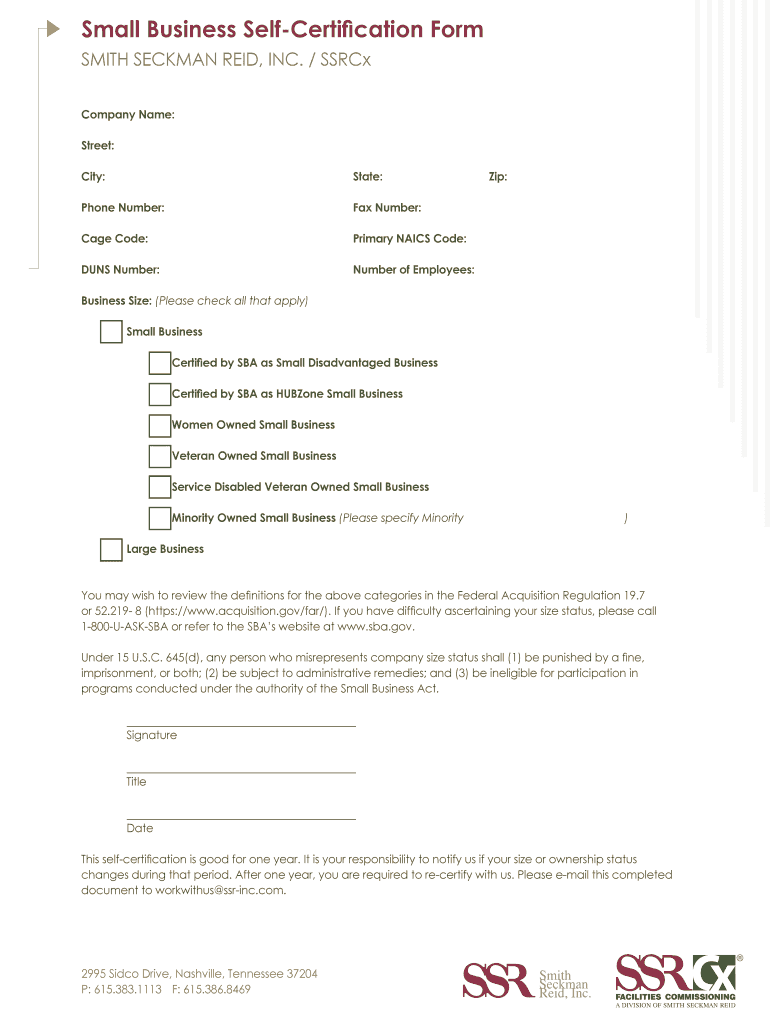

The small business self certification form is a document that enables small businesses to certify their status as a small business entity. This form is often used in various contexts, such as applying for government contracts or grants, where proof of small business status is required. The form typically requires information about the business's size, ownership, and operational status, ensuring compliance with relevant regulations. By completing this form, businesses can access opportunities specifically designed for small enterprises, thereby fostering growth and support within the community.

Steps to complete the Small Business Self Certification Form

Filling out the small business self certification form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your business, including:

- Business name and contact details

- Ownership structure and key personnel

- Financial information, such as revenue and employee count

Once you have this information, follow these steps:

- Download the blank small business self certification form from a reliable source.

- Fill in the required fields carefully, ensuring all information is accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Sign and date the form, acknowledging the accuracy of the information provided.

After completing the form, it can be submitted electronically or via mail, depending on the requirements of the specific application or agency.

Legal use of the Small Business Self Certification Form

The small business self certification form is legally binding, provided it is completed accurately and in accordance with applicable laws. It is essential to understand that submitting false information on this form can lead to significant penalties, including disqualification from government programs and potential legal action. The form must comply with various regulations, including the ESIGN Act, which governs electronic signatures, ensuring that all submissions are valid and enforceable in a court of law. Businesses should maintain records of their submissions for future reference and compliance verification.

Key elements of the Small Business Self Certification Form

When completing the small business self certification form, several key elements must be included to ensure its validity. These elements typically consist of:

- Business Identification: Name, address, and contact information.

- Ownership Information: Details about the owners and their percentage of ownership.

- Size Standards: Information regarding the number of employees and annual revenue to confirm small business status.

- Certification Statement: A declaration affirming the accuracy of the information provided.

Including all these elements is crucial for the form to be accepted by agencies or organizations requiring certification.

How to obtain the Small Business Self Certification Form

The small business self certification form can typically be obtained from various sources, including government websites, business development agencies, and online form repositories. To ensure you are using the most current version, it is advisable to visit official government websites or trusted business resources. Many agencies provide the form in downloadable formats, allowing for easy access and completion. Additionally, some organizations may offer guidance or templates to assist businesses in accurately filling out the form.

Eligibility Criteria

Eligibility criteria for completing the small business self certification form generally include specific requirements that define a small business. These criteria may vary by agency but often include:

- A maximum number of employees, typically fewer than five hundred.

- Annual revenue limits, which can vary depending on the industry.

- Ownership requirements, such as being at least fifty-one percent owned by individuals from specific demographic groups.

Understanding these criteria is essential for businesses to determine their eligibility and ensure successful certification.

Quick guide on how to complete small business self certification statement form

Discover how to effortlessly complete the Small Business Self Certification Form with this simple guide

Filing electronically and finishing forms on the internet is becoming more prevalent and the preferred option for numerous clients. It provides many advantages over conventional printed documents, such as convenience, time savings, enhanced precision, and safety.

With tools like airSlate SignNow, you can find, alter, sign, enhance, and transmit your Small Business Self Certification Form without getting slowed down by endless printing and scanning. Follow this brief guide to begin and complete your form.

Follow these steps to obtain and complete Small Business Self Certification Form

- Start by clicking the Get Form button to access your form in our editor.

- Observe the green indicator on the left highlighting required fields to ensure you don’t overlook them.

- Utilize our advanced tools to annotate, edit, sign, secure, and enhance your form.

- Secure your document or convert it into a fillable form using the appropriate tab features.

- Review the form and verify it for errors or inconsistencies.

- Click DONE to complete the editing process.

- Rename your form or keep it as is.

- Select the storage option you prefer to save your form, send it via USPS, or click the Download Now button to save your file.

If Small Business Self Certification Form is not what you needed, feel free to explore our extensive collection of pre-loaded forms that you can fill out with little effort. Test our platform today!

Create this form in 5 minutes or less

FAQs

-

What form do I need to fill out when I’m a self-employee but the business belongs to my sister and mine (IRS question)?

Thanks Bruce. Edited answer below:Ok. It's time you do some reading…and if your business made decent money, get a tax accountant.Self employed / sole proprietor: 1040Self employed / LLC: must file Corp business filing and issue K1 then 1040Self employed / LLC w S Corp option: (you should have been on your own payroll) must file Corp business filing and issue K1, then 1040Self employed / C Corp: (you should have been on your own payroll) must file Corp business filing and issue 1099 DIV, then 1040.Corporate business filing and tax is due March 15. You can extend the filing, but any tax is due the March 15. If you don't pay on or before March 15, fees and interest are applied.Personal filing and tax is due April 15. You can extend the filing, but any tax is due on April 15. If you don't pay on or before April 15, fees and interest are applied.Same for your sister.Don't forget to file/pay the company's sales and use taxes, if applicable (State).You will also have to do corporate and personal filings with your state.

-

What are some tips to fill out the kvpy self appraisal form?

You should not lie in the self-appraisal form. Professors generally do not ask anything from the self appraisal form. But if they find out some extraordinary stuffs in your form, they may ask you about those topics. And if you do not know those topics properly, you will have higher chance of NOT getting selected for the fellowship. So, DO NOT write anything that you are not sure about.If I remember properly, in the form they ask, “What is your favorite subject?” and I mentioned Biology there. Head of the interview panel saw that and asked me about my favorite field of biology. When I told genetics, two professors started asking question from genetics and did not ask anything from any other fields at all (except exactly 2 chemistry questions as I mentioned chemistry as my 2nd favorite subject). But they did not check other answers in self-appraisal form (at least in my presence).Do mention about science camps if you have attended any. Again, do not lie.All the best for interview round. :)

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

Create this form in 5 minutes!

How to create an eSignature for the small business self certification statement form

How to make an eSignature for your Small Business Self Certification Statement Form in the online mode

How to generate an electronic signature for the Small Business Self Certification Statement Form in Chrome

How to create an electronic signature for signing the Small Business Self Certification Statement Form in Gmail

How to create an eSignature for the Small Business Self Certification Statement Form right from your smart phone

How to create an electronic signature for the Small Business Self Certification Statement Form on iOS devices

How to generate an eSignature for the Small Business Self Certification Statement Form on Android OS

People also ask

-

What is a Small Business Self Certification Form?

A Small Business Self Certification Form is a document that allows small businesses to signNow their eligibility for various programs and benefits. This form typically includes information about the business structure, ownership, and compliance with specific regulations. Using airSlate SignNow, you can easily create, send, and eSign this form to streamline your application process.

-

How can the Small Business Self Certification Form benefit my business?

The Small Business Self Certification Form can signNowly benefit your business by simplifying the application process for grants, loans, and other financial assistance programs. By using airSlate SignNow, you can ensure that your documents are securely signed and submitted quickly, which can enhance your chances of receiving timely support for your business needs.

-

Is there a cost associated with using the Small Business Self Certification Form on airSlate SignNow?

Yes, there is a cost associated with using the Small Business Self Certification Form on airSlate SignNow. However, our pricing plans are designed to be cost-effective for small businesses, ensuring you get the best value for your eSignature needs. You can choose a plan that fits your budget and access all the features you need to manage your forms efficiently.

-

Can I customize the Small Business Self Certification Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the Small Business Self Certification Form to fit your specific requirements. You can add your business logo, modify the fields, and include any additional information necessary, making it a tailored solution for your business.

-

What integrations does airSlate SignNow offer for the Small Business Self Certification Form?

airSlate SignNow offers various integrations with popular tools and platforms, allowing you to seamlessly manage your Small Business Self Certification Form. You can integrate with CRM systems, cloud storage services, and other business applications to enhance your workflow and improve efficiency.

-

How secure is the Small Business Self Certification Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use the Small Business Self Certification Form, your data is protected with bank-level encryption and secure cloud storage. This ensures that your sensitive business information remains confidential and secure throughout the signing process.

-

How do I get started with the Small Business Self Certification Form on airSlate SignNow?

Getting started with the Small Business Self Certification Form on airSlate SignNow is easy! Simply sign up for an account, select the form template, and customize it as needed. Once you're ready, you can send it to your recipients for eSignature and track its status in real-time.

Get more for Small Business Self Certification Form

Find out other Small Business Self Certification Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word