Corporation E File Signature Form Form VA Virginia Tax

Understanding the VA Tax Authorization Form

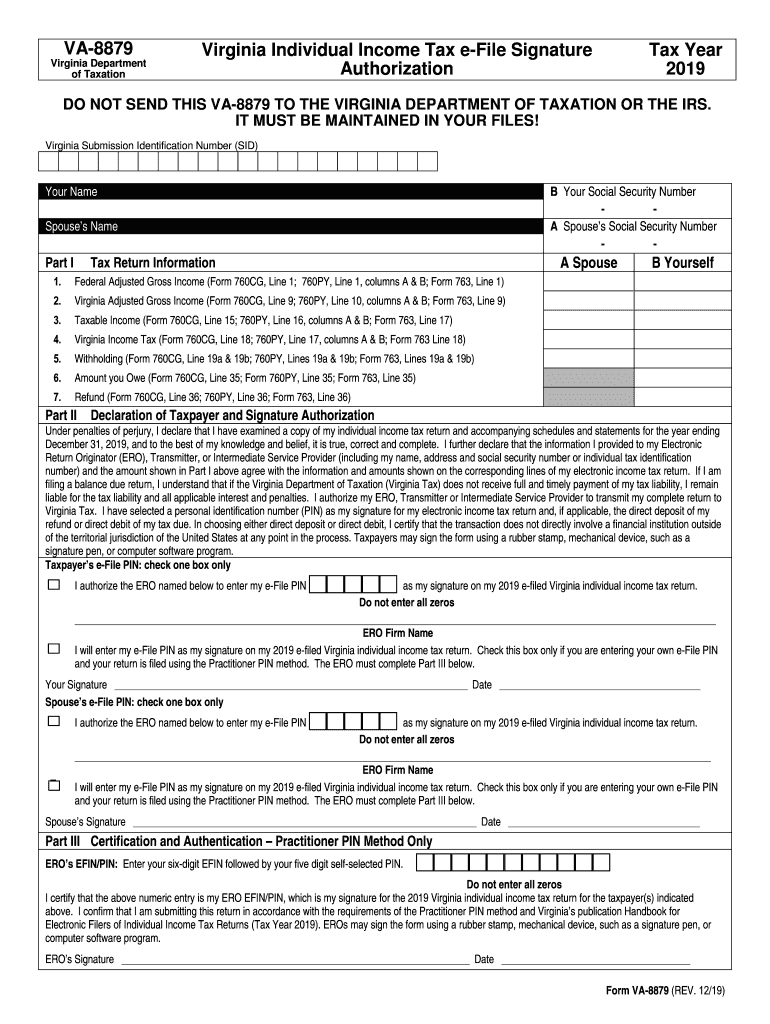

The Virginia tax authorization form, often referred to as the VA 8879, is a critical document for taxpayers in Virginia. This form allows individuals to authorize a tax professional to electronically file their income tax returns on their behalf. It serves as a declaration of consent, ensuring that the tax preparer has the necessary permission to submit the return to the IRS. Understanding the purpose and requirements of this form is essential for a smooth tax filing process.

Steps to Complete the VA Tax Authorization Form

Completing the VA 8879 form involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and details about your tax return. Next, fill out the form with the required information, ensuring that all entries are correct. After completing the form, review it for any errors before signing. The final step involves providing your signature, which can be done electronically, confirming your authorization for the tax preparer to file your return.

Legal Use of the VA Tax Authorization Form

The VA tax authorization form is legally binding when completed correctly. It complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as valid. This legal framework ensures that the authorization you provide through the VA 8879 is enforceable and that your tax preparer can file your return without any legal issues. It is crucial to keep a copy of the signed form for your records, as it serves as proof of authorization.

Filing Deadlines for the VA Tax Authorization Form

Timely submission of the VA 8879 is essential to avoid penalties. The form must be signed and submitted before the tax filing deadline, which is typically April 15 for most taxpayers. If you are unable to file by this date, you may request an extension, but the VA 8879 must still be submitted by the original deadline to ensure that your tax preparer can file your return on time. Staying aware of these deadlines helps prevent any complications with your tax filings.

Required Documents for the VA Tax Authorization Form

To complete the VA tax authorization form, you will need several key documents. These include your previous year’s tax return, W-2 forms from your employer, and any 1099 forms if you have income from freelance work or investments. Additionally, having your Social Security number and the tax preparer's information ready will streamline the process. Collecting these documents in advance can help ensure that you fill out the VA 8879 accurately and efficiently.

Common Scenarios for Using the VA Tax Authorization Form

The VA tax authorization form is commonly used by various taxpayer scenarios, including self-employed individuals, retirees, and students. For self-employed individuals, this form allows their tax preparers to file business income and expenses electronically. Retirees may use the form to ensure that their pension and Social Security income are accurately reported. Students, particularly those with part-time jobs or scholarships, can also benefit from the assistance of tax professionals in filing their returns, making the VA 8879 a valuable tool for diverse taxpayer situations.

Quick guide on how to complete corporation e file signature form form va virginia tax

Complete Corporation E File Signature Form Form VA Virginia Tax effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Administer Corporation E File Signature Form Form VA Virginia Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most effective way to modify and eSign Corporation E File Signature Form Form VA Virginia Tax effortlessly

- Obtain Corporation E File Signature Form Form VA Virginia Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced paperwork, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Corporation E File Signature Form Form VA Virginia Tax and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Virginia tax authorization and why is it important?

Virginia tax authorization refers to the process of granting permission to a designated individual or entity to handle your tax affairs with the state. This authorization is crucial for ensuring that your tax matters are handled accurately and efficiently, which can help avoid costly penalties and ensure compliance.

-

How does airSlate SignNow simplify the VA tax authorization process?

airSlate SignNow streamlines the VA tax authorization process by allowing you to electronically sign and send documents securely. This eliminates the need for physical paperwork, making it easier to manage your tax filings and communications with state authorities.

-

What are the costs associated with using airSlate SignNow for VA tax authorization?

airSlate SignNow offers various pricing plans to accommodate different business needs, ensuring a cost-effective solution for VA tax authorization. You can choose from monthly or annual subscriptions, with options that scale as your business grows.

-

What features does airSlate SignNow offer for managing VA tax authorization documents?

airSlate SignNow provides a range of features tailored for managing VA tax authorization documents, including customizable templates, secure electronic signatures, and real-time tracking of document status. These tools enhance your efficiency and provide peace of mind.

-

Can I integrate airSlate SignNow with other software for VA tax authorization?

Yes, airSlate SignNow seamlessly integrates with various productivity and accounting tools, allowing for a smooth workflow when managing VA tax authorization. This integration helps ensure that all your financial documents are easily accessible and organized.

-

Is airSlate SignNow compliant with Virginia tax regulations for authorization?

Absolutely! airSlate SignNow adheres to all applicable Virginia tax regulations, ensuring that your VA tax authorization documents meet legal requirements. This compliance helps protect your business from potential legal issues.

-

What benefits can I expect from using airSlate SignNow for VA tax authorization?

By using airSlate SignNow for VA tax authorization, you can expect increased efficiency, improved accuracy, and enhanced security for your sensitive documents. The platform's user-friendly design also minimizes the learning curve for new users.

Get more for Corporation E File Signature Form Form VA Virginia Tax

- Customer authorization of disclosure of financial records dboqr 500265 rev 10 17 form

- Fillable online equipment lease agreement catalog form

- All information on this form must be

- 921 michigan department of licensing and regulatory 574519671 form

- 21 michigan department of licensing and regulatory form

- Michigan profit corporation filing information

- Pdf foreign registration statement arizona corporation commission form

- Get the free fis 0407 618 department of insurance and form

Find out other Corporation E File Signature Form Form VA Virginia Tax

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form