Charitable Gift Annuity Application Southern Poverty Law Center Splcenter Form

Understanding the Charitable Gift Annuity Application

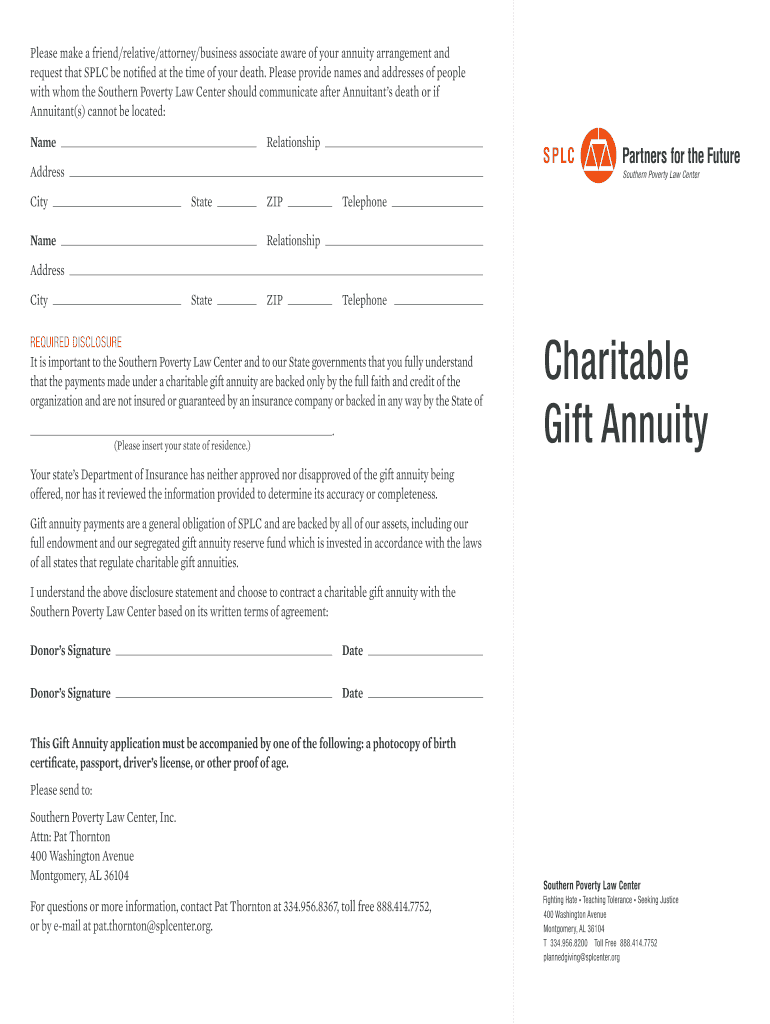

The Charitable Gift Annuity Application is a legal document that allows individuals to make a charitable contribution while also receiving a fixed income for life. This application is particularly relevant for donors who wish to support organizations like the Southern Poverty Law Center (SPLC) while securing a steady income stream. It outlines the terms of the annuity, including the amount donated, the income rate, and the duration of payments. Understanding the specifics of this application is crucial for both the donor and the organization to ensure compliance with legal and tax regulations.

Steps to Complete the Charitable Gift Annuity Application

Completing the Charitable Gift Annuity Application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your full name, address, and Social Security number. Next, determine the amount you wish to donate and the desired income rate. Fill out the application form with this information, ensuring that all fields are completed accurately. After reviewing the application for any errors, sign and date the document. Finally, submit the application according to the specified submission methods, which may include online, mail, or in-person options.

Key Elements of the Charitable Gift Annuity Application

The Charitable Gift Annuity Application includes several essential elements that must be clearly defined. These elements typically encompass the donor's personal information, the amount of the gift, the annuity rate, and the frequency of payments. Additionally, it should outline the charitable organization receiving the donation, in this case, the SPLC. Understanding these key components helps ensure that the application is filled out correctly and meets all necessary legal requirements.

Eligibility Criteria for the Charitable Gift Annuity Application

To qualify for a Charitable Gift Annuity, donors must meet specific eligibility criteria. Generally, individuals must be at least 60 years old to receive annuity payments. Additionally, the minimum contribution amount may vary by organization, often starting at a few thousand dollars. It is important for potential donors to review these criteria to determine their eligibility and ensure that their contributions align with their financial goals and charitable intentions.

IRS Guidelines for Charitable Gift Annuities

When considering a Charitable Gift Annuity, it is essential to understand the IRS guidelines that govern these financial instruments. The IRS allows donors to receive a charitable deduction for a portion of their contribution, which can provide significant tax benefits. However, the deduction amount is dependent on factors such as the donor's age, the annuity rate, and the expected payout duration. Familiarizing oneself with these guidelines can help donors maximize their tax advantages while supporting charitable causes.

Form Submission Methods for the Charitable Gift Annuity Application

Submitting the Charitable Gift Annuity Application can typically be done through various methods. Donors may choose to submit the form online, which often provides a quicker processing time. Alternatively, applications can be mailed to the designated address of the charitable organization or delivered in person. Each method has its own advantages, and donors should select the one that best suits their preferences and timelines.

Quick guide on how to complete charitable gift annuity application southern poverty law center splcenter

Complete Charitable Gift Annuity Application Southern Poverty Law Center Splcenter effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Charitable Gift Annuity Application Southern Poverty Law Center Splcenter on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Charitable Gift Annuity Application Southern Poverty Law Center Splcenter with ease

- Locate Charitable Gift Annuity Application Southern Poverty Law Center Splcenter and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically supplies for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Revise and eSign Charitable Gift Annuity Application Southern Poverty Law Center Splcenter and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charitable gift annuity application southern poverty law center splcenter

How to generate an electronic signature for the Charitable Gift Annuity Application Southern Poverty Law Center Splcenter in the online mode

How to create an eSignature for the Charitable Gift Annuity Application Southern Poverty Law Center Splcenter in Google Chrome

How to make an electronic signature for putting it on the Charitable Gift Annuity Application Southern Poverty Law Center Splcenter in Gmail

How to generate an electronic signature for the Charitable Gift Annuity Application Southern Poverty Law Center Splcenter from your mobile device

How to generate an electronic signature for the Charitable Gift Annuity Application Southern Poverty Law Center Splcenter on iOS devices

How to generate an eSignature for the Charitable Gift Annuity Application Southern Poverty Law Center Splcenter on Android

People also ask

-

What is an annuity in New Bern?

An annuity in New Bern is a financial product that provides a steady income stream, typically used for retirement planning. It allows individuals to invest money, which can then grow over time and be withdrawn in the form of periodic payments. Understanding how annuities work is essential for effective financial planning.

-

How can I purchase an annuity in New Bern?

To purchase an annuity in New Bern, you can consult with a licensed financial advisor or insurance agent who specializes in annuities. They can provide guidance and help you choose the best product based on your financial goals. Additionally, some companies offer online platforms where you can compare and buy annuities directly.

-

What are the benefits of investing in an annuity in New Bern?

Investing in an annuity in New Bern offers several benefits, such as guaranteed income for a specific period or lifetime, tax-deferred growth, and potential for additional payouts. Annuities can be particularly beneficial for those looking for a reliable retirement income strategy. Additionally, they may provide options for family protection through death benefits.

-

What types of annuities are available in New Bern?

In New Bern, you can find various types of annuities such as fixed, variable, and indexed annuities. Each type has its unique features tailored to different financial goals, whether you seek guaranteed returns, market-linked growth, or a combination of both. Understanding these options helps you select an annuity that best suits your needs.

-

What is the cost of an annuity in New Bern?

The cost of an annuity in New Bern varies based on factors like type, terms, and fees associated with the contract. Typically, fees may include surrender charges, mortality and expense risk charges, and administrative fees. Requesting a detailed breakdown from the provider will ensure you understand all potential costs before making a decision.

-

Are there any tax implications with annuities in New Bern?

Yes, annuities in New Bern come with specific tax implications that you should consider. Generally, the money you invest in an annuity grows tax-deferred until you withdraw it. However, distributions can be taxed as ordinary income, so it's crucial to discuss your circumstances with a tax professional to understand the impact fully.

-

Can I integrate my annuity with other financial products in New Bern?

Many annuities in New Bern can be integrated with other financial products, such as life insurance or retirement accounts. This integration allows for a more comprehensive and cohesive financial planning strategy. Be sure to discuss potential integrations with your financial advisor to maximize benefits from your investments.

Get more for Charitable Gift Annuity Application Southern Poverty Law Center Splcenter

- 2020 21 verification worksheet independent form

- Atsu verification request form

- St cloud state cheer competition form

- Phone 716 673 3253 fax 716 673 3785 form

- Financial aid codes for federal aid ampamp tapfredoniaedu form

- Financial aid forms the university of la verne

- You may appeal your financial aid satisfactory academic progress sap status if form

- Apsa msu human resources michigan state university form

Find out other Charitable Gift Annuity Application Southern Poverty Law Center Splcenter

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy