Fuel Charge Return for Non Registrants under the Greenhouse Gas Pollution Pricing Act B401 E Form

Understanding the Fuel Charge Return for Non-Registrants Under the Greenhouse Gas Pollution Pricing Act B401 E

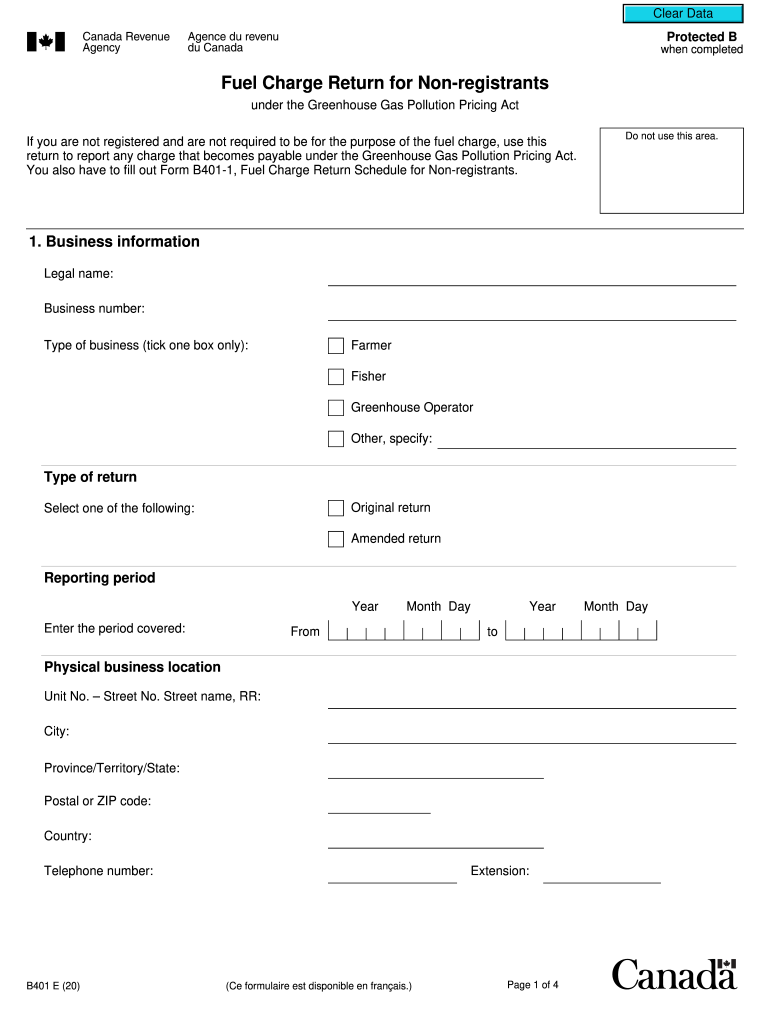

The Fuel Charge Return for Non-Registrants is a crucial form for individuals and businesses that do not have a registration number but are required to report and remit fuel charges under the Greenhouse Gas Pollution Pricing Act. This form is specifically designed to help non-registrants fulfill their obligations regarding fuel charges, ensuring compliance with Canadian environmental regulations. The B401 E form allows users to accurately report their fuel consumption and calculate the applicable charges, contributing to the overall goal of reducing greenhouse gas emissions.

Steps to Complete the Fuel Charge Return for Non-Registrants Under the Greenhouse Gas Pollution Pricing Act B401 E

Completing the Fuel Charge Return involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding fuel purchases, including dates, quantities, and types of fuel. Next, calculate the total fuel charge based on the rates applicable during the reporting period. It is essential to fill out the B401 E form accurately, providing all required details such as your contact information and the total amount of fuel consumed. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Required Documents for the Fuel Charge Return for Non-Registrants Under the Greenhouse Gas Pollution Pricing Act B401 E

When filing the Fuel Charge Return, certain documents are necessary to support your submission. These may include receipts for fuel purchases, invoices, and any other relevant documentation that verifies the amount and type of fuel acquired. Keeping accurate records is vital, as these documents may be requested for verification purposes by tax authorities. Ensuring that all documentation is organized and readily available can facilitate a smoother filing process.

Filing Deadlines and Important Dates for the Fuel Charge Return B401 E

Timely submission of the Fuel Charge Return is essential to avoid penalties. The filing deadlines for the B401 E form typically align with specific reporting periods, which may vary based on individual circumstances. It is crucial to stay informed about these deadlines to ensure compliance. Marking your calendar with important dates can help you manage your filing responsibilities effectively and avoid any late fees.

Legal Use of the Fuel Charge Return for Non-Registrants Under the Greenhouse Gas Pollution Pricing Act B401 E

The legal framework surrounding the Fuel Charge Return mandates that non-registrants must accurately report their fuel consumption to comply with environmental regulations. The B401 E form serves as a legal document that must be completed truthfully and submitted within the designated timeframes. Failing to adhere to these regulations can result in penalties, making it essential for users to understand their legal obligations when utilizing this form.

Examples of Using the Fuel Charge Return for Non-Registrants Under the Greenhouse Gas Pollution Pricing Act B401 E

Practical examples of using the Fuel Charge Return can clarify how to apply the form in real-life scenarios. For instance, a small business that purchases fuel for its delivery vehicles may need to complete the B401 E form to report its fuel usage and pay the corresponding charges. Similarly, an individual who uses fuel for personal heating may also need to submit this form. Understanding these examples can help users grasp the importance of the Fuel Charge Return in their specific situations.

Quick guide on how to complete fuel charge return for non registrants under the greenhouse gas pollution pricing act b401 e

Complete Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can find the needed template and safely store it online. airSlate SignNow equips you with all necessary tools to create, edit, and electronically sign your documents quickly without interruptions. Manage Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and electronically sign Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E effortlessly

- Locate Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive details with features specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fuel charge return for non registrants under the greenhouse gas pollution pricing act b401 e

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

How can Canada Revenue Create help my business?

Canada Revenue Create offers businesses a streamlined way to manage and eSign documents efficiently. By integrating with airSlate SignNow, you can ensure that all forms required by Canada Revenue are handled quickly and securely, improving your workflow and compliance.

-

What features does airSlate SignNow provide for Canada Revenue Create?

With airSlate SignNow, Canada Revenue Create users can enjoy features like customizable templates, advanced eSigning options, and document tracking. These tools enhance the overall efficiency of your paperwork processes, ensuring you meet Canada Revenue requirements effectively.

-

What pricing options are available for Canada Revenue Create users?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs. For Canada Revenue Create users, the pricing is competitive and includes features tailored to enhance your document management and eSigning—a cost-effective solution for any size of business.

-

Is airSlate SignNow compliant with Canada Revenue regulations?

Yes, airSlate SignNow is designed to be compliant with Canada Revenue regulations. This compliance ensures that your documents are secure and legally binding, making it easier for you to submit eSigned documents to Canada Revenue without any concerns.

-

Can I integrate airSlate SignNow with my current systems for Canada Revenue Create?

Absolutely! AirSlate SignNow offers seamless integrations with various software systems, allowing you to easily incorporate Canada Revenue Create into your existing workflow. This integration ensures your processes are unified and more efficient.

-

What are the benefits of using airSlate SignNow for Canada Revenue Create?

Using airSlate SignNow for Canada Revenue Create provides numerous benefits, including increased speed and efficiency in document processing. It also enhances security and compliance, giving businesses peace of mind while managing important Canada Revenue documents.

-

How user-friendly is airSlate SignNow for Canada Revenue Create?

AirSlate SignNow prioritizes user experience, making it incredibly user-friendly for Canada Revenue Create users. Even those with limited technical skills can easily navigate the platform, allowing for quick adaptation and minimal learning time.

Get more for Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E

- Sapropterin for bh4 deficiency initial and continuing pbs authority application form

- Reference form 2017 18 rosthern junior college rosthernjuniorcollege

- Referral form the camelot difference

- Au state administrative tribunal form

- Verification of experience form for certified employees

- Form 9465sp rev december 2003 installment agreement request spanish

- Ap 193 form

- Revised 403 certificate of correctiondoc form

Find out other Fuel Charge Return For Non registrants Under The Greenhouse Gas Pollution Pricing Act B401 E

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself