Form 763S, Virginia Special Nonresident Claim for Individual Income Tax Withheld 2021

What is the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

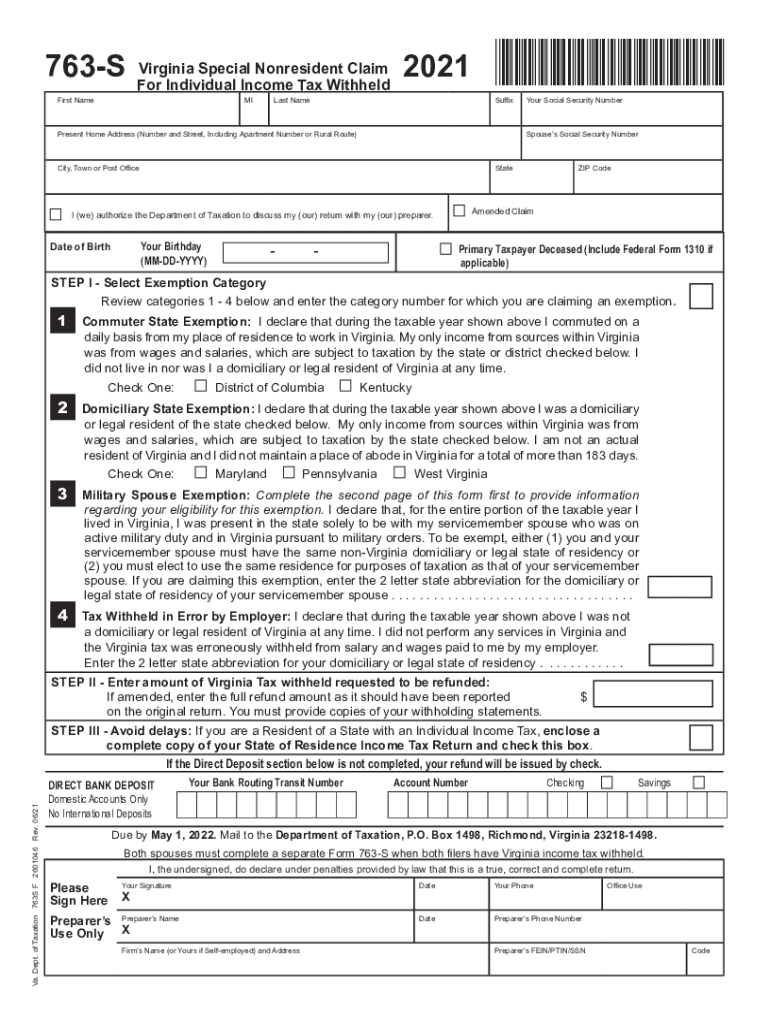

The Form 763S is a specific document used by nonresidents of Virginia to claim a refund for individual income tax withheld. This form is essential for individuals who earn income in Virginia but do not reside in the state. By completing the 763S, taxpayers can ensure that they receive any overpaid taxes back, adhering to Virginia's tax regulations. Understanding the purpose of this form is crucial for nonresidents to navigate their tax obligations effectively.

How to use the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

Using the Form 763S involves a straightforward process. First, gather all necessary income documentation, including W-2 forms and any other relevant tax documents. Next, fill out the form accurately, ensuring that all personal information and income details are correct. After completing the form, submit it to the Virginia Department of Taxation either electronically or by mail. It is important to keep a copy for your records. This process helps ensure that you receive any tax refunds owed to you in a timely manner.

Steps to complete the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

Completing the Form 763S requires attention to detail. Follow these steps to ensure accuracy:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income earned in Virginia during the tax year.

- Indicate the amount of Virginia income tax withheld, as shown on your W-2 forms.

- Calculate your refund amount by subtracting your total tax liability from the amount withheld.

- Sign and date the form to certify that the information provided is accurate.

By following these steps, you can ensure that your Form 763S is completed correctly, facilitating a smooth refund process.

Legal use of the Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

The legal use of the Form 763S is governed by Virginia tax laws. This form must be used by nonresidents who have had income tax withheld from their earnings in Virginia. To ensure compliance, it is essential to submit the form within the designated filing period and to provide accurate information. Failure to adhere to these regulations may result in delays or denial of your refund claim. Understanding the legal framework surrounding the Form 763S helps nonresidents navigate their tax responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form 763S are critical for ensuring that your claim is processed. Typically, the form must be submitted by May first of the year following the tax year in question. It is advisable to check for any updates or changes to these deadlines annually, as they may vary. Missing the deadline could result in forfeiting your right to a tax refund, making it important to stay informed about these key dates.

Required Documents

When filing the Form 763S, certain documents are required to support your claim. These typically include:

- W-2 forms showing income earned in Virginia.

- Any 1099 forms if applicable.

- Proof of residency in another state.

- Any additional documentation that substantiates your claim for a refund.

Having these documents ready will facilitate a smoother filing process and help ensure that your claim is processed without delays.

Quick guide on how to complete 2021 form 763s virginia special nonresident claim for individual income tax withheld

Effortlessly prepare Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld on any device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld on any platform using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to modify and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld with ease

- Find Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then press the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searching, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 763s virginia special nonresident claim for individual income tax withheld

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 763s virginia special nonresident claim for individual income tax withheld

How to make an e-signature for your PDF document online

How to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is 763s Virginia and how can it benefit my business?

763s Virginia is a versatile electronic signature solution that streamlines the document signing process. With airSlate SignNow, businesses can efficiently send documents for eSigning, reducing time and improving workflow. By using this solution, you can enhance productivity and ensure compliance in managing your documents.

-

How much does the 763s Virginia service cost?

Pricing for the 763s Virginia service depends on the plan you choose, with various options to fit different business needs. airSlate SignNow offers competitive pricing that reflects the features and benefits tailored for businesses of all sizes. You can find detailed pricing information on our website to choose the best plan for your requirements.

-

What features does the 763s Virginia offer?

The 763s Virginia includes a range of features designed to simplify the eSigning process, such as customizable templates, secure storage, and real-time tracking. Additionally, it supports compliance with eSigning laws, ensuring your documents are legally binding. With these features, airSlate SignNow empowers businesses to manage their signing processes more effectively.

-

Is the 763s Virginia suitable for small businesses?

Absolutely! The 763s Virginia is designed for businesses of all sizes, including small enterprises. With its user-friendly interface and cost-effective pricing, small businesses can leverage airSlate SignNow to improve their document workflows and customer satisfaction without breaking the bank.

-

Can I integrate 763s Virginia with other software?

Yes, the 763s Virginia easily integrates with numerous third-party applications, enhancing your current software stack. Whether it's CRM systems, project management tools, or other productivity apps, airSlate SignNow provides seamless integration options. This flexibility allows businesses to streamline their processes and maintain a cohesive workflow.

-

What are the security measures in place for 763s Virginia?

With airSlate SignNow, the 763s Virginia is equipped with robust security measures to protect your sensitive documents. It includes features like secure encryption, multi-factor authentication, and audit trails to ensure your information remains safe. This commitment to security gives businesses peace of mind when sending and signing important documents electronically.

-

Can I track the status of documents sent with 763s Virginia?

Yes, the 763s Virginia offers real-time tracking features that allow you to monitor the status of your documents easily. You will receive notifications when your documents have been viewed and signed, helping you manage your workflow more effectively. This transparency enables better communication with clients and stakeholders regarding document progress.

Get more for Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

- Quitclaim deed form arizona 497297024

- Special warranty deed from two individuals or husband and wife to an individual arizona form

- Az deed trust 497297026 form

- Special warranty deed from a trust to a individual arizona form

- Quitclaim deed from one individual to five individuals arizona form

- Warranty deed from husband and wife or two individuals to four individuals arizona form

- Az husband wife 497297030 form

- Special warranty deed from two individuals or husband and wife to a trust arizona form

Find out other Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement