When Can a Retirement Plan Distribute Benefits?Internal Form

Understanding the 8915 Form

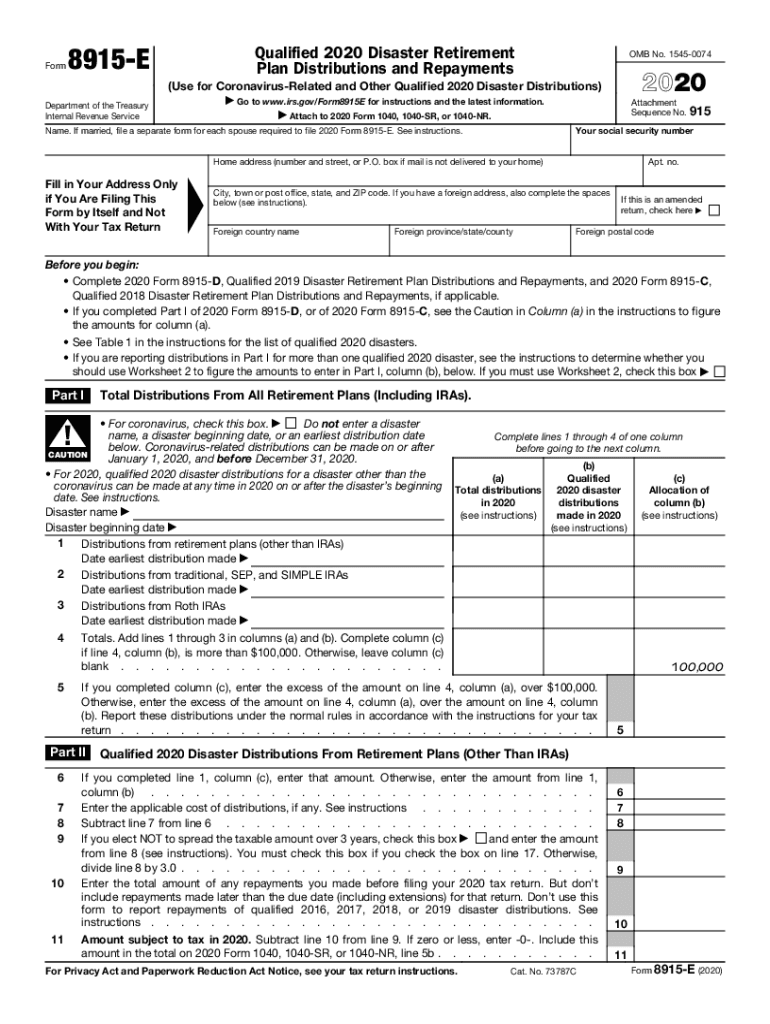

The 8915 form, officially known as the IRS Qualified Disaster Retirement Distributions form, is designed for individuals who have taken distributions from their retirement plans due to a qualified disaster. This form allows taxpayers to report these distributions and, if applicable, to spread the tax liability over three years. It is essential for ensuring compliance with IRS regulations and for accurately calculating tax obligations related to these distributions.

Eligibility Criteria for Using the 8915 Form

To utilize the 8915 form, individuals must meet specific eligibility criteria. Primarily, the taxpayer must have received a distribution from a qualified retirement plan as a result of a federally declared disaster. Additionally, the distribution must meet the IRS guidelines regarding the timing and amount. Understanding these criteria helps ensure that the form is used correctly and that taxpayers can benefit from potential tax relief.

Steps to Complete the 8915 Form

Completing the 8915 form involves several key steps:

- Gather necessary documentation, including details of the retirement plan and the amount distributed.

- Fill out personal information, including name, address, and Social Security number.

- Report the total amount of distributions received as a result of the qualified disaster.

- Indicate the portion of the distribution that is eligible for tax relief.

- Complete any additional sections required by the IRS for your specific situation.

Following these steps carefully can help ensure that the form is filled out accurately, minimizing the risk of errors that could lead to penalties.

IRS Guidelines for the 8915 Form

The IRS provides specific guidelines regarding the use of the 8915 form. These guidelines outline the types of disasters that qualify, the time frame for distributions, and how to report the income. It is crucial for taxpayers to familiarize themselves with these guidelines to ensure compliance and to take advantage of any available tax benefits. The IRS updates these guidelines periodically, so staying informed is essential.

Filing Deadlines for the 8915 Form

Timely submission of the 8915 form is critical to avoid penalties. The filing deadline typically aligns with the standard tax return deadline, which is usually April 15 of the following year. However, if an extension is filed for the tax return, the same extension applies to the 8915 form. Taxpayers should be aware of these deadlines to ensure that they submit their forms on time and avoid unnecessary complications.

Penalties for Non-Compliance with the 8915 Form

Failure to properly complete and submit the 8915 form can result in penalties imposed by the IRS. These penalties may include fines for late filing or inaccuracies in reporting distributions. Additionally, taxpayers may miss out on potential tax relief associated with qualified disaster distributions. Understanding the importance of compliance can help individuals avoid these penalties and ensure they are taking full advantage of their tax rights.

Quick guide on how to complete when can a retirement plan distribute benefitsinternal

Manage When Can A Retirement Plan Distribute Benefits?Internal seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without holdups. Handle When Can A Retirement Plan Distribute Benefits?Internal on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to update and eSign When Can A Retirement Plan Distribute Benefits?Internal effortlessly

- Find When Can A Retirement Plan Distribute Benefits?Internal and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign When Can A Retirement Plan Distribute Benefits?Internal to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the when can a retirement plan distribute benefitsinternal

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow 8915 and how does it work?

AirSlate SignNow 8915 is a powerful eSignature solution that allows businesses to send and sign documents electronically. With its user-friendly interface, users can quickly create and manage documents, ensuring a seamless signing experience. The platform signNowly speeds up workflows by facilitating efficient document handling, making it a preferable choice for various industries.

-

How much does airSlate SignNow 8915 cost?

The pricing for airSlate SignNow 8915 is competitive and designed to fit different business needs. There are various plans available, each offering unique features tailored for individual and team requirements. For detailed pricing information, please visit our pricing page.

-

What features are included with airSlate SignNow 8915?

AirSlate SignNow 8915 includes a variety of essential features such as customizable templates, document tracking, and user authentication options. The platform also supports in-person signing, mobile access, and integration with other applications, helping to streamline your workflow. These features make it a comprehensive tool for managing electronic signatures.

-

What benefits can businesses expect from using airSlate SignNow 8915?

By using airSlate SignNow 8915, businesses can expect increased efficiency and faster turnaround times for document processing. The platform reduces paper waste and improves compliance with legally binding electronic signatures. Additionally, users gain access to analytics that help monitor document status and engagement.

-

Can airSlate SignNow 8915 integrate with other software?

Yes, airSlate SignNow 8915 offers seamless integrations with numerous applications such as Google Drive, Salesforce, and Microsoft 365. These integrations enhance your workflow by allowing you to send documents directly from your existing platforms. This connectivity ensures that managing your documents becomes hassle-free and efficient.

-

Is airSlate SignNow 8915 suitable for small businesses?

Absolutely! AirSlate SignNow 8915 is designed to cater to businesses of all sizes, including small enterprises. Its scalability and affordability make it an ideal choice for smaller organizations looking to implement a reliable eSignature solution without breaking the bank. Small businesses can streamline their document processes and enhance customer satisfaction.

-

How secure is airSlate SignNow 8915?

AirSlate SignNow 8915 prioritizes security and utilizes advanced encryption protocols to protect your documents and data. The platform is compliant with various regulations, including GDPR and HIPAA, ensuring your sensitive information remains safe. Users can trust that their electronic signatures are legally valid and their data is well-guarded.

Get more for When Can A Retirement Plan Distribute Benefits?Internal

Find out other When Can A Retirement Plan Distribute Benefits?Internal

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document