Ofm Wa Gov Sites DefaultTransportation Revenue Forecast Council Washington 2022-2026

Filing Deadlines and Important Dates

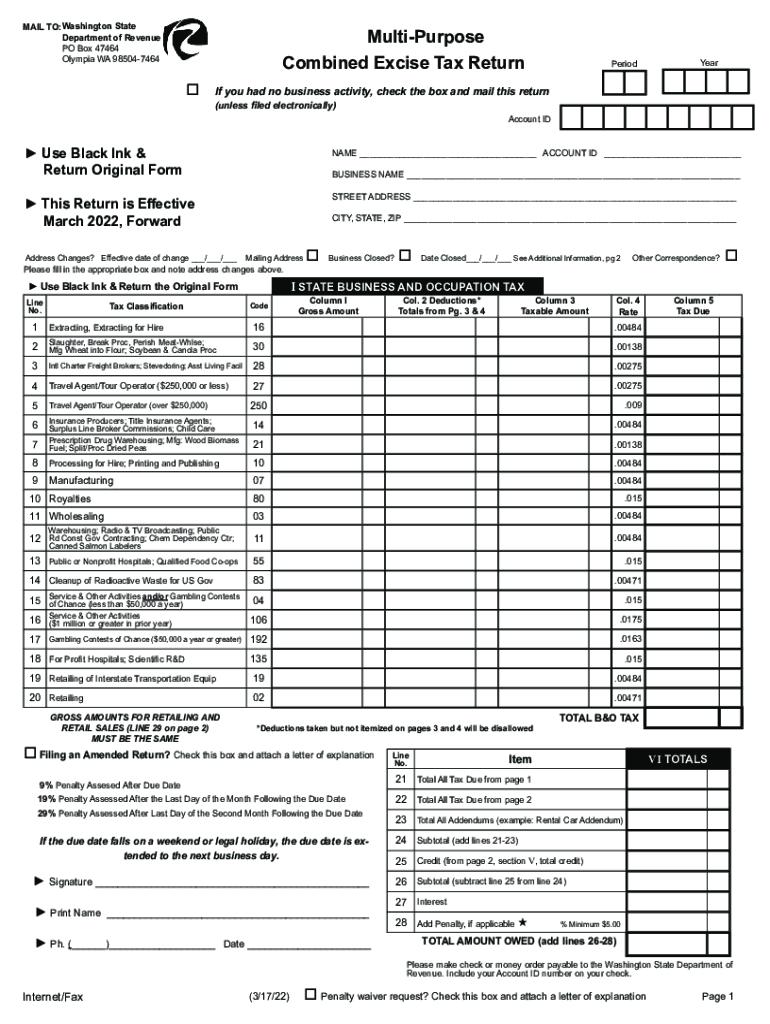

When submitting the WA combined excise tax return, it is crucial to be aware of the specific filing deadlines to avoid penalties. Generally, businesses must file their returns on a monthly or quarterly basis, depending on their tax liability. The deadlines are as follows:

- Monthly filers: Returns are due on the 20th of the month following the reporting period.

- Quarterly filers: Returns are due on the last day of the month following the end of the quarter.

- Annual filers: Returns are due on January 31 of the following year.

It is advisable to keep track of these dates to ensure timely submissions and compliance with Washington state tax regulations.

Required Documents for Filing

To successfully complete the WA combined excise tax return, certain documents are necessary. These documents help ensure accurate reporting of sales and other taxable activities. Key documents include:

- Sales records: Detailed logs of all sales transactions.

- Purchase records: Documentation of all purchases made that may affect tax calculations.

- Exemption certificates: If applicable, these certificates should be included to justify any exempt sales.

- Previous tax returns: Having past returns on hand can assist in ensuring consistency and accuracy.

Gathering these documents in advance can streamline the filing process and reduce the risk of errors.

Form Submission Methods

The WA combined excise tax return can be submitted through various methods, allowing businesses to choose the most convenient option. Available submission methods include:

- Online: Using the Washington Department of Revenue's online portal for electronic filing.

- Mail: Sending a paper form to the appropriate tax office.

- In-Person: Delivering the form directly to a local Department of Revenue office.

Each method has its benefits, with online submission often providing immediate confirmation of receipt.

Penalties for Non-Compliance

Failing to file the WA combined excise tax return on time can result in significant penalties. Understanding these penalties can help businesses avoid costly mistakes. Potential penalties include:

- Late filing penalty: A percentage of the tax due, applied for each month the return is late.

- Interest charges: Accumulated on any unpaid tax from the original due date until paid in full.

- Additional penalties: May apply for repeated non-compliance or failure to respond to notices from the Department of Revenue.

Being proactive about filing can help mitigate these risks and ensure compliance with state regulations.

Eligibility Criteria for Filing

Understanding the eligibility criteria for filing the WA combined excise tax return is essential for businesses operating in Washington state. Generally, the following criteria apply:

- Businesses with gross income exceeding the threshold set by the Washington Department of Revenue must file.

- All types of business entities, including sole proprietorships, partnerships, and corporations, are required to file if they meet the income criteria.

- Non-profit organizations may also need to file, depending on their activities and income levels.

Reviewing these criteria can help businesses determine their obligations and ensure compliance.

Quick guide on how to complete ofmwagov sites defaulttransportation revenue forecast council washington

Effortlessly Prepare Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington on Any Device

The management of online documents has become increasingly favored by corporations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington with Ease

- Find Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow specifically provides for that function.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form—via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your choice. Edit and eSign Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ofmwagov sites defaulttransportation revenue forecast council washington

Create this form in 5 minutes!

People also ask

-

What is the combined excise tax return form Washington?

The combined excise tax return form Washington is a consolidated tax form that businesses use to report various taxes, including sales tax, use tax, and litter taxes. It simplifies the filing process for business owners by combining multiple tax reports into one. Using the combined excise tax return form Washington ensures that your submissions are accurate and timely.

-

How can airSlate SignNow help with the combined excise tax return form Washington?

airSlate SignNow streamlines the process of completing the combined excise tax return form Washington by providing an easy-to-use digital platform for form filling and eSigning. With our solution, you can quickly fill out the necessary fields, ensuring accuracy while saving time. This efficiency helps you stay compliant and avoid penalties related to tax submissions.

-

What features does airSlate SignNow offer for completing tax forms?

airSlate SignNow offers features like customizable templates and in-app document collaboration to create and manage your combined excise tax return form Washington easily. You'll also have access to secure cloud storage, automatic reminders, and tracking options for document signing. These features help you efficiently navigate through your tax documentation.

-

Is there a cost associated with using airSlate SignNow for the combined excise tax return form Washington?

Yes, there is a cost associated with using airSlate SignNow, but it provides a cost-effective solution tailored to your business needs. Pricing varies based on the number of users and features selected, ensuring you pay only for what you need. Considering the time and effort saved, the investment in airSlate SignNow can greatly benefit businesses dealing with the combined excise tax return form Washington.

-

Can I integrate airSlate SignNow with my existing software for tax reporting?

Absolutely! airSlate SignNow can be integrated with various accounting and tax reporting software to streamline your processes, including the combined excise tax return form Washington. This means you can import necessary data directly into SignNow, reducing manual entry and minimizing errors. Integrations enhance your overall efficiency and accuracy in tax filing.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, including the combined excise tax return form Washington, offers multiple benefits such as enhanced security, efficiency, and compliance. Your documents are encrypted and securely stored, reducing the risk of loss or theft. The intuitive platform helps ensure that documents are filed correctly and on time, giving you peace of mind.

-

How do I get started with airSlate SignNow for my combined excise tax return form Washington?

Getting started with airSlate SignNow is simple! You can sign up for an account on our website, select a suitable pricing plan, and start creating your combined excise tax return form Washington immediately. Our user-friendly interface and support resources guide you through using our platform to maximize efficiency in tax filings.

Get more for Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington

- Nc certificate trust form

- Partial release of property from deed of trust for corporation north carolina form

- Partial release of property from deed of trust for individual north carolina form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy north carolina form

- Warranty deed for parents to child with reservation of life estate north carolina form

- Nc property form

- Warranty deed to separate property of one spouse to both spouses as joint tenants north carolina form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries north carolina form

Find out other Ofm wa gov Sites DefaultTransportation Revenue Forecast Council Washington

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile