School Readiness Tax Credit Act Nebraska Department of 2021-2026

Understanding the School Readiness Tax Credit Act

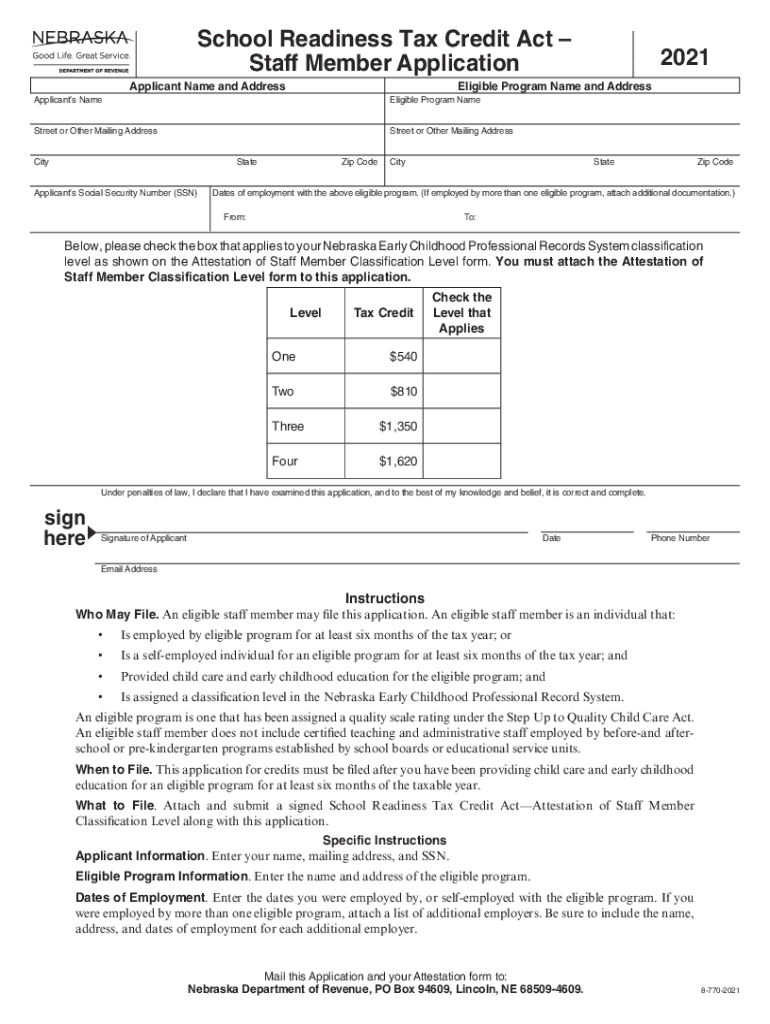

The School Readiness Tax Credit Act is a legislative measure in Nebraska designed to support families with children in early childhood education programs. This tax credit aims to help offset the costs associated with school readiness, making quality education more accessible. The Act provides financial relief to eligible families, encouraging early learning and development for children.

Eligibility Criteria for the School Readiness Tax Credit

To qualify for the School Readiness Tax Credit, applicants must meet specific criteria set by the Nebraska Department of Revenue. Generally, eligibility includes:

- Residency in Nebraska

- Enrollment of a child in an approved early childhood education program

- Meeting income thresholds established by the state

It is important to review the detailed eligibility requirements to ensure compliance and maximize the benefits of the tax credit.

Steps to Complete the School Readiness Tax Credit Application

Filling out the Nebraska tax form for the School Readiness Tax Credit involves several key steps:

- Gather necessary documentation, including proof of income and enrollment in an early childhood program.

- Access the Nebraska tax form specific to the School Readiness Tax Credit.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Following these steps will help ensure a smooth application process and increase the likelihood of receiving the tax credit.

Required Documents for the School Readiness Tax Credit

When applying for the School Readiness Tax Credit, certain documents are essential to validate your application. These typically include:

- Proof of residency in Nebraska

- Income statements, such as W-2 forms or tax returns

- Documentation of the child’s enrollment in an approved early childhood education program

Having these documents ready will facilitate the application process and help avoid delays.

Form Submission Methods for the School Readiness Tax Credit

Applicants can submit the Nebraska tax form for the School Readiness Tax Credit through various methods. These include:

- Online submission via the Nebraska Department of Revenue's website

- Mailing a physical copy of the completed form to the appropriate state office

- In-person submission at designated state offices

Choosing the most convenient submission method can help ensure timely processing of your application.

Filing Deadlines for the School Readiness Tax Credit

It is crucial to be aware of the filing deadlines associated with the School Readiness Tax Credit. Generally, applications must be submitted by the tax filing deadline for the year in which the credit is claimed. Staying informed about these dates will help you avoid penalties and ensure you receive the credit in a timely manner.

Quick guide on how to complete school readiness tax credit act nebraska department of

Effortlessly Prepare School Readiness Tax Credit Act Nebraska Department Of on Any Device

The management of documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage School Readiness Tax Credit Act Nebraska Department Of on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign School Readiness Tax Credit Act Nebraska Department Of with Ease

- Locate School Readiness Tax Credit Act Nebraska Department Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or black out sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign School Readiness Tax Credit Act Nebraska Department Of to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct school readiness tax credit act nebraska department of

Create this form in 5 minutes!

How to create an eSignature for the school readiness tax credit act nebraska department of

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Nebraska tax form and why is it important?

The Nebraska tax form is an essential document used for filing state income taxes in Nebraska. It's important because it ensures that taxpayers accurately report their income and pay the correct amount of taxes, avoiding penalties or fines. Utilizing tools like airSlate SignNow can streamline the process of preparing and signing these forms.

-

How can airSlate SignNow help with the Nebraska tax form?

airSlate SignNow simplifies the process of completing and sending the Nebraska tax form. Our platform allows you to eSign documents securely and efficiently, making it easy to manage your tax filings. With our user-friendly interface, you can fill out the necessary information and send your forms directly to relevant authorities.

-

Is there a cost associated with using airSlate SignNow for Nebraska tax forms?

Yes, there is a pricing structure associated with airSlate SignNow, which offers various plans to suit different needs. Our plans are designed to be cost-effective while providing robust features for managing Nebraska tax forms and other documents. You can choose a plan that fits your business requirements and budget.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as eSigning, document storage, and collaborative editing that are highly beneficial for managing tax documents like the Nebraska tax form. You can easily track document statuses, sending reminders and ensuring timely submissions. Our platform also supports templates for repetitive tasks, enhancing productivity.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates with a variety of popular software applications to streamline your tax management workflow. You can connect it with accounting software or tax preparation tools to directly handle the Nebraska tax form, ensuring a smooth and efficient process. Check out our integration options to see what's available.

-

How secure is airSlate SignNow when handling Nebraska tax forms?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Nebraska tax form. We implement stringent security measures, including encryption and secure data storage, to protect your information. You can trust that your tax documents will be handled safely and confidentially.

-

What types of documents can be sent with airSlate SignNow besides Nebraska tax forms?

In addition to the Nebraska tax form, airSlate SignNow can manage a variety of documents including contracts, agreements, and legal forms. Our platform is versatile, catering to the needs of businesses across different industries. This means you can use the same tool for multiple document management processes, saving time and effort.

Get more for School Readiness Tax Credit Act Nebraska Department Of

- Rmit ssvf form

- Imm 5839 f form

- Instructionsdesignation of registered agent washington form

- Hawaii respiratory license form

- F 1 program extension instruction sheet form

- Facility addititional location form form used to report additional network facilty location to healthchoice

- Ndp 8 rn assessment form

- Color correction release form hair by christine ampamp co

Find out other School Readiness Tax Credit Act Nebraska Department Of

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple