State of Delaware Delaware Division of Revenue Delaware Gov Form

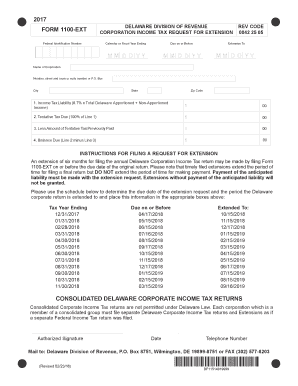

What is the Delaware 1100 EXT Form?

The Delaware 1100 EXT form is an extension request for businesses that need additional time to file their Delaware corporate income tax return. This form allows corporations to extend their filing deadline by six months, ensuring they have adequate time to prepare their returns accurately. It is essential for businesses to understand that while the form extends the filing deadline, it does not extend the payment deadline for any taxes owed.

Steps to Complete the Delaware 1100 EXT Form

Completing the Delaware 1100 EXT form involves several straightforward steps:

- Obtain the form from the Delaware Division of Revenue website or other official resources.

- Fill in the required information, including your business name, address, and federal employer identification number (EIN).

- Indicate the tax year for which you are requesting an extension.

- Calculate any estimated tax liability and ensure you include any payment with the form if applicable.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the Delaware Division of Revenue by the original due date of your return.

Filing Deadlines for the Delaware 1100 EXT Form

The Delaware 1100 EXT form must be filed by the original due date of the corporate income tax return. Typically, this deadline is the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is crucial to adhere to this deadline to avoid penalties.

Legal Use of the Delaware 1100 EXT Form

The Delaware 1100 EXT form is legally binding when completed and submitted according to the state's regulations. It provides businesses with an official extension to file their tax returns, ensuring compliance with Delaware tax laws. Failure to file the form on time can result in penalties and interest on any unpaid taxes.

Required Documents for Filing

When filing the Delaware 1100 EXT form, businesses should have the following documents ready:

- Federal employer identification number (EIN)

- Previous year’s tax return for reference

- Estimated tax liability calculations

- Any supporting documentation for deductions or credits

Penalties for Non-Compliance

Non-compliance with the Delaware 1100 EXT form filing requirements can result in significant penalties. If the form is not filed by the due date, the state may impose late fees and interest on any unpaid taxes. Additionally, failure to file the corporate income tax return by the extended deadline can lead to further penalties, including potential legal action.

Quick guide on how to complete state of delaware delaware division of revenue delawaregov

Easily Prepare State Of Delaware Delaware Division Of Revenue Delaware gov on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly, without delays. Handle State Of Delaware Delaware Division Of Revenue Delaware gov on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and eSign State Of Delaware Delaware Division Of Revenue Delaware gov Effortlessly

- Locate State Of Delaware Delaware Division Of Revenue Delaware gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and eSign State Of Delaware Delaware Division Of Revenue Delaware gov and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Delaware 1100 ext form?

The Delaware 1100 ext form is an extension form used for filing taxes in the state of Delaware. It allows businesses to request additional time to file their corporate income tax returns. This form is essential for ensuring compliance with state tax regulations while giving you the flexibility you need.

-

How can airSlate SignNow help with the Delaware 1100 ext form?

airSlate SignNow simplifies the process of filling out and submitting your Delaware 1100 ext form. With our intuitive eSignature technology, you can easily sign, send, and manage your tax documents securely. This streamlines your filing process and ensures that you meet submission deadlines efficiently.

-

Is there a cost associated with using airSlate SignNow for the Delaware 1100 ext form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, which include features for managing the Delaware 1100 ext form. Our affordable plans provide access to premium features that enhance your document management experience. You can choose a plan that aligns with your budget and requirements.

-

What features does airSlate SignNow offer for handling the Delaware 1100 ext form?

airSlate SignNow includes features such as customizable templates, secure storage, and team collaboration tools for the Delaware 1100 ext form. You can easily create and manage multiple versions of your form while keeping everything organized. The platform also allows you to track document status and reminders for important deadlines.

-

How can I ensure my Delaware 1100 ext form is filed securely?

With airSlate SignNow, your Delaware 1100 ext form is secured with advanced encryption technology. Our platform complies with industry standards to protect your sensitive information, ensuring that your data is safe during the submission process. You can confidently manage your tax documents knowing they are handled securely.

-

Can I integrate airSlate SignNow with other applications for the Delaware 1100 ext form?

Yes, airSlate SignNow offers integrations with popular applications, enhancing your workflow when dealing with the Delaware 1100 ext form. You can connect with platforms like Google Drive, Dropbox, and more for streamlined document management. These integrations make it easy to access and share your tax documents seamlessly.

-

What are the benefits of using airSlate SignNow for the Delaware 1100 ext form?

Using airSlate SignNow for the Delaware 1100 ext form provides you with a cost-effective and user-friendly solution for managing your tax documents. The platform saves time and reduces paperwork, improving efficiency in your filing process. Additionally, the ability to eSign documents expedites approvals and final submissions.

Get more for State Of Delaware Delaware Division Of Revenue Delaware gov

- Traffic offenders program online nsw form

- Imed complaints form

- Lost property form

- Imm 5807 form

- Mammalian submission form animal health

- Final application form for an authorization amendment

- Mount sinai hospitaldepartment of dentistry oral medicine referral form oral medicine referral form

- Your billing responsibilities centers for medicare ampamp medicaid form

Find out other State Of Delaware Delaware Division Of Revenue Delaware gov

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile