Ne Exemption Form

What is the Ne Exemption Form

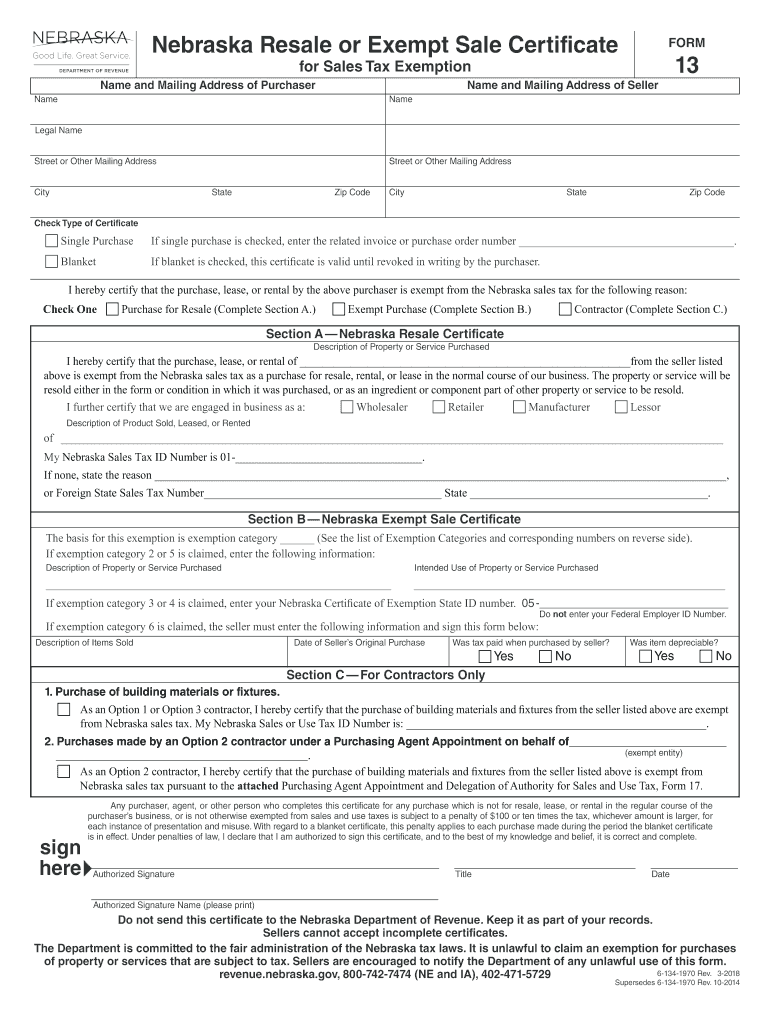

The Ne Exemption Form, often referred to as the form 13, is a crucial document used in Nebraska for tax exemption purposes. This form allows qualifying entities, such as non-profit organizations and certain businesses, to claim exemption from sales and use taxes. By submitting this form, eligible applicants can avoid paying taxes on specific purchases, thereby reducing their overall operational costs. Understanding the purpose and implications of this form is essential for businesses and organizations seeking tax relief in Nebraska.

How to use the Ne Exemption Form

Using the Ne Exemption Form involves several steps to ensure compliance with state regulations. First, applicants must determine their eligibility based on the criteria set forth by the Nebraska Department of Revenue. Once eligibility is confirmed, the form can be filled out accurately, providing all necessary information about the entity and the nature of the exemption being claimed. After completing the form, it should be submitted to the appropriate tax authority, either online or via mail, depending on the specific submission guidelines. It is important to retain a copy of the submitted form for record-keeping purposes.

Steps to complete the Ne Exemption Form

Completing the Ne Exemption Form requires careful attention to detail. Here are the key steps involved:

- Gather relevant information about your organization, including tax identification numbers and contact details.

- Review the eligibility criteria to ensure that your entity qualifies for the exemption.

- Fill out the form accurately, providing all requested details and ensuring that all sections are complete.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form as directed, either online or through traditional mail.

Legal use of the Ne Exemption Form

The Ne Exemption Form must be used in accordance with Nebraska state laws to ensure its legal validity. This includes adhering to the guidelines set forth by the Nebraska Department of Revenue regarding eligibility and proper use. Misuse of the form, such as submitting it without meeting the necessary criteria or providing false information, can lead to penalties and loss of exemption status. It is essential for applicants to understand their legal obligations when utilizing this form to avoid complications.

Eligibility Criteria

To qualify for the Ne Exemption Form, applicants must meet specific eligibility criteria established by the Nebraska Department of Revenue. Generally, eligible entities include non-profit organizations, government agencies, and certain educational institutions. Additionally, the purchases for which the exemption is claimed must be directly related to the exempt purpose of the organization. It is important to review the detailed eligibility requirements to ensure compliance and maximize the benefits of the exemption.

Required Documents

When applying for the Ne Exemption Form, specific documents may be required to support the application. These typically include:

- A copy of the organization's tax-exempt status documentation, if applicable.

- Proof of the entity's operational status, such as incorporation papers or bylaws.

- Any additional documentation that demonstrates the nature of the purchases being exempted.

Having these documents ready can streamline the application process and help ensure a successful claim for exemption.

Form Submission Methods

The Ne Exemption Form can be submitted through various methods, depending on the preferences of the applicant and the guidelines provided by the Nebraska Department of Revenue. Common submission methods include:

- Online submission through the state’s tax portal, which may offer a faster processing time.

- Mailing a physical copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can affect the speed and efficiency of the application process.

Quick guide on how to complete ne exemption form

Complete Ne Exemption Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Ne Exemption Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to alter and electronically sign Ne Exemption Form with ease

- Obtain Ne Exemption Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Ne Exemption Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is NE exempt in the context of airSlate SignNow?

NE exempt refers to the exemption in New England for certain electronic signatures processed through airSlate SignNow. This feature allows businesses to simplify their document workflows while ensuring compliance with regional regulations.

-

How does airSlate SignNow ensure NE exempt compliance?

airSlate SignNow provides robust tools to guarantee that documents signed electronically are NE exempt compliant. Our platform adheres to state-specific regulations, ensuring that your eSignatures are legally binding and supported in legal scenarios.

-

What pricing plans does airSlate SignNow offer for NE exempt usage?

airSlate SignNow offers various pricing plans that cater to organizations needing NE exempt options. Our plans are designed to accommodate different business sizes, with features that provide flexibility and scalability to meet your specific needs.

-

Can I integrate airSlate SignNow with other software for NE exempt needs?

Yes, airSlate SignNow offers seamless integrations with popular software applications to support NE exempt workflows. You can connect with CRM, document management, and productivity tools, enhancing your efficiency in managing legally binding documents.

-

What features of airSlate SignNow help with NE exempt documentation?

airSlate SignNow includes a variety of features tailored to assist with NE exempt documentation, such as customizable templates, secure cloud storage, and powerful tracking capabilities. These tools streamline the preparation and signing of vital documents, ensuring compliance.

-

What are the benefits of using airSlate SignNow for NE exempt transactions?

Using airSlate SignNow for NE exempt transactions offers several benefits, including faster turnaround times, reduced paperwork, and enhanced security for sensitive documents. Our solution simplifies the signing process while ensuring your documents remain compliant with regional laws.

-

Is customer support available for NE exempt inquiries?

Absolutely! airSlate SignNow provides comprehensive customer support for NE exempt inquiries. Our team is available to assist you with any questions or concerns, ensuring you fully understand how to maximize the benefits of our platform.

Get more for Ne Exemption Form

- 17 printable mechanic repair forms templates fillable

- New service installation requirementsnew peoples gas form

- Application for mediation or hearing form a

- Accessory dwelling unit application accessory dwelling unit application form

- Instructions for completing the certificate of surrender form

- 2012 form fl building permit application martin county fill

- Business information change form washington state

- These instructions guide the permittee through completing the notice of commencement form

Find out other Ne Exemption Form

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application