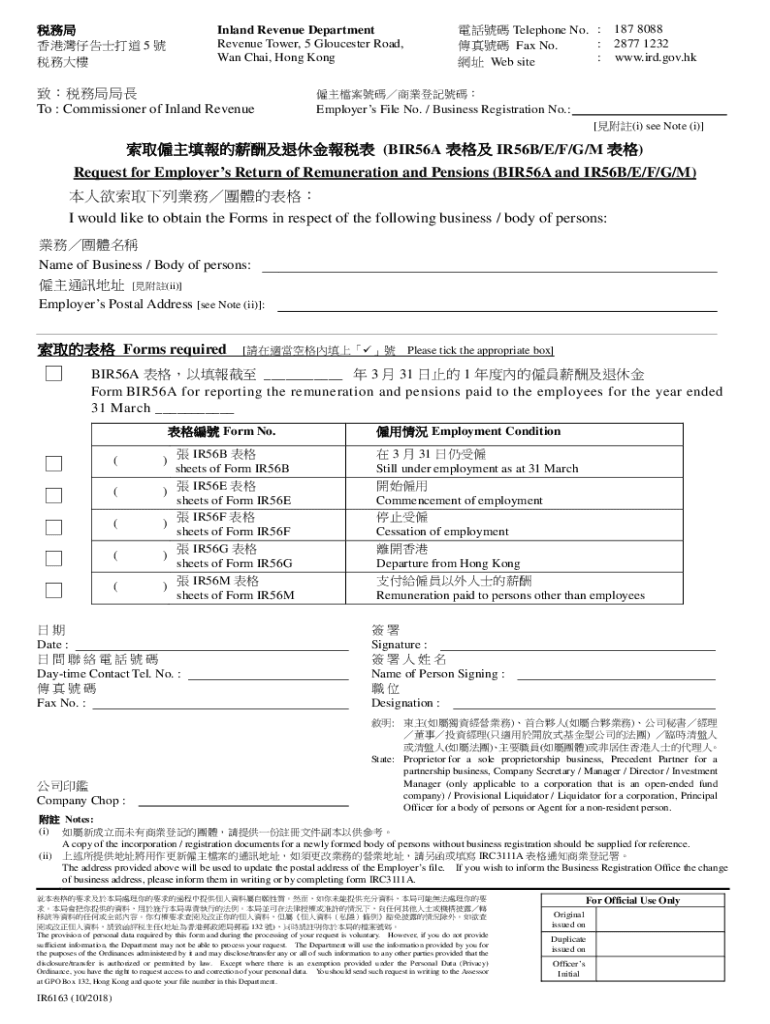

To Commissioner of Inland Revenue Form

What is the IR6163 form?

The IR6163 form is a document used by individuals and businesses to report specific financial information to the Commissioner of Inland Revenue. This form is essential for ensuring compliance with tax regulations and helps in the accurate assessment of taxes owed. Understanding the purpose of the IR6163 form is crucial for proper tax filing and adherence to U.S. tax laws.

How to use the IR6163 form

Using the IR6163 form involves several steps to ensure accurate completion. First, gather all necessary financial documents and information required to fill out the form. Next, carefully follow the instructions provided with the form to input your data correctly. It is essential to review the completed form for accuracy before submission to avoid any potential issues with the tax authorities.

Steps to complete the IR6163 form

Completing the IR6163 form requires a systematic approach:

- Collect all relevant financial documents, including income statements and expense records.

- Download the IR6163 form from the official website or obtain a physical copy.

- Fill in the required fields, ensuring all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Sign and date the form as required.

- Submit the completed form according to the provided submission methods.

Legal use of the IR6163 form

The IR6163 form is legally binding when completed and submitted according to the guidelines set forth by the IRS. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal ramifications. Compliance with relevant laws, including the ESIGN Act, ensures that electronic submissions of the IR6163 form are recognized as valid.

Filing Deadlines / Important Dates

Filing deadlines for the IR6163 form are crucial to avoid penalties. Typically, the form must be submitted by the designated tax deadline, which varies based on individual circumstances. It is advisable to stay informed about any changes to deadlines, especially during tax season, to ensure timely submission and compliance with IRS requirements.

Required Documents

When preparing to complete the IR6163 form, certain documents are required:

- Income statements, such as W-2s or 1099s.

- Records of expenses related to the income being reported.

- Previous tax returns for reference.

- Any additional documentation that supports your claims on the form.

Form Submission Methods

The IR6163 form can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Quick guide on how to complete to commissioner of inland revenue

Effortlessly Manage To Commissioner Of Inland Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle To Commissioner Of Inland Revenue seamlessly from any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The Simplest Way to Edit and Electronically Sign To Commissioner Of Inland Revenue with Ease

- Obtain To Commissioner Of Inland Revenue and select Get Form to initiate the process.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your document, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, time-consuming document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign To Commissioner Of Inland Revenue while ensuring effective communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ir6163 feature in airSlate SignNow?

The ir6163 feature in airSlate SignNow allows users to manage their document workflows efficiently. It provides a streamlined interface for sending, signing, and tracking documents, ensuring that businesses can operate smoothly while also saving time and resources.

-

How does pricing work for airSlate SignNow with the ir6163 functionality?

Pricing for airSlate SignNow varies based on the level of access and features needed, including the ir6163 capabilities. Plans are designed to be cost-effective, catering to different business sizes while ensuring they have the necessary tools to manage their eSignature needs efficiently.

-

What are the key benefits of using airSlate SignNow's ir6163?

The ir6163 feature in airSlate SignNow offers several benefits, including enhanced document security, quick turnaround times, and comprehensive tracking of signature statuses. By adopting this solution, businesses can minimize paperwork and improve their operational efficiency.

-

Can airSlate SignNow's ir6163 integrate with other software?

Yes, airSlate SignNow's ir6163 can seamlessly integrate with various software solutions, including CRM systems, project management tools, and cloud storage services. This flexibility ensures that businesses can incorporate eSignatures into their existing workflows without disruption.

-

Is it easy to use the ir6163 feature in airSlate SignNow?

Absolutely! The ir6163 feature in airSlate SignNow is designed for user-friendliness, allowing even those with minimal technical skills to navigate the platform easily. Its intuitive interface means that businesses can start sending and receiving eSignatures quickly and efficiently.

-

How secure is the ir6163 feature in airSlate SignNow?

The ir6163 feature in airSlate SignNow prioritizes security, implementing advanced encryption protocols to protect sensitive information. Businesses can rest assured that their documents are secure throughout the signing process, complying with industry-leading security standards.

-

What types of documents can I send using the ir6163 feature?

With the ir6163 feature in airSlate SignNow, you can send a wide range of documents including contracts, agreements, and forms. This versatility makes it suitable for different industries looking to streamline their document signing processes.

Get more for To Commissioner Of Inland Revenue

Find out other To Commissioner Of Inland Revenue

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document