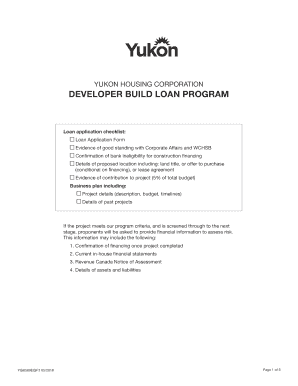

YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN Form

What is the Yukon Housing Corporation Developer Build Loan?

The Yukon Housing Corporation Developer Build Loan is a financial product designed to assist developers in constructing new residential properties in Yukon. This loan provides funding for various stages of development, including land acquisition, construction costs, and other associated expenses. The program aims to promote housing development in the region, ensuring that there is adequate and affordable housing available for residents.

How to Obtain the Yukon Housing Corporation Developer Build Loan

To obtain the Yukon Housing Corporation Developer Build Loan, developers must follow a structured application process. This typically involves submitting a detailed proposal that outlines the project scope, budget, and timeline. Developers may also need to provide financial statements and demonstrate their ability to repay the loan. It is essential to check for any specific eligibility criteria set by the Yukon Housing Corporation, as these may vary based on the project type and location.

Steps to Complete the Yukon Housing Corporation Developer Build Loan

Completing the Yukon Housing Corporation Developer Build Loan involves several key steps:

- Prepare a comprehensive project proposal, including financial projections and development plans.

- Gather necessary documentation, such as proof of identity, business registration, and financial statements.

- Submit the application to the Yukon Housing Corporation for review.

- Await feedback and address any questions or requests for additional information from the corporation.

- Upon approval, review the loan agreement and ensure all terms are understood before signing.

Legal Use of the Yukon Housing Corporation Developer Build Loan

The Yukon Housing Corporation Developer Build Loan is legally binding once the loan agreement is signed by all parties involved. It is crucial for developers to understand the terms and conditions outlined in the agreement, as these will govern the use of the funds and the repayment schedule. Compliance with local laws and regulations regarding construction and development is also essential to ensure the legality of the project funded by the loan.

Key Elements of the Yukon Housing Corporation Developer Build Loan

Several key elements define the Yukon Housing Corporation Developer Build Loan:

- Loan Amount: The total funding available for each project, which may vary based on the scope and scale of the development.

- Interest Rate: The rate applied to the loan, which can impact the overall cost of borrowing.

- Repayment Terms: The schedule and conditions under which the loan must be repaid, including any grace periods or penalties for late payments.

- Use of Funds: Specific guidelines on how the loan proceeds can be utilized within the project.

Eligibility Criteria

Eligibility for the Yukon Housing Corporation Developer Build Loan typically includes several factors:

- Developers must demonstrate experience in residential construction or related fields.

- Financial stability and the ability to repay the loan are critical considerations.

- Projects must align with the goals of the Yukon Housing Corporation, focusing on increasing housing availability.

- Compliance with local zoning and building regulations is mandatory.

Quick guide on how to complete yukon housing corporation developer build loan

Complete YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the functionalities required to create, edit, and eSign your documents quickly without delays. Manage YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN seamlessly

- Locate YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Select pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all entered information and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN?

The YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN is a financial product specifically designed for developers looking to finance construction projects in Yukon. It offers flexible terms and competitive interest rates to help you successfully build and develop housing solutions.

-

How can the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN benefit my construction project?

Utilizing the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN allows developers to access essential funding at crucial project stages. This loan can relieve financial pressure, ensuring that projects move forward on time, which can ultimately enhance your profitability.

-

What are the eligibility requirements for the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN?

Eligibility for the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN typically includes having a solid development plan, proof of previous successful projects, and demonstrating financial capability. Specific criteria may vary, so it's best to consult with Yukon Housing Corporation for detailed requirements.

-

What types of projects can be financed with the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN?

The YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN can finance a variety of residential construction projects, including single-family homes, multi-family units, and affordable housing developments. It is geared towards supporting initiatives that tackle housing shortages in Yukon.

-

Are there any fees associated with the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN?

Yes, there may be associated fees with the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN, including processing fees, appraisal fees, and potential closing costs. It's recommended to review the loan terms thoroughly to understand all financial obligations before proceeding.

-

How can I apply for the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN?

To apply for the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN, you should begin by preparing your development project details and finances. Then, contact Yukon Housing Corporation or visit their website to access the application process and required documentation.

-

What is the typical interest rate for the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN?

Interest rates for the YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN vary based on market conditions and your credit profile. It is advisable to signNow out to Yukon Housing Corporation for the most current rates and to get a tailored quote based on your specific project.

Get more for YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN

Find out other YUKON HOUSING CORPORATION DEVELOPER BUILD LOAN

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF