PPT 10 Form

What is the Ppt 10

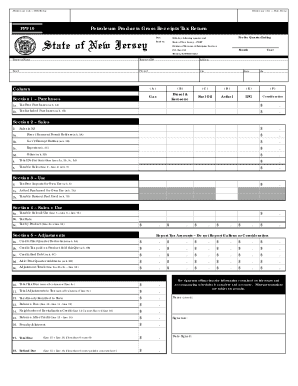

The Ppt 10 is a form used in New Jersey for reporting petroleum products. It is specifically designed for businesses involved in the sale or distribution of petroleum products within the state. This form helps ensure compliance with state tax regulations and provides a clear record of gross receipts from petroleum sales. The Ppt 10 form is essential for maintaining accurate tax records and for fulfilling state reporting requirements.

How to use the Ppt 10

Using the Ppt 10 involves several steps to ensure accurate completion and submission. First, gather all necessary financial records related to petroleum sales. This includes invoices, receipts, and any other documentation that reflects gross receipts. Next, accurately fill out the form by entering the required information about sales and taxes collected. After completing the form, review it for accuracy before submission. Finally, submit the form according to the specified methods, ensuring you meet any deadlines to avoid penalties.

Steps to complete the Ppt 10

Completing the Ppt 10 requires careful attention to detail. Follow these steps:

- Gather all relevant sales documentation, including receipts and invoices.

- Fill out the form with accurate figures for gross receipts from petroleum sales.

- Ensure that all calculations are correct, particularly regarding tax amounts.

- Review the completed form for any errors or missing information.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the Ppt 10

The legal use of the Ppt 10 is governed by New Jersey state law. To be considered valid, the form must be completed accurately and submitted on time. It serves as a legal document that verifies the gross receipts from petroleum sales and ensures compliance with tax obligations. Failure to use the form correctly can result in penalties or legal repercussions, making it crucial for businesses to adhere to all guidelines and regulations associated with the Ppt 10.

Filing Deadlines / Important Dates

Filing deadlines for the Ppt 10 are critical for compliance. Businesses must be aware of the specific dates when the form is due to avoid penalties. Typically, the Ppt 10 must be filed quarterly, with deadlines falling on the last day of the month following the end of each quarter. It is essential to keep track of these dates to ensure timely submissions and maintain good standing with state tax authorities.

Required Documents

To complete the Ppt 10, certain documents are necessary. These include:

- Sales invoices detailing petroleum product transactions.

- Receipts that reflect gross receipts from sales.

- Records of any tax collected on petroleum sales.

- Previous Ppt 10 forms, if applicable, for reference.

Having these documents readily available will facilitate the accurate completion of the form.

Form Submission Methods (Online / Mail / In-Person)

The Ppt 10 can be submitted through various methods to accommodate different preferences. Businesses may choose to file the form online for a quicker process. Alternatively, the form can be mailed directly to the appropriate state department. In-person submissions may also be possible at designated state offices. Each method has its own requirements, so it is important to verify the correct procedure based on the chosen submission method.

Quick guide on how to complete ppt 10

Effortlessly Prepare Ppt 10 on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Ppt 10 on any device using the airSlate SignNow apps available for Android or iOS, and enhance your document-centric processes today.

How to Edit and eSign Ppt 10 with Ease

- Find Ppt 10 and click Get Form to initiate the process.

- Utilize the provided tools to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to apply your changes.

- Select your preferred method for delivering your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any selected device. Modify and eSign Ppt 10 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to ppt10?

airSlate SignNow is a document management platform that allows users to easily send and eSign documents. With the introduction of ppt10, we've enhanced our features to provide a more seamless signing experience, making it an excellent choice for businesses looking to streamline their document workflows.

-

How much does airSlate SignNow cost and what are the pricing tiers related to ppt10?

airSlate SignNow offers flexible pricing plans starting at an affordable rate, with options to suit different business sizes. The ppt10 package includes advanced features at a competitive price, ensuring you get the most out of your investment for document signing and management.

-

What features does ppt10 offer for document signing?

The ppt10 package includes key features such as templates for frequently used forms, customizable signing workflows, and real-time tracking of document statuses. These features make it easier for businesses to manage their signing processes effectively.

-

Can I integrate airSlate SignNow with other software as part of the ppt10 offering?

Yes, airSlate SignNow integrates smoothly with numerous popular applications like Google Workspace, Salesforce, and more. The ppt10 offering supports these integrations, allowing businesses to use airSlate SignNow alongside their existing tools for enhanced efficiency.

-

What are the benefits of using airSlate SignNow's ppt10 for my business?

Using airSlate SignNow's ppt10 can signNowly reduce the time it takes to manage and sign documents. The user-friendly interface coupled with powerful features ensures that businesses can enhance productivity while ensuring compliance and secure handling of their documents.

-

Is airSlate SignNow secure, especially for sensitive documents within ppt10?

Absolutely! airSlate SignNow prioritizes security, employing encryption and secure storage measures. The ppt10 package includes these security features to protect your sensitive documents throughout the signing process.

-

How does airSlate SignNow streamline the document workflow with ppt10?

With ppt10, airSlate SignNow automates various aspects of your document workflow, from template creation to signing notifications. This automation minimizes manual efforts and reduces the chances of errors, leading to a more efficient process overall.

Get more for Ppt 10

- Hamburger graphic organizer pdf form

- Hoja de campo rula form

- Reading comprehension for grade 3 form

- Distance time and velocity time graphs gizmo answers form

- Food stamp application form

- Form 872

- Tcc dental hygiene program required observation hours form

- Application for change of beneficiary or name form

Find out other Ppt 10

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement