Donor Information Toys for Tots Toysfortots

Understanding the Toys for Tots Donation Receipt

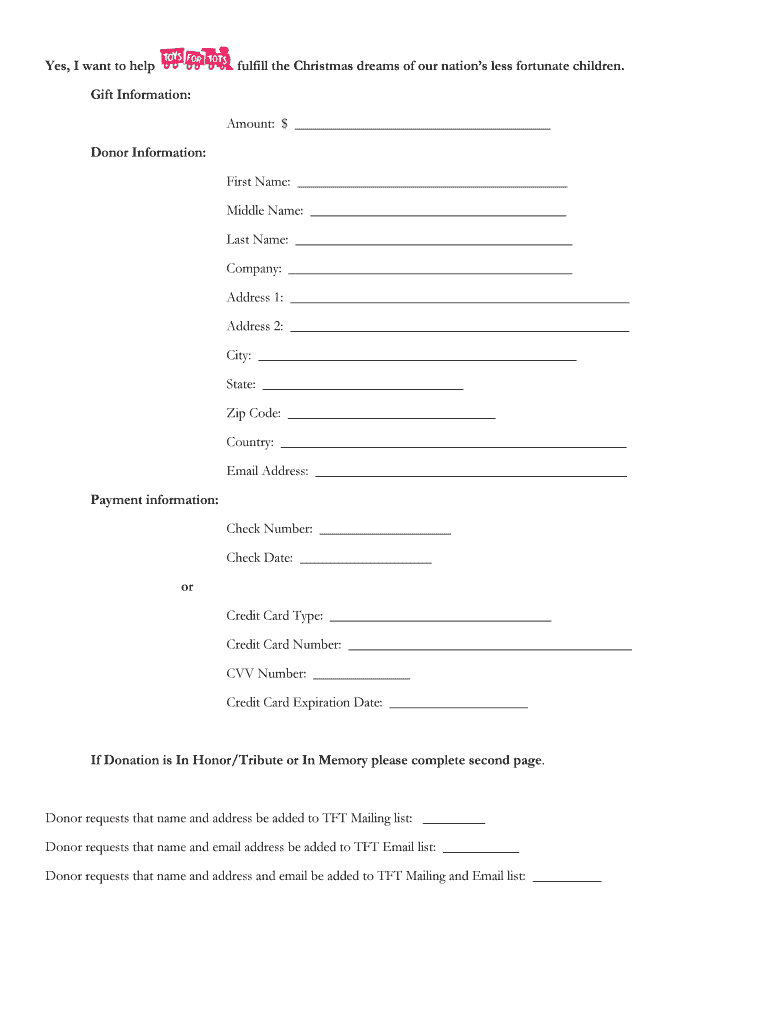

The Toys for Tots donation receipt is a crucial document for individuals who contribute to this charitable organization. It serves as proof of the donation made, which can be essential for tax purposes. This receipt typically includes the donor's name, the date of the donation, a description of the items donated, and the estimated value of those items. Understanding the components of this receipt can help ensure that donors have all necessary information for their tax records.

Steps to Complete the Toys for Tots Donation Receipt

Completing the Toys for Tots donation receipt involves several straightforward steps. First, gather all relevant information about your donation, including the items donated and their estimated value. Next, fill in your personal details, such as your name and address. Ensure that you accurately describe the items donated, as this information is vital for record-keeping. Finally, sign and date the receipt to validate it. Using a digital platform like signNow can simplify this process, allowing for easy completion and secure storage of your documents.

Legal Use of the Toys for Tots Donation Receipt

The Toys for Tots donation receipt is not just a formality; it holds legal significance, especially when it comes to tax deductions. The IRS requires that donors maintain records of their charitable contributions, and a properly filled out receipt serves this purpose. To be legally binding, the receipt should include all necessary details and comply with IRS guidelines regarding charitable donations. Utilizing a reliable eSignature solution can ensure that the receipt is executed in accordance with legal standards.

Key Elements of the Toys for Tots Donation Receipt

Several key elements must be included in the Toys for Tots donation receipt to ensure its validity. These include:

- Donor Information: Name, address, and contact details of the donor.

- Donation Details: Description of the donated items and their estimated value.

- Date of Donation: The specific date when the donation was made.

- Signature: The donor's signature to authenticate the receipt.

Including these elements helps maintain transparency and ensures compliance with tax regulations.

IRS Guidelines for Charitable Donations

The IRS provides specific guidelines regarding charitable donations, which apply to the Toys for Tots donation receipt. Donors are advised to keep receipts for any contributions over a certain amount, typically $250, to claim deductions on their tax returns. The receipt must be issued by the charity and should detail the donation's value and nature. Familiarizing oneself with these guidelines can help ensure that donors maximize their tax benefits while supporting a worthy cause.

Obtaining the Toys for Tots Donation Receipt

Obtaining a Toys for Tots donation receipt is a straightforward process. After making a donation, donors should request a receipt from the organization. Many local Toys for Tots coordinators provide receipts on-site during donation events. For online donations, the receipt is often sent via email or can be downloaded from the organization's website. Ensuring that you receive this receipt promptly is essential for maintaining accurate records for tax purposes.

Quick guide on how to complete donor information toys for tots toysfortots

Prepare Donor Information Toys For Tots Toysfortots easily on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, alter, and eSign your documents swiftly without any hold-ups. Manage Donor Information Toys For Tots Toysfortots on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Donor Information Toys For Tots Toysfortots effortlessly

- Obtain Donor Information Toys For Tots Toysfortots and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial parts of your documents or cover sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, arduous form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Donor Information Toys For Tots Toysfortots and ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How long does it take to fill out an organ donor card?

I can't speak for the US, but it took me a three minute form online. I pretty much only did it as part of my provisional drivers licence application. Just a few boxes aaking if I want to after this statement:Over 44,000 people die in traffic accidents from injuries that could be treated by donor organs. Would you like to join the NHS Scotland Donor Registry?Just shrugged, ticked yet, and that was it. Not the most cheery thing to read when applying for your licence online, but it was there.

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

How can I raise money for charity?

At a high-level, my advice would be to make the effort as personal as possible so that it resonates with your immediate network of friends and family. There are two ways of doing that, 1) tell a passionate and compelling story about why you care to fundraise in the first place and how others can help, and 2) bring people together (online or off) on behalf of your effort so they can see/feel/experience your passion for the cause. Both will lead to more contributions. Here are a few ideas for you that you could incorporate into your fundraising efforts: Face a Personal Challenge. Commit to doing something challenging (running a marathon, sky diving, quit smoking, etc.), then set up a fundraising page (or incorporate into one you already have) and ask your friends and family to pledge donations if you accomplish your challenge.Give up your birthday or other holiday like Christmas. Set up a fundraising page and ask your friends and family for donations instead of presents.Host an art auction. Get your artist friends to donate one piece of art each, and then host an art show somewhere and auction each piece off. Proceeds go to the cause.Host a fundraising event at a bar (if you're 21). Even if you have a small network of immediate friends, this tactic only requires a partnership with a bar on an already popular night (aka, they provide the crowd). The trick is convincing them that they should give a portion of the door or a drink special to the worthy cause. Another approach is to find an alcohol sponsor first, and have them donate the liquor so the proceeds can go towards your goal.Partner with a restaurant, coffee shop, etc. Similar to the bar concept, convince a restaurant to donate a portion of proceeds for the day to the cause.Get local businesses to match donations. One way you can get businesses involved is to get them to match personal donations to your campaigns up to a certain limit. Sometimes they prefer to make donations this way, because it limits the risk on their end (they don't have to go first with a big donation), and it gives them more exposure because you're likely to promote to people that X company is matching donations during a period of time up to X amount.Here's a link for even more tips on how to see success with personal fundraising for a cause:http://www.stayclassy.org/fundra...__ Hope this answer was helpful!More on this and other topics at:http://www.stayclassy.org/bloghttp://www.scotchisholm.com

-

Why do patients have to fill out forms when visiting a doctor? Why isn't there a "Facebook connect" for patient history/information?

There are many (many) reasons - so I'll list a few of the ones that I can think of off-hand.Here in the U.S. - we have a multi-party system: Provider-Payer-Patient (unlike other countries that have either a single payer - or universal coverage - or both). Given all the competing interests - at various times - incentives are often mis-aligned around the sharing of actual patient dataThose mis-aligned incentives have not, historically, focused on patient-centered solutions. That's starting to change - but slowly - and only fairly recently.Small practices are the proverbial "last mile" in healthcare - so many are still paper basedThere are still tens/hundreds of thousands of small practices (1-9 docs) - and a lot of healthcare is still delivered through the small practice demographicThere are many types of specialties - and practice types - and they have different needs around patient data (an optometrist's needs are different from a dentist - which is different from a cardiologist)Both sides of the equation - doctors and patients - are very mobile (we move, change employers - doctors move, change practices) - and there is no "centralized" data store with each persons digitized health information.As we move and age - and unless we have a chronic condition - our health data can become relatively obsolete - fairly quickly (lab results from a year ago are of limited use today)Most of us (in terms of the population as a whole) are only infrequent users of the healthcare system more broadly (cold, flu, stomach, UTI etc....). In other words, we're pretty healthy, so issues around healthcare (and it's use) is a lower priorityThere is a signNow loss of productivity when a practice moves from paper to electronic health records (thus the government "stimulus" funding - which is working - but still a long way to go)The penalties for PHI data bsignNow under HIPAA are signNow - so there has been a reluctance/fear to rely on electronic data. This is also why the vast majority of data bsignNowes are paper-based (typically USPS)This is why solutions like Google Health - and Revolution Health before them - failed - and closed completely (as in please remove your data - the service will no longer be available)All of which are contributing factors to why the U.S. Healthcare System looks like this:===============Chart Source: Mary Meeker - USA, Inc. (2011) - link here:http://www.kpcb.com/insights/usa...

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

Create this form in 5 minutes!

How to create an eSignature for the donor information toys for tots toysfortots

How to generate an eSignature for the Donor Information Toys For Tots Toysfortots online

How to make an eSignature for the Donor Information Toys For Tots Toysfortots in Google Chrome

How to create an electronic signature for putting it on the Donor Information Toys For Tots Toysfortots in Gmail

How to make an eSignature for the Donor Information Toys For Tots Toysfortots right from your mobile device

How to make an electronic signature for the Donor Information Toys For Tots Toysfortots on iOS devices

How to generate an eSignature for the Donor Information Toys For Tots Toysfortots on Android OS

People also ask

-

What is Donor Information for Toys For Tots?

Donor Information for Toys For Tots refers to essential details collected from individuals and organizations that contribute toys or funds to support the Toys For Tots initiative. This information helps ensure that donations are tracked accurately and that the program can efficiently distribute toys to children in need during the holiday season.

-

How can I donate to Toys For Tots?

To donate to Toys For Tots, you can visit their official website and follow the donation instructions provided. You can choose to give new, unwrapped toys or make a monetary contribution. Your Donor Information for Toys For Tots will help facilitate the donation process and ensure it signNowes the intended recipients.

-

What are the benefits of donating to Toys For Tots?

Donating to Toys For Tots not only brings joy to children in need but also strengthens community ties and fosters a spirit of giving. Your contribution, along with your Donor Information for Toys For Tots, helps create a memorable holiday experience for less fortunate families. Additionally, donations may be tax-deductible, providing potential financial benefits.

-

How does Toys For Tots ensure fair distribution of toys?

Toys For Tots ensures fair distribution of toys by collaborating with local organizations and volunteers who understand the needs of their communities. They use the Donor Information for Toys For Tots to manage and allocate resources effectively, ensuring that toys signNow children in a timely and equitable manner.

-

Can businesses participate in Toys For Tots donations?

Yes, businesses can participate in Toys For Tots donations by organizing toy drives or making monetary contributions. When a business donates, their Donor Information for Toys For Tots can enhance visibility and recognition within the community, showcasing their commitment to social responsibility.

-

What types of toys are accepted by Toys For Tots?

Toys For Tots accepts a variety of new, unwrapped toys suitable for children of all ages, including educational toys, games, and sporting equipment. The organization encourages donors to provide items that are age-appropriate and in good condition, and your Donor Information for Toys For Tots is crucial for tracking and reporting donations.

-

How can I find a Toys For Tots drop-off location?

To find a Toys For Tots drop-off location near you, visit the official Toys For Tots website and use their locator tool. This feature allows you to enter your zip code to see nearby drop-off points where you can contribute your toys. Remember to provide your Donor Information for Toys For Tots when you make a donation to help streamline the process.

Get more for Donor Information Toys For Tots Toysfortots

- F 1 full course waiver form

- Department of employment services labor washington dc form

- 440 775 8180 or form

- Complaint civil action louisiana free legal forms

- Student information sheet csusm

- Handbook for the doctor of nursing practice student form

- Attestation form pdf southern new hampshire university snhu

- Fillable online jurisdiction under ampquotlong armampquot statute over form

Find out other Donor Information Toys For Tots Toysfortots

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA