Form 231

What is the Form 231

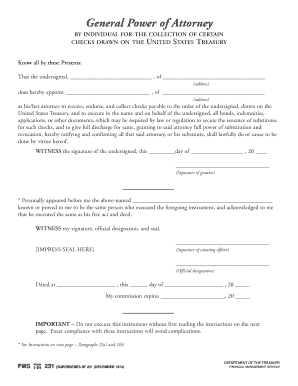

The Form 231, also known as the FS Form 231, is a document utilized primarily for financial transactions involving the U.S. Treasury. This form is essential for individuals and businesses that need to request payments or manage funds drawn from government accounts. It is typically used in various financial contexts, ensuring that payments are processed correctly and efficiently. Understanding the purpose and function of the Form 231 is crucial for anyone involved in financial dealings with federal entities.

How to use the Form 231

Using the Form 231 involves several straightforward steps. First, identify the specific purpose for which you need the form, such as requesting a payment or authorizing a transaction. Next, ensure that you have all necessary information at hand, including account details and the amount involved. Complete the form accurately, paying close attention to each section to avoid errors. Once filled out, the form can be submitted electronically or via mail, depending on the requirements of the issuing agency.

Steps to complete the Form 231

Completing the Form 231 requires careful attention to detail. Here are the steps to follow:

- Gather all required information, including personal or business details and financial data.

- Fill out each section of the form, ensuring accuracy in all entries.

- Review the completed form for any mistakes or missing information.

- Sign and date the form where indicated.

- Submit the form according to the specified submission method, either online or by mail.

Legal use of the Form 231

The legal validity of the Form 231 is contingent upon its proper completion and submission. It is essential to adhere to all applicable regulations and guidelines when using this form. Electronic signatures are generally accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Ensuring that the form is filled out correctly and submitted through the appropriate channels helps maintain its legal standing.

Key elements of the Form 231

Several key elements must be included in the Form 231 to ensure its effectiveness:

- Identification Information: Personal or business details of the requester.

- Transaction Details: Specifics regarding the payment or transaction being requested.

- Signature: A valid signature is required to authenticate the request.

- Date: The date of submission must be clearly indicated.

Form Submission Methods

The Form 231 can be submitted through various methods, depending on the requirements of the issuing agency. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through secure portals.

- Mail: The form can be printed and sent via postal service to the appropriate address.

- In-Person: Some situations may require the form to be submitted directly at designated offices.

Quick guide on how to complete form 231

Effortlessly prepare Form 231 on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to acquire the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 231 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Form 231 seamlessly

- Locate Form 231 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with instruments specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 231 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 231 and how can it be used with airSlate SignNow?

Form 231 is a specific document type that users often need to fill out and sign for various purposes. With airSlate SignNow, you can easily create, send, and eSign form 231, ensuring that you streamline your workflow while maintaining compliance and security.

-

How much does it cost to use airSlate SignNow for signing form 231?

AirSlate SignNow offers flexible pricing plans that fit different business needs. You can start for free to test the features, and then choose a subscription plan that suits your volume and budget requirements for processing form 231 and other documents.

-

What are the key features of airSlate SignNow for managing form 231?

AirSlate SignNow provides a range of features for managing form 231, including document templates, an intuitive drag-and-drop editor, and real-time tracking of signatures. These features simplify the signing process, allowing you to focus on your business rather than paperwork.

-

Is it secure to eSign form 231 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security with advanced encryption and secure authentication measures. When you eSign form 231 through our platform, you can trust that your documents and personal information are protected against unauthorized access.

-

Can I integrate airSlate SignNow with other applications for handling form 231?

Absolutely! AirSlate SignNow offers seamless integrations with popular applications like Google Workspace, Salesforce, and Microsoft 365. This allows you to easily manage form 231 alongside other business processes and enhance overall productivity.

-

How does airSlate SignNow improve the efficiency of processing form 231?

By using airSlate SignNow to handle form 231, businesses can automate workflows, reduce paper usage, and eliminate manual errors. This leads to faster turnaround times for getting signatures and completing agreements, allowing teams to focus on critical tasks.

-

What benefits can I expect when using airSlate SignNow for form 231?

Using airSlate SignNow for form 231 provides businesses with cost-efficiency and convenience. You can reduce paperwork, speed up approvals, and enhance collaboration among teams and clients, resulting in better overall management of your documentation process.

Get more for Form 231

Find out other Form 231

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation