Ma Form 2

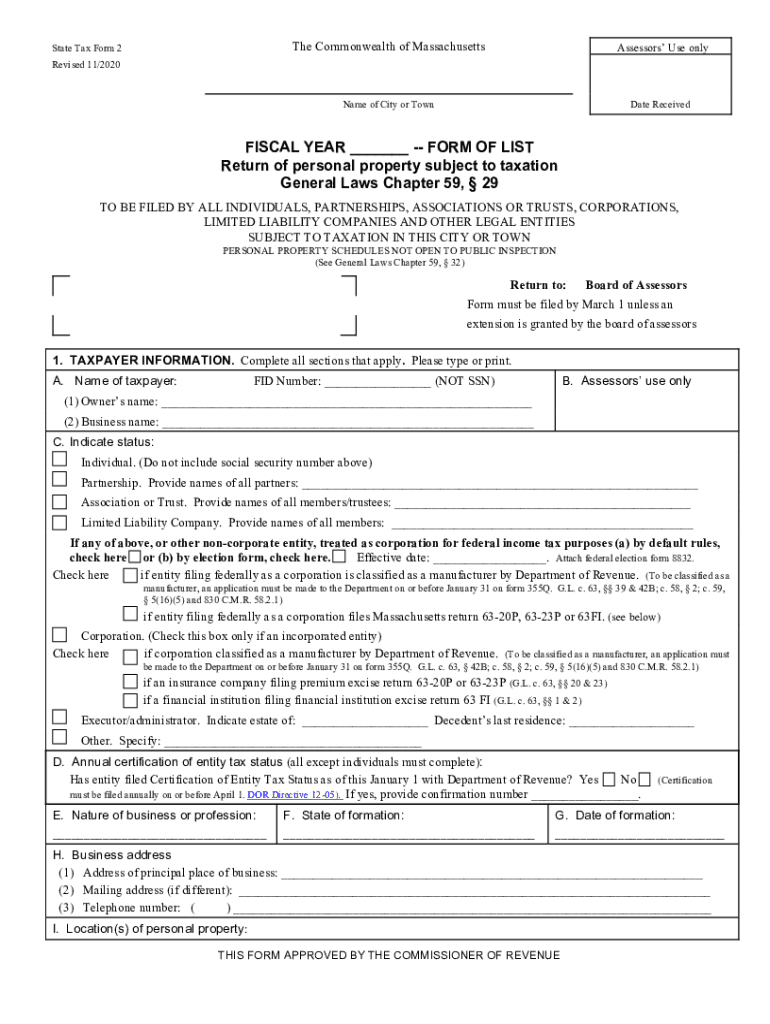

What is the Massachusetts Form 2?

The Massachusetts Form 2, also known as the Massachusetts state tax form 2, is a tax return form specifically designed for individuals who are filing their state income taxes in Massachusetts. This form is primarily used by residents and part-year residents to report their income, calculate their tax liability, and claim any applicable credits or deductions. The Massachusetts Department of Revenue provides this form to ensure that taxpayers fulfill their state tax obligations accurately and efficiently.

How to Obtain the Massachusetts Form 2

To obtain the Massachusetts Form 2, individuals can visit the Massachusetts Department of Revenue's official website, where the form is available for download in a fillable PDF format. Additionally, taxpayers can request a physical copy of the form by contacting the Department of Revenue directly. It is essential to ensure that you are using the correct version of the form for the applicable tax year, as forms may vary from year to year.

Steps to Complete the Massachusetts Form 2

Completing the Massachusetts Form 2 involves several key steps:

- Gather all necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Calculate your total tax liability based on the income reported.

- Claim any eligible deductions or credits to reduce your taxable income.

- Review the completed form for accuracy before submission.

Legal Use of the Massachusetts Form 2

The Massachusetts Form 2 is legally binding when completed and submitted in accordance with state regulations. To ensure legal compliance, it is crucial to provide accurate information and sign the form electronically or physically, as required. Utilizing a reliable electronic signature solution can enhance the legal validity of your submission, as it complies with the ESIGN Act and other relevant laws governing electronic signatures.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines associated with the Massachusetts Form 2. Generally, the filing deadline for personal income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid last-minute issues and ensure timely processing of your tax return.

Form Submission Methods

The Massachusetts Form 2 can be submitted through various methods:

- Online: Taxpayers can file electronically using approved e-filing software, which simplifies the process and may expedite refunds.

- Mail: Individuals can print the completed form and mail it to the appropriate address designated by the Massachusetts Department of Revenue.

- In-Person: Some taxpayers may choose to deliver their forms in person at designated tax offices, although this method is less common.

Quick guide on how to complete ma form 2

Effortlessly Prepare Ma Form 2 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, adjust, and eSign your documents swiftly without delays. Manage Ma Form 2 across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Ma Form 2 effortlessly

- Find Ma Form 2 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Ma Form 2 to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Massachusetts State Tax Form 2 used for?

The Massachusetts State Tax Form 2 is a crucial document used by taxpayers to report income and calculate tax liabilities. It is specifically designed for residents who have multiple sources of income or those who need to itemize deductions. Completing this form accurately ensures compliance with state tax regulations.

-

How can airSlate SignNow help me with the Massachusetts State Tax Form 2?

airSlate SignNow simplifies the process of signing and submitting the Massachusetts State Tax Form 2 by providing a user-friendly platform. With features like electronic signatures and cloud storage, you can complete your tax forms securely and efficiently. This saves time and minimizes the risk of errors when filing.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts State Tax Form 2?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. While there is a cost to access premium features, the platform’s affordability makes it a cost-effective solution for managing the Massachusetts State Tax Form 2 and other documents. You can explore different plans to find one that fits your budget.

-

Can I integrate airSlate SignNow with other accounting software for the Massachusetts State Tax Form 2?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software programs, making it easier to manage the Massachusetts State Tax Form 2 alongside your financial records. This integration helps streamline your workflow, ensuring that all necessary data is easily accessible and organized.

-

What features does airSlate SignNow offer for completing the Massachusetts State Tax Form 2?

airSlate SignNow provides numerous features tailored for completing the Massachusetts State Tax Form 2, including customizable templates and the ability to collect electronic signatures. The platform also allows for collaboration with tax professionals, making it easier to ensure your form is filled out correctly. These features enhance efficiency and accuracy.

-

How secure is my information when using airSlate SignNow for the Massachusetts State Tax Form 2?

Security is a top priority for airSlate SignNow. When you use the platform for the Massachusetts State Tax Form 2, your information is protected through advanced encryption and secure access protocols. This ensures that your sensitive data remains confidential and safe from unauthorized access.

-

Can I access the Massachusetts State Tax Form 2 from my mobile device using airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access the Massachusetts State Tax Form 2 from your smartphone or tablet. This flexibility enables you to manage your documents on the go, making it easier to complete and submit your tax forms whenever you need to.

Get more for Ma Form 2

Find out other Ma Form 2

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile