Compromise Application Minnesota Department of Revenue Form

What is the Compromise Application Minnesota Department of Revenue

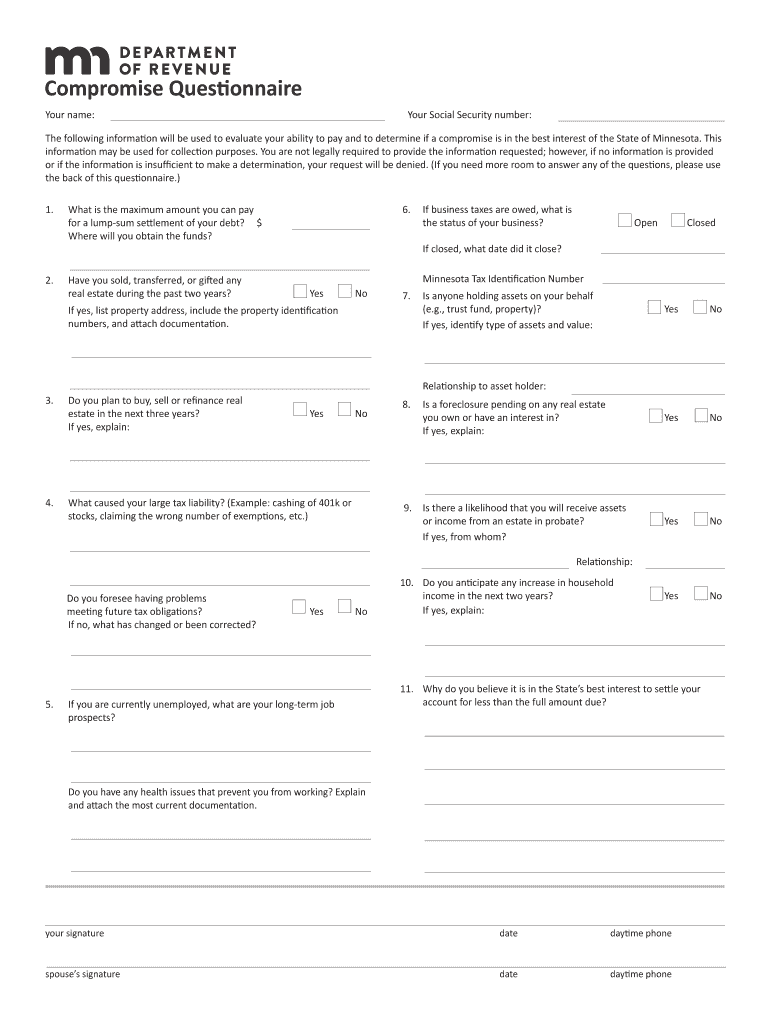

The Compromise Application is a form provided by the Minnesota Department of Revenue that allows taxpayers to negotiate a settlement for their tax liabilities. This form is particularly useful for individuals or businesses facing financial difficulties, enabling them to propose a reduced payment amount that the state may accept to resolve outstanding tax debts. The goal of the application is to provide relief to taxpayers while ensuring the state can still collect a portion of the owed taxes.

Steps to Complete the Compromise Application Minnesota Department of Revenue

Completing the Compromise Application involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expenses, and any other relevant information that supports your financial situation. Next, fill out the application form, providing detailed information about your tax liabilities, income, and assets. It is essential to be honest and thorough, as any discrepancies may lead to delays or denials. Finally, submit the completed application along with any required documentation to the Minnesota Department of Revenue for review.

Eligibility Criteria for the Compromise Application Minnesota Department of Revenue

Eligibility for the Compromise Application is determined by several factors. Taxpayers must demonstrate an inability to pay their full tax liability due to financial hardship. This may include situations such as unemployment, medical expenses, or other significant financial burdens. Additionally, applicants should have filed all required tax returns and made any necessary estimated tax payments. Meeting these criteria is crucial for the application to be considered.

Legal Use of the Compromise Application Minnesota Department of Revenue

The Compromise Application is legally recognized as a valid means of negotiating tax liabilities in Minnesota. When properly completed and submitted, it can lead to a legally binding agreement between the taxpayer and the Minnesota Department of Revenue. To ensure legal compliance, it is important to follow all guidelines outlined by the department and maintain transparency throughout the process. This includes providing accurate financial information and adhering to any terms set forth in the compromise agreement.

Required Documents for the Compromise Application Minnesota Department of Revenue

When submitting the Compromise Application, certain documents are required to support your request. These typically include proof of income, such as pay stubs or tax returns, documentation of expenses, and any other financial statements that reflect your current situation. It may also be necessary to provide a statement explaining your financial hardship and why a compromise is warranted. Ensuring that all required documents are included will help facilitate a smoother review process.

Form Submission Methods for the Compromise Application Minnesota Department of Revenue

The Compromise Application can be submitted through various methods to accommodate different preferences. Taxpayers have the option to submit the form online through the Minnesota Department of Revenue's secure portal, which provides a convenient and efficient way to file. Alternatively, applications can be mailed directly to the department or delivered in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions provided for the chosen method.

Quick guide on how to complete compromise application minnesota department of revenue

Effortlessly Prepare Compromise Application Minnesota Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents quickly without any holdups. Manage Compromise Application Minnesota Department Of Revenue across any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Compromise Application Minnesota Department Of Revenue with Ease

- Obtain Compromise Application Minnesota Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Compromise Application Minnesota Department Of Revenue and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the c58c feature offered by airSlate SignNow?

The c58c feature in airSlate SignNow allows users to easily send and eSign documents securely. This ensures that all parties involved can complete transactions quickly and efficiently, enhancing productivity and streamlining workflows.

-

How does pricing work for the airSlate SignNow c58c solution?

The pricing for the airSlate SignNow c58c solution is competitive and designed to be cost-effective for businesses of all sizes. You can choose from various subscription plans that cater to your specific needs, ensuring that you get the most value for your investment in document management.

-

What are the key benefits of using the c58c feature in airSlate SignNow?

Using the c58c feature in airSlate SignNow offers numerous benefits, including improved efficiency, reduced turnaround times for document signing, and enhanced compliance. This results in a smoother experience for both your team and your clients.

-

Can I integrate c58c with other software applications?

Yes, the c58c feature in airSlate SignNow can easily integrate with various software applications and platforms. This seamless integration allows you to synchronize your document workflows effortlessly, improving productivity across different tools.

-

Is the c58c solution secure for handling sensitive documents?

Absolutely! The c58c solution provided by airSlate SignNow employs industry-standard security protocols, ensuring that your sensitive documents remain protected throughout the signing process. Trust in our secure infrastructure to handle your confidential information safely.

-

What types of documents can I send using the c58c feature?

The c58c feature in airSlate SignNow supports a wide variety of document types, including contracts, agreements, and forms. This flexibility makes it suitable for various industries, helping meet diverse document signing needs.

-

Can I track the status of documents sent through c58c?

Yes, you can easily track the status of documents sent through the c58c feature in airSlate SignNow. This tracking capability allows you to monitor progress, ensuring you are always informed about where each document stands in the signing process.

Get more for Compromise Application Minnesota Department Of Revenue

- Reading explorer 3 answer key form

- Reading explorer 5 answer key form

- Akhuwat loan online application form

- My teaching strategies interrater reliability test answers form

- Lic life certificate form

- Job board department of corrections and rehabilitation form

- Bank appointment for currency exchange instructions ning form

- Dichiarazioni sostitutive dellatto di notoriet form

Find out other Compromise Application Minnesota Department Of Revenue

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free