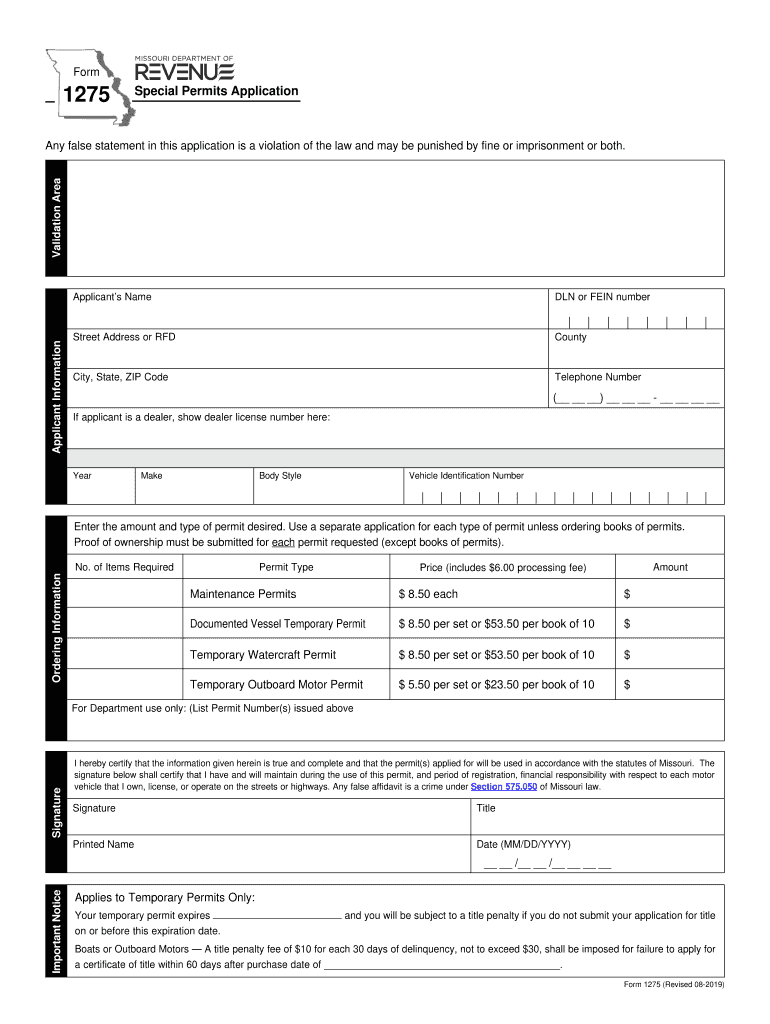

DLN or FEIN Number Form

What is the DLN Or FEIN Number

The DLN (Document Locator Number) and FEIN (Federal Employer Identification Number) are essential identifiers for businesses in the United States. The DLN is a unique number assigned to a specific tax document, allowing the IRS to track and manage tax filings efficiently. The FEIN, on the other hand, is a nine-digit number issued by the IRS to identify a business entity for tax purposes. It is often required when filing taxes, opening a business bank account, or applying for business licenses.

How to Obtain the DLN Or FEIN Number

To obtain a DLN, you typically do not need to apply separately, as it is generated when you file a tax document with the IRS. However, to acquire a FEIN, businesses must complete Form SS-4, which can be submitted online, by fax, or by mail. The online application process is the quickest, allowing businesses to receive their FEIN immediately upon completion. For those applying by mail or fax, processing times may vary.

Steps to Complete the DLN Or FEIN Number

When filling out forms that require a DLN or FEIN, follow these steps:

- Gather necessary information about your business, including its legal name, address, and structure.

- Complete Form SS-4 for the FEIN, ensuring all fields are filled accurately.

- If applicable, ensure that the DLN is included on your tax documents, which will be automatically generated upon submission.

- Review all information for accuracy before submitting the form to the IRS.

Legal Use of the DLN Or FEIN Number

The DLN and FEIN numbers serve crucial legal purposes. The FEIN is required for tax reporting and compliance, allowing the IRS to track business activities. The DLN helps in identifying specific documents submitted to the IRS, ensuring that all filings are processed correctly. It is important for businesses to use these numbers accurately to avoid penalties and maintain compliance with federal regulations.

Examples of Using the DLN Or FEIN Number

Businesses use the DLN and FEIN in various scenarios:

- When filing annual tax returns, the FEIN must be included to identify the business entity.

- The DLN is referenced on specific tax documents, such as payroll tax filings, to ensure proper tracking.

- When opening a business bank account, banks often require the FEIN to verify the business's identity.

IRS Guidelines

The IRS provides specific guidelines for the use of DLN and FEIN numbers. These guidelines include instructions for proper usage on tax forms, the importance of keeping these numbers confidential, and the procedures for reporting any discrepancies. Businesses should regularly consult IRS resources to stay updated on any changes or additional requirements regarding these identifiers.

Quick guide on how to complete dln or fein number

Handle DLN Or FEIN Number seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without hold-ups. Administer DLN Or FEIN Number on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign DLN Or FEIN Number effortlessly

- Locate DLN Or FEIN Number and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to submit your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign DLN Or FEIN Number to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a DLN or FEIN number and why is it important for businesses?

A DLN or FEIN number, or Federal Employer Identification Number, is essential for businesses as it uniquely identifies them for tax purposes. This number is vital for various functions including payroll processing, tax filings, and establishing business credit. Ensuring you have the correct DLN or FEIN number is key to maintaining compliance and avoiding potential legal issues.

-

How can airSlate SignNow help me manage my DLN or FEIN number documentation?

airSlate SignNow provides an easy-to-use solution for sending and eSigning documents related to your DLN or FEIN number. Our platform allows you to securely store, access, and manage important documents digitally, ensuring that your critical information is always at your fingertips. This efficiency can save your business valuable time and resources.

-

Is airSlate SignNow cost-effective for managing documentation related to my DLN or FEIN number?

Yes, airSlate SignNow is designed as a cost-effective solution for businesses of all sizes, making it easy to manage documents associated with your DLN or FEIN number. With a variety of pricing plans, it's suitable for small businesses to large enterprises. Investing in our services can ultimately save you money through enhanced efficiency.

-

What features does airSlate SignNow offer for handling DLN or FEIN number documents?

airSlate SignNow offers a host of features tailored for handling DLN or FEIN number documentation, including secure eSigning, document templates, and automatic reminders. These capabilities streamline the signing process and help ensure you never miss an important filing deadline related to your DLN or FEIN number. Our intuitive interface makes these features accessible to all users.

-

Are there integrations available with airSlate SignNow for DLN or FEIN number management?

Absolutely! airSlate SignNow integrates with a wide range of applications, allowing seamless management of documents related to your DLN or FEIN number. Whether you're using accounting software or CRM systems, our integrations ensure that your documentation needs are met without disrupting your existing workflows. This connectivity adds a layer of efficiency to your business operations.

-

Can I customize my DLN or FEIN number-related documents with airSlate SignNow?

Yes, airSlate SignNow allows for customization of your documents associated with your DLN or FEIN number. You can add your branding, logos, or specific terms that reflect your business needs within our document creation tools. This flexibility ensures that your documents not only meet legal standards but also maintain your brand’s identity.

-

How secure is my information related to my DLN or FEIN number with airSlate SignNow?

The security of your information, including your DLN or FEIN number details, is a top priority for airSlate SignNow. We implement robust encryption protocols and secure access controls to protect your data during every transaction. By trusting us with your documents, you can feel confident that your information is handled with the utmost confidentiality.

Get more for DLN Or FEIN Number

- Formb flcourts

- Illinois hearing officer form

- Bill costs form

- Hud 52672 form

- Vermont resale certificate blank form

- Etfwigovsitesdefaultwisconsin department employee identification etfwigov form

- Fillable online summary plan description for metromont form

- Oregon workers compensation division oregon workers form

Find out other DLN Or FEIN Number

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe