Nc3x Form

What is the Nc3x

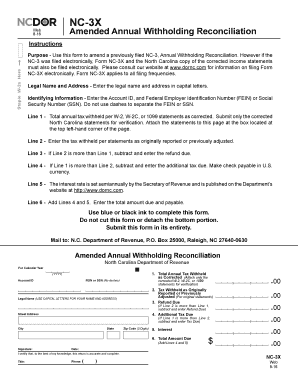

The Nc3x form, also known as the North Carolina annual withholding reconciliation form, is a document used by employers in North Carolina to report and reconcile state income tax withheld from employees' wages throughout the year. This form is essential for ensuring that the correct amount of state tax has been withheld and reported to the North Carolina Department of Revenue. Employers must accurately complete the Nc3x to reflect the total amount withheld, making it a crucial part of the payroll process.

How to use the Nc3x

To effectively use the Nc3x, employers should gather all necessary payroll records for the year, including total wages paid and state income tax withheld. The form requires detailed information about the employer, including their identification number and contact information. Employers must fill out the form accurately and submit it to the North Carolina Department of Revenue by the designated deadline to ensure compliance with state tax laws.

Steps to complete the Nc3x

Completing the Nc3x involves several key steps:

- Gather all payroll records, including total wages and state tax withheld for each employee.

- Fill out the employer information section, including the employer's name, address, and identification number.

- Report the total amount of state income tax withheld for the year.

- Review the completed form for accuracy to avoid any discrepancies.

- Submit the Nc3x form to the North Carolina Department of Revenue by the specified deadline.

Legal use of the Nc3x

The Nc3x form must be used in compliance with North Carolina tax regulations. It serves as a legal document that verifies the withholding of state income tax from employees' wages. Proper completion and timely submission of the Nc3x ensure that employers meet their legal obligations and avoid potential penalties for non-compliance. Additionally, maintaining accurate records related to the Nc3x can protect employers in the event of an audit.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Nc3x to avoid penalties. The Nc3x is typically due by the end of January for the previous calendar year. It is important for employers to mark their calendars and ensure that the form is submitted on time, as late submissions may incur fines or interest charges on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Nc3x can be submitted through various methods, providing flexibility for employers. Options for submission include:

- Online: Employers can submit the Nc3x electronically through the North Carolina Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Employers may also choose to deliver the Nc3x in person at designated Department of Revenue offices.

Quick guide on how to complete nc3x

Effortlessly Prepare Nc3x on Any Device

Managing documents online has gained signNow traction among organizations and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Manage Nc3x on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Modify and eSign Nc3x with Ease

- Find Nc3x and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to apply your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Nc3x to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nexus law in NC?

Stat. § 105-164.8(b), requires a retailer making remote sales sourced to North Carolina to register, collect, and remit sales and use tax on the remote sales. If sales and use tax is not collected by the seller, the purchaser is required to track and annually self-report use tax from mail order and online retailers.

-

How do you amend a NC sales tax return?

You can use a copy of your original return or one of the additional report forms provided in the back of your tax payment forms booklet to make the corrections to the applicable period. The report form should be marked "AMENDED" and forwarded to the Department with any additional tax, penalty and interest due.

-

Can you electronically file an amended return for NC?

Most states require taxpayers to paper file amended returns. TurboTax supports e-filing your amended return in the following states: California. North Carolina.

-

How to amend NC 3?

To file Form NC-3X electronically, visit the Department's website at .ncdor.gov. Use this form to amend a previously filed Form NC-3, Annual Withholding Reconciliation, if you do not submit the information electronically.

-

How do I file articles of amendment in NC?

How to file a North Carolina Corporation Amendment: To amend your North Carolina articles of incorporation, you just need to submit form B-02, Articles of Amendment, Business Corporation to the North Carolina Secretary of State, Corporations Division (SOS) by mail, in person, or online.

-

Does the NC-3 have to be filed electronically?

Note: The format prescribed by the Secretary requires you to file one Form NC-3, along with the State's copy of each required W-2 and 1099 statement, in an electronic format via the Department's eNC3 and Information Reporting Application.

Get more for Nc3x

Find out other Nc3x

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure