Personal Tax Return Form

What is the Personal Tax Return

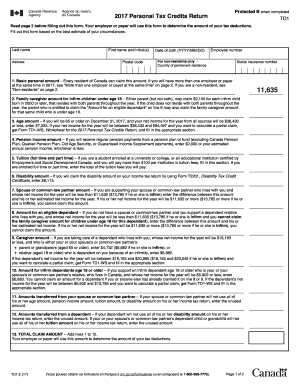

The personal tax return is a formal document submitted to the Internal Revenue Service (IRS) that reports an individual's income, expenses, and other pertinent tax information. This form is essential for calculating the amount of tax owed or the refund due. The most common form for individual taxpayers is the Form 1040, which allows for various income sources, deductions, and credits. Understanding this form is crucial for compliance with U.S. tax laws.

Steps to complete the Personal Tax Return

Completing a personal tax return involves several steps to ensure accuracy and compliance. The process typically includes:

- Gathering necessary documents, such as W-2s, 1099s, and other income statements.

- Identifying eligible deductions and credits that may apply to your situation.

- Filling out the appropriate tax form, usually Form 1040, ensuring all information is accurate.

- Reviewing the completed form for any errors or omissions.

- Submitting the form to the IRS either electronically or via mail.

Legal use of the Personal Tax Return

The legal use of a personal tax return is governed by various regulations set forth by the IRS. A properly completed tax return serves as a legal document that can be used for various purposes, including verifying income for loans or financial aid. It is essential to ensure that all information is truthful and accurate, as providing false information can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for personal tax returns are critical to avoid penalties. Typically, individual tax returns must be filed by April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete a personal tax return accurately, certain documents are required. Key documents include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Bank statements for interest income.

- Records of any other income sources.

Form Submission Methods (Online / Mail / In-Person)

Personal tax returns can be submitted through various methods. Taxpayers can file online using tax preparation software, which often provides guidance and checks for errors. Alternatively, returns can be mailed directly to the IRS, ensuring that the correct address is used based on the taxpayer's location and whether a payment is included. In-person filing is less common but may be available at certain IRS offices during tax season.

Quick guide on how to complete personal tax return

Complete Personal Tax Return seamlessly on any device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents promptly without delays. Handle Personal Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Personal Tax Return effortlessly

- Locate Personal Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Personal Tax Return and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a personal tax return?

A personal tax return is a document filed with the tax authorities that reports your income, expenses, and other relevant financial information for a given year. It is essential for calculating the correct amount of taxes owed or refunds to be received. Utilizing tools like airSlate SignNow can streamline the process of finalizing your personal tax return with electronic signatures.

-

How can airSlate SignNow help with my personal tax return?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents related to your personal tax return. With features like customizable templates and secure cloud storage, the platform ensures that your documents are organized and accessible. This efficiency can be particularly beneficial during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different needs, from individual users to businesses. The plans are designed to be cost-effective, ensuring you get the best value for managing your personal tax return and other documentation. You can choose a plan that fits your usage and budget requirements.

-

Is airSlate SignNow secure for handling my personal tax return?

Yes, airSlate SignNow prioritizes security and compliance with industry standards to ensure that your personal tax return documents are protected. With features like encryption and secure cloud storage, you can confidently manage sensitive tax information without fear of data bsignNowes.

-

Can I integrate airSlate SignNow with other software for my personal tax return?

Absolutely! airSlate SignNow offers robust integrations with popular financial and accounting software, making it easier to manage your personal tax return. This connectivity allows for seamless data transfer and enhances your workflow, ensuring that all your documents are in one centralized location.

-

What features should I look for in a personal tax return tool?

When selecting a tool for managing your personal tax return, look for features such as eSignature capabilities, document tracking, and automation. AirSlate SignNow offers these functionalities, allowing you to efficiently manage your tax-related documents and track the status of signatures in real-time.

-

How does airSlate SignNow improve the eSigning process for my personal tax return?

AirSlate SignNow simplifies the eSigning process by enabling users to sign documents electronically from anywhere and on any device. This accessibility helps speed up the submission of your personal tax return by eliminating the need for physical signatures, making it a convenient option during tax season.

Get more for Personal Tax Return

- Formulario wes 414283831

- Fatca declaration form

- Fatca declaration form 202760826

- Sierra at tahoe child care center child admission form sierra at tahoe child care center child admission form

- Bcbstx form claim

- Varsity spirit championship release amp waiver form adultcoach

- Box 1282 singapore 902532 form

- Governors emergency education relief fund office of form

Find out other Personal Tax Return

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter