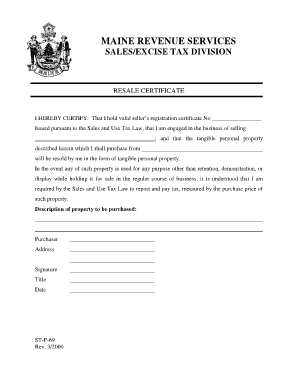

Maine Resale Certificate Form

What is the Maine Resale Certificate

The Maine resale certificate is a legal document that allows businesses to purchase goods without paying sales tax. This certificate is typically used by retailers who intend to resell the items they buy. By presenting a valid Maine resale certificate to suppliers, businesses can avoid the upfront cost of sales tax, which they will collect from customers when the products are sold. This document is essential for maintaining cash flow and ensuring compliance with state tax regulations.

How to Use the Maine Resale Certificate

To use the Maine resale certificate, a retailer must provide the certificate to the supplier at the time of purchase. The supplier should retain a copy of the certificate for their records. It is important that the certificate is filled out completely and accurately, including the seller's name, address, and the seller's sales tax identification number. This ensures that the transaction is recognized as tax-exempt under Maine state law.

Steps to Complete the Maine Resale Certificate

Completing the Maine resale certificate involves several straightforward steps:

- Obtain the Maine resale certificate form, which can typically be found online or through state tax offices.

- Fill in the required information, including the seller's name, address, and sales tax identification number.

- Clearly describe the type of property being purchased for resale.

- Sign and date the certificate to validate it.

- Provide the completed certificate to the supplier at the time of purchase.

Legal Use of the Maine Resale Certificate

The legal use of the Maine resale certificate is governed by state tax laws. It is crucial that the certificate is used only for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or items not intended for resale, can lead to penalties. Retailers must ensure they understand the legal implications and responsibilities associated with using the resale certificate to avoid complications with the Maine Revenue Services.

Key Elements of the Maine Resale Certificate

Key elements of the Maine resale certificate include:

- Seller Information: The name and address of the seller must be clearly stated.

- Sales Tax Identification Number: This number is essential for verifying the seller's tax status.

- Description of Property: A detailed description of the goods being purchased for resale is necessary.

- Signature and Date: The certificate must be signed and dated by the seller to be valid.

Eligibility Criteria

To be eligible for a Maine resale certificate, a business must be registered with the Maine Revenue Services and possess a valid sales tax identification number. The business must also be engaged in the retail sale of tangible personal property or taxable services. It is important for businesses to ensure they meet these criteria before applying for and using the resale certificate to avoid potential legal issues.

Quick guide on how to complete maine resale certificate

Easily Set Up Maine Resale Certificate on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Handle Maine Resale Certificate on any device with airSlate SignNow’s Android or iOS applications and enhance your document-driven processes today.

The Easiest Way to Edit and Electronically Sign Maine Resale Certificate Effortlessly

- Obtain Maine Resale Certificate and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Maine Resale Certificate and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Maine resale certificate?

A Maine resale certificate is a legal document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is essential for retailers and wholesalers in Maine to comply with state tax regulations while optimizing their purchasing processes.

-

How can I apply for a Maine resale certificate?

To apply for a Maine resale certificate, you need to fill out the appropriate application form, which can be obtained from the Maine Revenue Services website. You'll need to provide details about your business, including the nature of your sales and your seller's permit number.

-

What information do I need to provide to obtain a Maine resale certificate?

When applying for a Maine resale certificate, you will need to provide your business name, address, type of business, and tax identification number. Additionally, you should describe the types of products you plan to purchase for resale to ensure compliance with tax regulations.

-

Are there any fees associated with acquiring a Maine resale certificate?

Obtaining a Maine resale certificate is typically free of charge; however, it is crucial to check for any potential costs related to filing or maintaining your business licenses. It's always advisable to consult with a tax professional for the latest updates on state-specific regulations.

-

How does the Maine resale certificate affect my tax obligations?

Using a Maine resale certificate allows you to avoid paying sales tax on items intended for resale, which can signNowly lower your business costs. However, you must collect and remit sales tax on the final sale to your customers, ensuring compliance with Maine tax laws.

-

What types of businesses can use a Maine resale certificate?

Any business in Maine that sells taxable goods can use a Maine resale certificate, including retailers, wholesalers, and manufacturers. It's essential for businesses to ensure they meet the eligibility criteria to utilize this tax advantage efficiently.

-

Can I use my Maine resale certificate in other states?

No, a Maine resale certificate is only valid within the state of Maine. If you do business in other states, you will need to check the specific state regulations and apply for a resale certificate in those locations to benefit from sales tax exemptions.

Get more for Maine Resale Certificate

- Notice of termination the oklahoma department of form

- B 5962006 b 5962006 form

- This form must be received by the 15th of the month for your monthly benefit payment to be directly deposited into

- One emergency evacuation drill a drill or rapid dismissal shall be conducted during the first ten days of the form

- Administrationhudclipsformshud5 hudgov us department of

- 1412 sw 43rd street ste 120 form

- Full text of ampquotstudent handbookampquot internet archive form

- Enrollment waiver dc1707local95com head start employees dc1707l95wf form

Find out other Maine Resale Certificate

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed