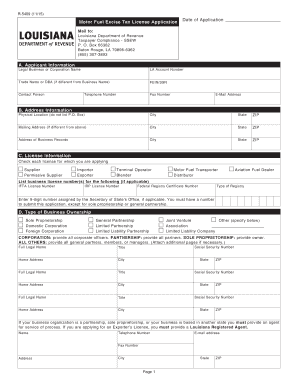

R 5409 1115 Revenue Louisiana 2015-2026

What is the Louisiana motor fuel tax?

The Louisiana motor fuel tax is a state-imposed tax on the sale of motor fuels, including gasoline and diesel. This tax is primarily used to fund transportation infrastructure projects and maintenance within the state. The tax rate can vary depending on the type of fuel and is subject to changes based on state legislation. Understanding this tax is crucial for businesses and individuals who operate vehicles or transport goods within Louisiana.

Key elements of the Louisiana motor fuel tax

Several key elements define the Louisiana motor fuel tax:

- Tax Rate: The current tax rate is set by state law and can be adjusted periodically.

- Exemptions: Certain entities may qualify for exemptions, such as government vehicles or specific agricultural uses.

- Reporting Requirements: Businesses must accurately report fuel purchases and sales to ensure compliance with state regulations.

- Use of Funds: Revenue generated from this tax is allocated to road and bridge construction, maintenance, and other transportation-related projects.

Steps to complete the Louisiana motor fuel tax form

Completing the Louisiana motor fuel tax form involves several important steps:

- Gather Required Information: Collect all necessary documentation, including fuel purchase records and vehicle information.

- Fill Out the Form: Accurately complete the Louisiana motor fuel tax form, ensuring all fields are filled out correctly.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties.

- Submit the Form: Submit the completed form through the appropriate channels, whether online, by mail, or in person.

Filing deadlines for the Louisiana motor fuel tax

Filing deadlines for the Louisiana motor fuel tax are crucial for compliance. Typically, the forms must be submitted quarterly, with specific due dates set by the state. It is important to keep track of these deadlines to avoid late fees or penalties. Businesses should mark their calendars and ensure timely submission of their tax forms to maintain good standing with state authorities.

Penalties for non-compliance with the Louisiana motor fuel tax

Failure to comply with the Louisiana motor fuel tax regulations can result in various penalties. These may include:

- Late Fees: Additional charges may apply if the tax form is not submitted by the deadline.

- Interest Charges: Accrued interest on unpaid tax amounts may increase the total owed over time.

- Legal Action: In severe cases, the state may pursue legal action to recover unpaid taxes.

Who issues the Louisiana motor fuel tax form?

The Louisiana Department of Revenue is responsible for issuing the motor fuel tax form. This state agency oversees the collection of motor fuel taxes and ensures compliance with state laws. Businesses and individuals can access the necessary forms and resources through the department's official channels, ensuring they have the most up-to-date information for their tax filings.

Quick guide on how to complete r 5409 1115 revenue louisiana

Effortlessly Prepare R 5409 1115 Revenue Louisiana on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the suitable template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage R 5409 1115 Revenue Louisiana on any device utilizing airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to edit and electronically sign R 5409 1115 Revenue Louisiana seamlessly

- Find R 5409 1115 Revenue Louisiana and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Edit and electronically sign R 5409 1115 Revenue Louisiana and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 5409 1115 revenue louisiana

Create this form in 5 minutes!

People also ask

-

What is the Louisiana motor fuel tax?

The Louisiana motor fuel tax is a state-imposed tax on the sale and use of motor fuels in Louisiana. This tax is used to fund transportation infrastructure and maintenance within the state. Understanding the specifics of the Louisiana motor fuel tax can help businesses and individuals budget their fuel expenses effectively.

-

How does airSlate SignNow help manage documents related to Louisiana motor fuel tax?

airSlate SignNow enables businesses to create, send, and eSign documents quickly, including those related to the Louisiana motor fuel tax. With our platform, you can streamline the process of submitting tax forms and keep track of important tax-related documents. This efficient management reduces the risk of errors and ensures compliance with Louisiana motor fuel tax regulations.

-

Are there any fees associated with filing Louisiana motor fuel tax electronically?

Typically, filing Louisiana motor fuel tax electronically may incur some fees, depending on the platform used. However, airSlate SignNow offers a cost-effective solution that allows you to manage your electronic submissions without additional charges. Adjusting your approach to tax filings can help minimize overall costs associated with the Louisiana motor fuel tax.

-

Can airSlate SignNow integrate with accounting software for Louisiana motor fuel tax reporting?

Yes, airSlate SignNow easily integrates with various accounting software to streamline Louisiana motor fuel tax reporting. By integrating with platforms like QuickBooks or Xero, businesses can automate their tax calculations and ensure accurate reporting. This seamless connection enhances efficiency and reduces the administrative burden associated with tax compliance.

-

What are the benefits of eSigning documents related to Louisiana motor fuel tax?

eSigning documents for the Louisiana motor fuel tax provides numerous benefits, including faster processing times and improved accuracy. With airSlate SignNow, you can sign essential tax documents securely and from anywhere, reducing the need for physical paperwork. This not only saves time but also enhances security and compliance with regulatory requirements.

-

Is airSlate SignNow user-friendly for those unfamiliar with Louisiana motor fuel tax processes?

Absolutely! airSlate SignNow is designed with a user-friendly interface that caters to users of all experience levels. Even if you are unfamiliar with the Louisiana motor fuel tax processes, our platform provides easy navigation and helpful features that make document signing and management straightforward and stress-free.

-

How can businesses ensure they comply with Louisiana motor fuel tax requirements using airSlate SignNow?

Businesses can ensure compliance with Louisiana motor fuel tax requirements by using airSlate SignNow's robust document management features. Our platform allows you to create, store, and sign documents needed for tax compliance while keeping everything organized and easily accessible. Regularly updating and submitting your documentation through our platform ensures adherence to Louisiana motor fuel tax regulations.

Get more for R 5409 1115 Revenue Louisiana

- Fw 001 info form

- Oaas programs service logsdepartment of healthstate form

- One church one child affidavit of good moral character of form

- Practitioner credentialing application premera blue cross form

- You can use this application to apply for the supplemental nutrition assistance program snap form

- Disability standards require that the disability form

- Child care provider listing dhs 7494 child care provider listing form dhs oregon department human services employment related

- Signed coe on file form

Find out other R 5409 1115 Revenue Louisiana

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document