Section 1 Mortgagee Information to Be Completed by HUD

What is the Section 1 Mortgagee Information To Be Completed By HUD

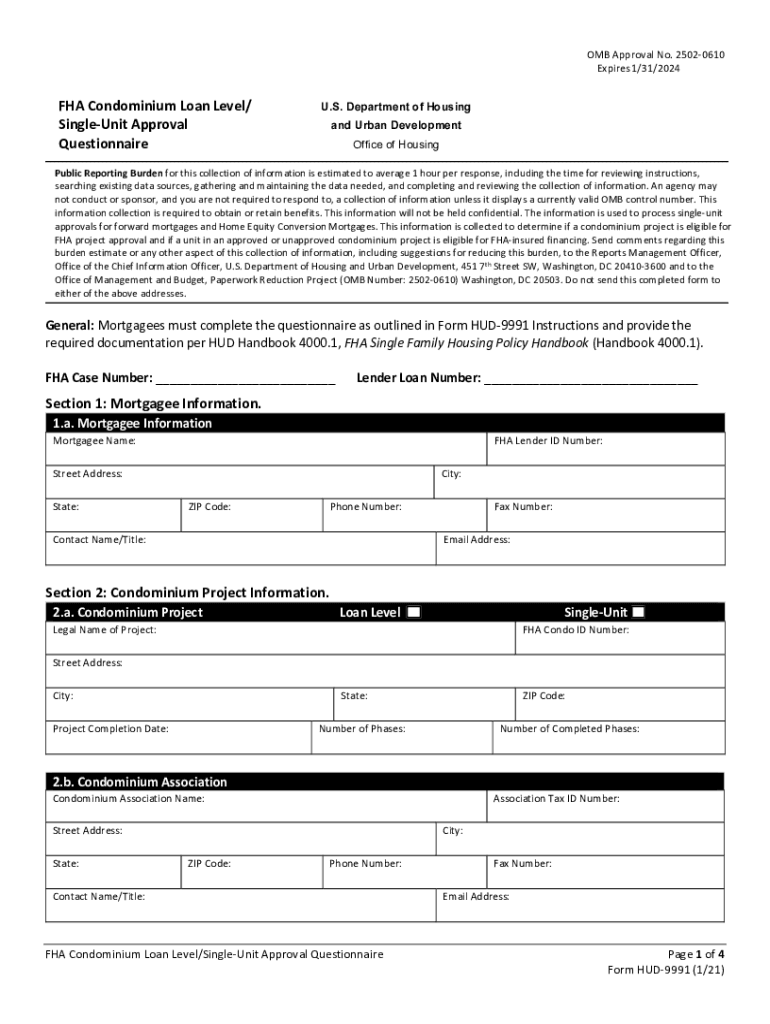

The Section 1 Mortgagee Information To Be Completed By HUD is a crucial document used in the mortgage process, specifically for loans insured by the Federal Housing Administration (FHA). This section gathers essential information about the mortgagee, or lender, involved in the transaction. It typically includes details such as the lender's name, address, contact information, and FHA lender number. Completing this section accurately is vital for ensuring compliance with HUD regulations and facilitating the loan approval process.

Steps to complete the Section 1 Mortgagee Information To Be Completed By HUD

Completing the Section 1 Mortgagee Information requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the mortgagee, including the lender's full name, address, and contact details.

- Locate the FHA lender number, which is essential for identification and verification purposes.

- Fill in the required fields on the form, ensuring all information is accurate and up to date.

- Review the completed section for any errors or omissions before submission.

- Submit the form as part of the overall mortgage application package to HUD or the relevant authority.

Legal use of the Section 1 Mortgagee Information To Be Completed By HUD

The Section 1 Mortgagee Information is legally binding when completed in accordance with HUD guidelines. It serves as an official record of the lender's involvement in the mortgage transaction. To ensure legal compliance, the information must be accurate, and the form should be submitted within the specified timelines. Electronic signatures, when used, must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) to be considered valid.

Key elements of the Section 1 Mortgagee Information To Be Completed By HUD

Several key elements must be included in the Section 1 Mortgagee Information to ensure it meets HUD requirements:

- Lender's Name: The full legal name of the mortgagee.

- Address: The complete mailing address of the lender.

- Contact Information: Phone number and email address for communication.

- FHA Lender Number: A unique identifier assigned to the lender by HUD.

- Signature: An authorized representative's signature may be required to validate the information.

How to use the Section 1 Mortgagee Information To Be Completed By HUD

The Section 1 Mortgagee Information is used primarily within the context of FHA-insured loans. To utilize this section effectively, follow these guidelines:

- Ensure that the mortgagee is registered and approved by HUD to participate in FHA programs.

- Complete the section accurately as part of the mortgage application process.

- Maintain a copy of the completed form for your records and future reference.

- Use the information provided in this section to facilitate communication with HUD and other stakeholders during the loan process.

Examples of using the Section 1 Mortgagee Information To Be Completed By HUD

Understanding practical applications of the Section 1 Mortgagee Information can enhance its effectiveness. Here are some examples:

- A lender completing the form as part of a borrower’s FHA loan application to ensure all necessary details are documented.

- Utilizing the information during audits or compliance checks to verify lender participation in FHA programs.

- Providing accurate lender information to streamline communication between borrowers, lenders, and HUD officials.

Quick guide on how to complete section 1 mortgagee informationto be completed by hud

Accomplish Section 1 Mortgagee Information To Be Completed By HUD effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the features required to create, edit, and eSign your documents swiftly without complications. Manage Section 1 Mortgagee Information To Be Completed By HUD on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Section 1 Mortgagee Information To Be Completed By HUD without hassle

- Find Section 1 Mortgagee Information To Be Completed By HUD and click on Get Form to begin.

- Make use of the tools at your disposal to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Section 1 Mortgagee Information To Be Completed By HUD and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Section 1 Mortgagee Information To Be Completed By HUD' and why is it important?

The 'Section 1 Mortgagee Information To Be Completed By HUD' is a crucial part of mortgage documentation that ensures compliance with HUD regulations. Completing this section accurately is essential for mortgage lenders to facilitate loan processing and avoid potential legal issues. airSlate SignNow provides a streamlined solution for completing this form electronically.

-

How does airSlate SignNow simplify the completion of the 'Section 1 Mortgagee Information To Be Completed By HUD'?

AirSlate SignNow simplifies the process by allowing users to fill out and eSign the 'Section 1 Mortgagee Information To Be Completed By HUD' digitally. This eliminates the need for paper forms and manual signatures, reducing processing time and errors. Our user-friendly interface makes completing complex mortgage documentation easier for everyone.

-

What features does airSlate SignNow offer for managing 'Section 1 Mortgagee Information To Be Completed By HUD' forms?

AirSlate SignNow offers several features tailored for 'Section 1 Mortgagee Information To Be Completed By HUD', including customizable templates, automated workflows, and secure cloud storage. These features help ensure that all information is accurately captured and easily accessible. Additionally, real-time collaboration allows multiple parties to work on the document simultaneously.

-

Can airSlate SignNow integrate with other tools for managing mortgage documents, including HUD forms?

Yes, airSlate SignNow offers seamless integrations with various CRMs, document management systems, and productivity tools. This means you can easily connect your workflows for 'Section 1 Mortgagee Information To Be Completed By HUD' with your existing software. Integrations enhance efficiency and ensure all your documents are well-organized and accessible.

-

Is there a cost associated with using airSlate SignNow for completing HUD forms?

AirSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose the plan that best fits your volume of usage for completing 'Section 1 Mortgagee Information To Be Completed By HUD' and other documents. Our cost-effective solution helps businesses save money while maintaining compliance with HUD regulations.

-

How does airSlate SignNow ensure the security of my 'Section 1 Mortgagee Information To Be Completed By HUD' documents?

AirSlate SignNow employs state-of-the-art encryption and security protocols to protect your 'Section 1 Mortgagee Information To Be Completed By HUD' documents. We adhere to industry standards to ensure that all data is safe from unauthorized access. Additionally, our platform offers features like password protection and audit trails for added security.

-

Can I access airSlate SignNow on mobile devices for signing HUD forms?

Absolutely! AirSlate SignNow is designed to be mobile-friendly, allowing you to complete and eSign 'Section 1 Mortgagee Information To Be Completed By HUD' forms directly from your smartphone or tablet. This flexibility ensures that you can manage your documents on the go without sacrificing functionality or security.

Get more for Section 1 Mortgagee Information To Be Completed By HUD

- Sp4 134a continuation form

- Vehicle for hire id badge renewal application information

- How to apply for a parking permit or license plates for nyc dot motorists ampamp parking parking permits for people nyc dot form

- Thank you letter for teacher forms and templates

- Inspection ampamp testing of fire and smoke control systems form

- Land disturbance permit application amp checklist form

- Wastewater fee adjustment form

- Cacfp forms quality care for children

Find out other Section 1 Mortgagee Information To Be Completed By HUD

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple