Combined Excise Tax Return 2005

What is the Combined Excise Tax Return

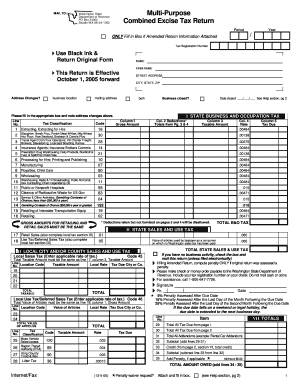

The Washington combined excise tax return is a crucial document for businesses operating in the state. It consolidates various tax obligations into a single form, simplifying the filing process for businesses. This return encompasses multiple taxes, including the business and occupation (B&O) tax, sales tax, and use tax. By using this form, businesses can efficiently report their tax liabilities and ensure compliance with state regulations.

Steps to Complete the Combined Excise Tax Return

Completing the Washington combined excise tax return involves several key steps:

- Gather necessary information: Collect all relevant financial data, including sales figures, purchases, and any deductions.

- Determine tax classifications: Identify the appropriate tax classifications based on your business activities.

- Fill out the form: Accurately complete the return, ensuring all required fields are filled in correctly.

- Review for accuracy: Double-check all entries for errors or omissions to avoid penalties.

- Submit the form: File the return electronically or via mail, depending on your preference.

Legal Use of the Combined Excise Tax Return

The legal validity of the Washington combined excise tax return is established through compliance with state laws and regulations. To be considered legally binding, the form must be completed accurately and submitted within the designated deadlines. E-signatures are accepted, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the return holds up under scrutiny from tax authorities.

Form Submission Methods

Businesses have multiple options for submitting the Washington combined excise tax return. The primary methods include:

- Online submission: Filing electronically through the Washington Department of Revenue’s online portal is the fastest and most efficient method.

- Mail: Businesses can print the completed form and send it via postal service to the appropriate tax office.

- In-person: Some businesses may choose to deliver the form directly to their local tax office for immediate processing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Washington combined excise tax return is essential for compliance. Generally, businesses must file their returns on a monthly, quarterly, or annual basis, depending on their tax liability. Key deadlines include:

- Monthly filers: Due on the last day of the month following the reporting period.

- Quarterly filers: Due on the last day of the month following the end of the quarter.

- Annual filers: Due on January 31 of the following year.

Required Documents

To complete the Washington combined excise tax return accurately, businesses need to prepare several documents, including:

- Sales records: Detailed reports of all sales transactions.

- Purchase records: Documentation of purchases subject to use tax.

- Previous tax returns: Reference to past filings can help ensure consistency and accuracy.

- Financial statements: These may be necessary for larger businesses to validate income and expenses.

Quick guide on how to complete combined excise tax return

Handle Combined Excise Tax Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, with the ability to easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without any holdups. Manage Combined Excise Tax Return on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Combined Excise Tax Return with ease

- Find Combined Excise Tax Return and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Edit and electronically sign Combined Excise Tax Return and guarantee smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct combined excise tax return

Create this form in 5 minutes!

People also ask

-

What is the Washington combined excise tax return?

The Washington combined excise tax return is a consolidated tax form that businesses in Washington State use to report various taxes including sales tax, use tax, and business and occupation (B&O) tax. Filing this return simplifies tax reporting by combining multiple taxes into one document, making compliance easier for business owners.

-

How does airSlate SignNow help with the Washington combined excise tax return?

airSlate SignNow streamlines the process of signing and submitting your Washington combined excise tax return electronically. With our easy-to-use platform, you can eSign your documents, ensuring quick submission to avoid penalties associated with late filings.

-

Are there any costs associated with using airSlate SignNow for the Washington combined excise tax return?

AirSlate SignNow offers flexible pricing options that cater to different business needs. While there are subscription fees, the ability to save time and reduce paper usage makes it a cost-effective solution when handling your Washington combined excise tax return.

-

What features does airSlate SignNow provide for tax document management?

With airSlate SignNow, you get features like customizable templates, secure eSigning, document tracking, and automated reminders. These tools enhance the efficiency of managing your Washington combined excise tax return and ensure that all necessary documents are completed on time.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow can integrate with various accounting software, allowing for seamless data transfer. This integration simplifies the preparation of your Washington combined excise tax return, making it easier to access necessary financial information directly from your accounting platform.

-

What benefits does eSigning my Washington combined excise tax return provide?

eSigning your Washington combined excise tax return with airSlate SignNow provides security, convenience, and efficiency. You can sign documents anytime and anywhere, which speeds up your filing process and helps to ensure your return is submitted accurately and on time.

-

Is airSlate SignNow compliant with Washington State tax regulations?

Absolutely, airSlate SignNow is designed to comply with Washington State's electronic signature laws and regulations. This compliance ensures that your Washington combined excise tax return is legally binding and meets all state requirements.

Get more for Combined Excise Tax Return

Find out other Combined Excise Tax Return

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template