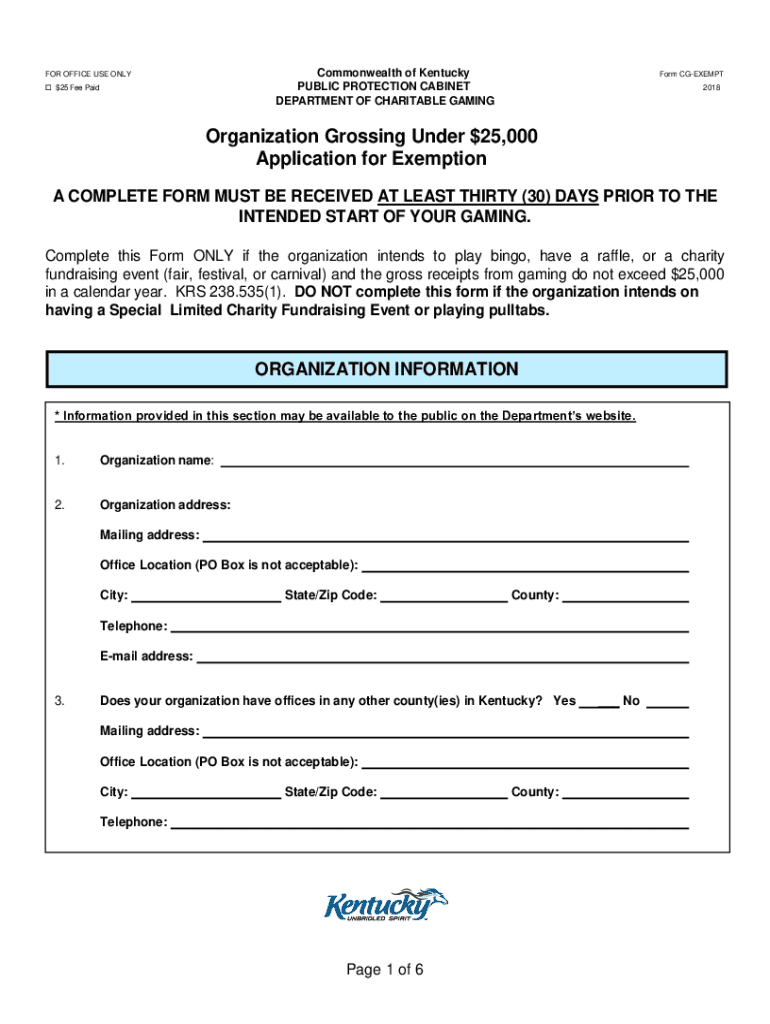

Additional Forms Department of Charitable Gaming 2018-2026

What is the form exemption PDF?

The form exemption PDF is a specific document used by organizations to claim exemption from certain taxes or regulations. This form is particularly relevant for charitable organizations and other entities that qualify for tax-exempt status under IRS guidelines. By submitting this form, organizations can demonstrate their eligibility for exemption, allowing them to operate without incurring specific tax liabilities.

Steps to complete the form exemption PDF

Completing the form exemption PDF involves several key steps to ensure accuracy and compliance with legal requirements:

- Gather necessary information, including the organization's legal name, address, and tax identification number.

- Identify the specific exemption being claimed, such as charitable, educational, or religious status.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state or federal agency, following their specific submission guidelines.

Legal use of the form exemption PDF

The legal use of the form exemption PDF is crucial for maintaining compliance with tax laws. Organizations must ensure that the form is filled out correctly and submitted on time to avoid penalties. The form serves as a formal declaration of the organization's tax-exempt status and must be retained for record-keeping purposes. Additionally, organizations should be aware of any state-specific regulations that may apply to their exemption claims.

Required documents for the form exemption PDF

When preparing to submit the form exemption PDF, organizations typically need to gather several supporting documents:

- Proof of the organization's tax-exempt status, such as a determination letter from the IRS.

- Bylaws or articles of incorporation that outline the organization's purpose and structure.

- Financial statements or budgets that demonstrate the organization's operations and funding sources.

- Any additional documentation required by the state or federal agency to support the exemption claim.

Form submission methods

The form exemption PDF can usually be submitted through various methods, depending on the requirements of the issuing agency:

- Online submission via the agency's website, which may offer a secure portal for electronic filing.

- Mailing a physical copy of the form to the designated office, ensuring it is sent with adequate postage.

- In-person submission at the agency's office, which may allow for immediate confirmation of receipt.

IRS guidelines related to the form exemption PDF

The IRS provides specific guidelines for organizations seeking tax exemption. These guidelines outline the eligibility criteria, necessary documentation, and the process for applying for tax-exempt status. Organizations should familiarize themselves with IRS Publication 557, which details the requirements for various types of tax-exempt organizations. Adhering to these guidelines ensures that the form exemption PDF is completed correctly and increases the likelihood of approval.

Quick guide on how to complete additional forms department of charitable gaming

Effortlessly Prepare Additional Forms Department Of Charitable Gaming on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Additional Forms Department Of Charitable Gaming across any platform using airSlate SignNow's Android or iOS applications and streamline your document-centered processes today.

The Easiest Way to Modify and eSign Additional Forms Department Of Charitable Gaming with Ease

- Locate Additional Forms Department Of Charitable Gaming and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Additional Forms Department Of Charitable Gaming, ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct additional forms department of charitable gaming

Create this form in 5 minutes!

People also ask

-

What is a grossing under exempt form, and how does it work?

A grossing under exempt form is a specific document used to report income that is exempt from certain taxation. With airSlate SignNow, you can easily create, send, and eSign grossing under exempt forms, ensuring compliance and efficiency in your financial reporting processes. This user-friendly solution simplifies managing essential documentation for businesses.

-

What features does airSlate SignNow offer for creating grossing under exempt forms?

airSlate SignNow provides a range of features to streamline the creation of grossing under exempt forms, including customizable templates, drag-and-drop functionality, and secure eSigning capabilities. Our platform ensures that your forms are completed accurately and efficiently, making it easier for businesses to handle their exempt income documentation.

-

Is airSlate SignNow cost-effective for small businesses needing grossing under exempt forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to the needs of companies looking to manage grossing under exempt forms without breaking the bank. This enables you to efficiently handle documentation while staying within your budget.

-

Can I integrate airSlate SignNow with other software to manage grossing under exempt forms?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, allowing you to easily manage grossing under exempt forms alongside your existing tools. This integration capability ensures that your workflow remains efficient and coordinated across different platforms, enhancing overall productivity.

-

What benefits can businesses expect from using airSlate SignNow for grossing under exempt forms?

By utilizing airSlate SignNow for grossing under exempt forms, businesses can expect increased efficiency, reduced paperwork, and improved compliance with tax regulations. Our platform streamlines document management, allowing you to focus on your core business rather than getting bogged down by administrative tasks.

-

How secure is airSlate SignNow when handling grossing under exempt forms?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and authentication protocols to ensure that your grossing under exempt forms and sensitive data are well-protected. With us, you can confidently send and manage documents without worrying about unauthorized access.

-

What is the process for eSigning grossing under exempt forms using airSlate SignNow?

The process for eSigning grossing under exempt forms with airSlate SignNow is straightforward. Once you create the form, simply invite the relevant parties to sign electronically. They will receive a link, allowing them to review and complete the signing process from any device, making it convenient and efficient for everyone involved.

Get more for Additional Forms Department Of Charitable Gaming

- Adap residency verification affidavit cdph 8727 form

- Form csfa 03 01 form csfa 03 01

- Charter school facilities program application california school finance authority charter school facilities program application form

- Financial statement de 926b rev 18 7 19 form

- Financial statement de 926b edd ca form

- State department of education administration of medication form

- Medicare select enrollment application quartz form

- Es 935 maryland form

Find out other Additional Forms Department Of Charitable Gaming

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now