Personal Details, Bank Account and Payroll Deductions Form

What is the Personal Details, Bank Account And Payroll Deductions Form

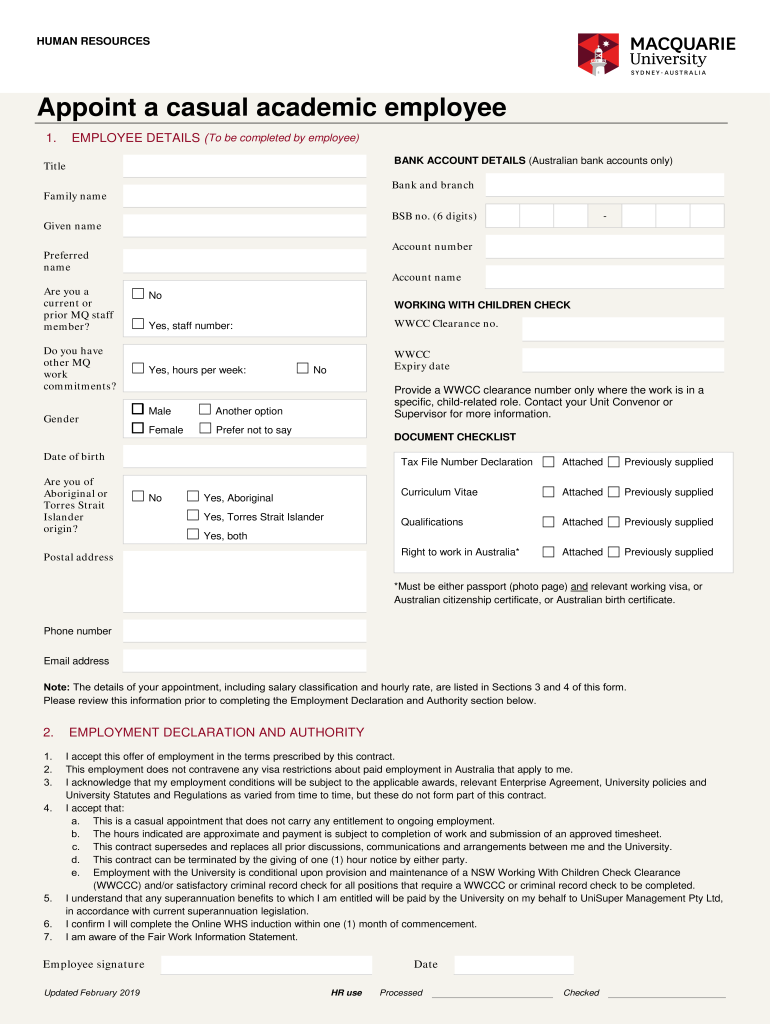

The Personal Details, Bank Account And Payroll Deductions Form is a crucial document used by employers and employees to manage payroll processes effectively. This form collects essential personal information, including the employee's name, address, Social Security number, and banking details necessary for direct deposit. Additionally, it outlines payroll deductions such as taxes, benefits, and other withholdings. Understanding this form is vital for ensuring accurate payroll management and compliance with federal and state regulations.

How to use the Personal Details, Bank Account And Payroll Deductions Form

Using the Personal Details, Bank Account And Payroll Deductions Form involves several key steps. First, gather all necessary personal information, including your Social Security number and banking details. Next, accurately complete each section of the form, ensuring that all information is correct to avoid delays in payroll processing. Once filled out, the form should be submitted to your employer or HR department for processing. Utilizing digital tools can simplify this process, allowing for easy editing and secure submission.

Steps to complete the Personal Details, Bank Account And Payroll Deductions Form

Completing the Personal Details, Bank Account And Payroll Deductions Form can be straightforward when following these steps:

- Begin by entering your personal details, including your full name and contact information.

- Provide your Social Security number, ensuring accuracy to prevent issues with tax reporting.

- Fill in your bank account information for direct deposit, including the account number and routing number.

- Specify any payroll deductions, such as federal and state taxes, health insurance, or retirement contributions.

- Review the completed form for any errors or omissions before submission.

Key elements of the Personal Details, Bank Account And Payroll Deductions Form

Several key elements make up the Personal Details, Bank Account And Payroll Deductions Form. These include:

- Personal Information: This section requires your name, address, and Social Security number.

- Bank Account Details: Essential for setting up direct deposit, this includes your bank's routing number and your account number.

- Payroll Deductions: This part outlines the various deductions that will be taken from your paycheck, such as taxes and benefits.

- Signature: A signature or electronic acknowledgment is necessary to validate the form.

Legal use of the Personal Details, Bank Account And Payroll Deductions Form

The Personal Details, Bank Account And Payroll Deductions Form is legally binding when filled out correctly and submitted to the appropriate parties. It complies with various regulations, including the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) guidelines. Ensuring that the form is completed accurately protects both the employee and employer from potential legal issues related to payroll discrepancies or misreporting of taxes.

Form Submission Methods

The Personal Details, Bank Account And Payroll Deductions Form can be submitted through various methods, depending on the employer's preferences. Common submission methods include:

- Online Submission: Many employers allow employees to submit the form electronically through secure portals.

- Mail: The form can be printed and mailed to the HR department or payroll office.

- In-Person: Employees may also deliver the completed form directly to their employer's HR office.

Quick guide on how to complete personal details bank account and payroll deductions form

Complete Personal Details, Bank Account And Payroll Deductions Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without interruptions. Handle Personal Details, Bank Account And Payroll Deductions Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Personal Details, Bank Account And Payroll Deductions Form with ease

- Find Personal Details, Bank Account And Payroll Deductions Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools specially provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Personal Details, Bank Account And Payroll Deductions Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Personal Details, Bank Account And Payroll Deductions Form?

The Personal Details, Bank Account And Payroll Deductions Form is a document used by businesses to gather essential employee information for payroll processing. This form ensures accurate deduction calculations and bank account details for direct deposits, streamlining the payment process. Businesses can efficiently manage payroll with this form integrated into the airSlate SignNow platform.

-

How does airSlate SignNow simplify the Personal Details, Bank Account And Payroll Deductions Form process?

airSlate SignNow simplifies the process by allowing users to create, send, and eSign the Personal Details, Bank Account And Payroll Deductions Form electronically. This reduces paperwork and manual errors, saving time and increasing efficiency in payroll management. Additionally, the user-friendly interface ensures employees can complete the form quickly and securely.

-

Can I integrate airSlate SignNow with other payroll systems for the Personal Details, Bank Account And Payroll Deductions Form?

Yes, airSlate SignNow offers seamless integrations with various payroll systems, allowing businesses to transfer data from the Personal Details, Bank Account And Payroll Deductions Form directly into their payroll software. This integration enhances data accuracy and reduces the need for manual entry, facilitating smoother payroll operations.

-

What are the pricing options for using the airSlate SignNow platform for the Personal Details, Bank Account And Payroll Deductions Form?

airSlate SignNow offers flexible pricing plans tailored to fit any business size, making it cost-effective to manage the Personal Details, Bank Account And Payroll Deductions Form. Pricing varies based on the features and number of users. You can choose a plan that best suits your organization's needs without compromising on functionality.

-

Is the Personal Details, Bank Account And Payroll Deductions Form secure in airSlate SignNow?

Absolutely! The Personal Details, Bank Account And Payroll Deductions Form processed through airSlate SignNow utilizes high-level security protocols, including encryption and secure cloud storage. This ensures that sensitive employee information is protected, giving businesses and employees peace of mind regarding data privacy.

-

What are the benefits of using airSlate SignNow for the Personal Details, Bank Account And Payroll Deductions Form?

Using airSlate SignNow for the Personal Details, Bank Account And Payroll Deductions Form results in higher efficiency, reduced processing time, and improved accuracy in payroll administration. The platform allows for easy tracking and management of document statuses while providing a user-friendly experience for both employers and employees.

-

How can I get started with creating the Personal Details, Bank Account And Payroll Deductions Form on airSlate SignNow?

Getting started is simple! Sign up for an airSlate SignNow account and use the intuitive form builder to create your Personal Details, Bank Account And Payroll Deductions Form. The platform offers various templates and customization options to ensure your form meets your specific needs, allowing for quick deployment and collection of information.

Get more for Personal Details, Bank Account And Payroll Deductions Form

- Form 502 ampquotpass through entity return of income and return

- Form i 129s nonimmigrant petition based on blanket l petition nonimmigrant petition based on blanket l petition

- 2022 form 760es estimated income tax payment vouchers for individuals 2022 form 760es estimated income tax payment vouchers for

- 2020 form 760 resident individual income tax booklet

- Va form 21p 509 veterans benefits administration

- Form 770es ampquotvirginia estimated payment vouchers for

- Middle name veterans benefits administration form

- Va form 29 4364 application for service disabled veterans insurance

Find out other Personal Details, Bank Account And Payroll Deductions Form

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy