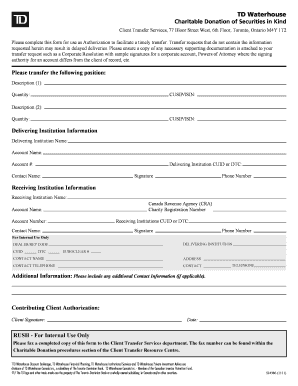

TD Waterhouse Charitable Donation of Securities in Kind Form

What is the TD Waterhouse Charitable Donation Of Securities In Kind Form

The TD Waterhouse Charitable Donation of Securities In Kind Form is a legal document used to facilitate the donation of securities directly to a charitable organization. This form allows donors to transfer ownership of stocks, bonds, or other financial instruments to a charity, which can then sell the securities to fund its programs. By using this form, donors may also benefit from tax deductions, as donations of appreciated securities can provide significant tax advantages.

How to use the TD Waterhouse Charitable Donation Of Securities In Kind Form

To use the TD Waterhouse Charitable Donation of Securities In Kind Form, start by obtaining the form from a reliable source, such as the TD Waterhouse website or your financial advisor. Complete the required fields, including your personal information, the details of the securities being donated, and the charity's information. Ensure that all sections are filled out accurately to avoid any delays in processing. Once completed, submit the form according to the instructions provided, typically via mail or electronically, depending on the charity's requirements.

Steps to complete the TD Waterhouse Charitable Donation Of Securities In Kind Form

Completing the TD Waterhouse Charitable Donation of Securities In Kind Form involves several key steps:

- Obtain the form from a trusted source.

- Fill in your personal details, including name, address, and contact information.

- Provide information about the securities being donated, such as the type, quantity, and current value.

- Include the charity's name and tax identification number to ensure proper processing.

- Sign and date the form to validate your donation.

- Submit the form according to the instructions provided, ensuring it reaches the charity in a timely manner.

Legal use of the TD Waterhouse Charitable Donation Of Securities In Kind Form

The legal use of the TD Waterhouse Charitable Donation of Securities In Kind Form is crucial for ensuring that the donation is recognized by the IRS and the receiving charity. The form must be completed accurately and signed by the donor to establish a clear record of the transaction. Compliance with federal and state laws regarding charitable donations is essential, as it protects both the donor and the charity. Proper documentation can also facilitate tax deductions for the donor, provided that the donation meets IRS guidelines.

Key elements of the TD Waterhouse Charitable Donation Of Securities In Kind Form

Several key elements are essential for the TD Waterhouse Charitable Donation of Securities In Kind Form to be valid:

- Donor Information: Complete details about the donor, including full name and contact information.

- Securities Details: A clear description of the securities being donated, including their type and quantity.

- Charity Information: The name and tax identification number of the charitable organization receiving the donation.

- Signatures: The donor's signature and date to confirm the donation.

- Submission Instructions: Clear guidelines on how to submit the form to the charity.

IRS Guidelines

The IRS has specific guidelines regarding the donation of securities, which are important to follow when using the TD Waterhouse Charitable Donation of Securities In Kind Form. Donors should be aware that contributions of appreciated securities may qualify for a charitable deduction equal to the fair market value of the securities on the date of the donation. Additionally, donors should maintain proper documentation, including the completed form and any correspondence with the charity, to substantiate their deductions during tax filing. It is advisable to consult a tax professional for personalized guidance based on individual circumstances.

Quick guide on how to complete td waterhouse charitable donation of securities in kind form

Effortlessly Prepare TD Waterhouse Charitable Donation Of Securities In Kind Form on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any holdups. Manage TD Waterhouse Charitable Donation Of Securities In Kind Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Simplest Way to Edit and eSign TD Waterhouse Charitable Donation Of Securities In Kind Form Seamlessly

- Locate TD Waterhouse Charitable Donation Of Securities In Kind Form and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Craft your signature with the Sign feature, which takes only moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Modify and eSign TD Waterhouse Charitable Donation Of Securities In Kind Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the TD Waterhouse Charitable Donation Of Securities In Kind Form?

The TD Waterhouse Charitable Donation Of Securities In Kind Form is a specialized document that allows individuals to donate securities directly to charitable organizations. This form simplifies the process and ensures that donations are handled efficiently, benefiting both the donor and the charity.

-

How does the TD Waterhouse Charitable Donation Of Securities In Kind Form work?

When you fill out and submit the TD Waterhouse Charitable Donation Of Securities In Kind Form, the securities you wish to donate are transferred from your brokerage account to the charity. This process helps you avoid capital gains taxes while maximizing the impact of your charitable contribution.

-

Are there any fees associated with using the TD Waterhouse Charitable Donation Of Securities In Kind Form?

While using the TD Waterhouse Charitable Donation Of Securities In Kind Form is generally free of charge, you should verify any potential fees with your financial institution. airSlate SignNow offers cost-effective solutions to streamline your donation process, ensuring you keep more of your charitable contribution.

-

What are the benefits of using the TD Waterhouse Charitable Donation Of Securities In Kind Form?

Using the TD Waterhouse Charitable Donation Of Securities In Kind Form provides signNow tax benefits, allowing donors to contribute more while minimizing tax liabilities. Additionally, it enables charities to receive valuable assets that can further their mission.

-

Can I use airSlate SignNow to complete the TD Waterhouse Charitable Donation Of Securities In Kind Form?

Yes, airSlate SignNow allows users to easily fill out and eSign the TD Waterhouse Charitable Donation Of Securities In Kind Form online. Our platform provides a user-friendly interface, making the donation process straightforward and efficient.

-

Is the TD Waterhouse Charitable Donation Of Securities In Kind Form accepted by all charities?

Most registered charities are equipped to accept the TD Waterhouse Charitable Donation Of Securities In Kind Form, but it's essential to confirm with the specific organization beforehand. airSlate SignNow can help you facilitate communication with charities to ensure a smooth donation process.

-

How do I store my completed TD Waterhouse Charitable Donation Of Securities In Kind Form?

Once you complete the TD Waterhouse Charitable Donation Of Securities In Kind Form using airSlate SignNow, your documents can be securely stored in the cloud. This ensures easy access and retrieval whenever you need to reference your charitable donations.

Get more for TD Waterhouse Charitable Donation Of Securities In Kind Form

- Fillable online form 500ez department of revenue fax

- Publication 5412 g sp rev 3 2021 economic impact payment by prepaid debit card spanish version form

- Real property conveyance fee dte 100 statement of value form

- Tennessee department of revenuepdf4pro form

- Reconciliation of income tax form

- Resale certificate kentucky form pdf studyeducationorg

- Learn about homestead exemption south carolinasenior property tax homestead exemptionhomestead exemption frequently asked form

- Form w 1louisvillekygov

Find out other TD Waterhouse Charitable Donation Of Securities In Kind Form

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now