Texas End User Agricultural Signed Statement Form

What is the Texas End User Agricultural Signed Statement

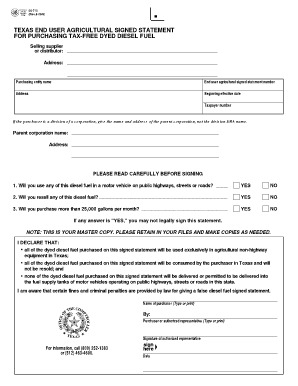

The Texas End User Agricultural Signed Statement is a crucial document used by individuals or businesses purchasing dyed diesel fuel in Texas. This form certifies that the fuel will be used for exempt purposes, such as agricultural activities. By signing this statement, the purchaser confirms compliance with state regulations regarding the use of dyed diesel, which is typically subject to lower taxes compared to regular diesel fuel. This statement is essential for ensuring that the fuel is not misused for taxable purposes, thus protecting both the buyer and the seller from potential legal issues.

How to use the Texas End User Agricultural Signed Statement

To effectively use the Texas End User Agricultural Signed Statement, follow these steps:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in the required information, including your name, address, and details about the agricultural use of the fuel.

- Sign and date the form to validate your declaration.

- Provide the completed statement to the fuel supplier at the time of purchase.

This process helps ensure that you comply with Texas regulations while benefiting from the tax exemptions associated with dyed diesel fuel.

Steps to complete the Texas End User Agricultural Signed Statement

Completing the Texas End User Agricultural Signed Statement involves several key steps:

- Download or request the form from your fuel supplier or the Texas Comptroller's office.

- Enter your personal information accurately, including your business name if applicable.

- Specify the purpose for which the dyed diesel will be used, ensuring it aligns with agricultural exemptions.

- Review the completed form for accuracy and completeness.

- Sign and date the form to affirm your declaration.

- Submit the form to your supplier before purchasing the dyed diesel fuel.

Following these steps ensures that your statement is correctly filled out and legally binding.

Legal use of the Texas End User Agricultural Signed Statement

The legal use of the Texas End User Agricultural Signed Statement is governed by state regulations that define how dyed diesel fuel may be utilized. This document is legally binding when filled out correctly, providing proof that the fuel will be used for exempt purposes. Misuse of this statement can lead to penalties, including fines and back taxes. Therefore, it is essential to ensure that all information provided is truthful and that the fuel is indeed used for the purposes stated.

Key elements of the Texas End User Agricultural Signed Statement

Key elements of the Texas End User Agricultural Signed Statement include:

- Purchaser Information: Name, address, and contact details of the individual or business purchasing the fuel.

- Fuel Usage Declaration: A clear statement indicating the intended agricultural use of the dyed diesel.

- Signature: The purchaser's signature, affirming that the information provided is accurate and complete.

- Date: The date on which the statement is signed, which is important for record-keeping and compliance.

These elements ensure that the statement serves its purpose effectively and complies with Texas regulations.

Examples of using the Texas End User Agricultural Signed Statement

Examples of using the Texas End User Agricultural Signed Statement include:

- A farmer purchasing dyed diesel to fuel tractors and other machinery used in crop production.

- A rancher using dyed diesel for vehicles that transport livestock and feed.

- A horticulturist buying dyed diesel for equipment used in maintaining greenhouses and nurseries.

In each case, the statement serves to confirm that the fuel will be used for exempt agricultural activities, ensuring compliance with tax regulations.

Quick guide on how to complete texas end user agricultural signed statement

Effortlessly Prepare Texas End User Agricultural Signed Statement on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Handle Texas End User Agricultural Signed Statement on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Easily Edit and eSign Texas End User Agricultural Signed Statement

- Obtain Texas End User Agricultural Signed Statement and click on Get Form to begin.

- Use the provided tools to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or errors that require printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Texas End User Agricultural Signed Statement and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the texas dyed diesel form?

The texas dyed diesel form is a state-specific document required for the purchase and use of dyed diesel fuel in Texas. This form ensures compliance with state regulations and allows users to avoid certain taxes associated with standard diesel fuel. It's essential for businesses and individuals who utilize dyed diesel for off-road use.

-

How can airSlate SignNow help with the texas dyed diesel form?

airSlate SignNow streamlines the process of completing and signing the texas dyed diesel form digitally. Our platform enables users to fill out, sign, and send this document efficiently without the need for printing. This not only saves time but also ensures that the form is completed accurately every time.

-

Is there a cost associated with using airSlate SignNow for the texas dyed diesel form?

Yes, airSlate SignNow offers various pricing plans, allowing you to choose one that fits your needs, including the ability to manage the texas dyed diesel form. Our cost-effective solution provides great value, especially for businesses that frequently handle document signing and compliance.

-

What features does airSlate SignNow offer for the texas dyed diesel form?

With airSlate SignNow, users can easily create, customize, and send the texas dyed diesel form. You can track the document's status in real-time, set reminders for signers, and ensure that all necessary parties are notified. These features enhance the efficiency of managing compliance documents.

-

Can airSlate SignNow integrate with other software for the texas dyed diesel form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications that can help manage the texas dyed diesel form. Whether you use accounting, CRM, or document management systems, our integrations simplify workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for the texas dyed diesel form?

Using airSlate SignNow for the texas dyed diesel form offers several benefits, including increased efficiency, enhanced accuracy, and reduced paper usage. The digital process minimizes human error and accelerates the turnaround time for approvals and submissions. Additionally, it keeps all your documents organized and easily accessible.

-

Is electronic signing of the texas dyed diesel form legally binding?

Yes, electronic signing of the texas dyed diesel form using airSlate SignNow is legally binding and compliant with state laws. Our platform adheres to the U.S. Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that your digitally signed documents hold the same legal weight as their traditional counterparts.

Get more for Texas End User Agricultural Signed Statement

- Oklahoma paper tag template form

- Undertaking application for migration certificate form

- Gde 0001 form pdf

- Cp600 form

- Ikm assessment test answers pdf form

- Coca cola aptitude test questions and answers pdf form

- Ukzn acceptance form

- Jv 101a additional children attachment juvenile dependency petition form

Find out other Texas End User Agricultural Signed Statement

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document