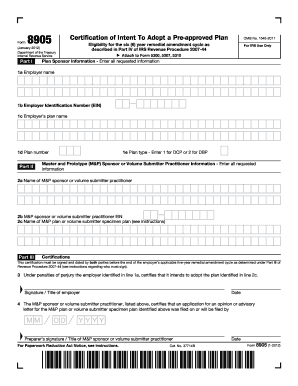

Form 8905 Rev January Internal Revenue Service

What is the Form 8905 Rev January Internal Revenue Service

The Form 8905 is a document issued by the Internal Revenue Service (IRS) that is used for specific tax-related purposes. This form is primarily designed to assist taxpayers in reporting certain types of income or deductions, ensuring compliance with federal tax regulations. It is essential for individuals and businesses to understand the purpose of this form to accurately report their financial activities and avoid potential penalties.

How to use the Form 8905 Rev January Internal Revenue Service

Using the Form 8905 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the reporting period. Next, carefully fill out the form, ensuring that all entries are accurate and complete. It is important to double-check calculations and verify that all required fields are filled. Once completed, the form can be submitted to the IRS via the appropriate method, which may include electronic filing or mailing a paper copy.

Steps to complete the Form 8905 Rev January Internal Revenue Service

Completing the Form 8905 requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or authorized sources.

- Read the instructions carefully to understand the requirements and sections of the form.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the necessary financial information as requested in the form.

- Review your entries for accuracy before finalizing the form.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Form 8905 Rev January Internal Revenue Service

The legal use of Form 8905 is governed by IRS regulations. It is crucial for taxpayers to ensure that the information provided is truthful and complies with federal tax laws. Incorrect or fraudulent information can lead to penalties, including fines or audits. Therefore, understanding the legal implications of using this form is essential for maintaining compliance and protecting oneself from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8905 are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for most taxpayers. However, specific circumstances may warrant different deadlines, such as extensions or special provisions for certain taxpayers. It is advisable to check the IRS guidelines for the most current filing dates and any updates that may affect submission timelines.

Form Submission Methods (Online / Mail / In-Person)

The Form 8905 can be submitted through various methods, depending on the taxpayer's preference and IRS guidelines. Options include:

- Online: Many taxpayers opt for electronic filing through IRS-authorized software, which can streamline the process and reduce errors.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person: Some taxpayers may choose to deliver the form in person at designated IRS offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete form 8905 rev january 2012 internal revenue service

Complete Form 8905 Rev January Internal Revenue Service effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage Form 8905 Rev January Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to edit and eSign Form 8905 Rev January Internal Revenue Service easily

- Locate Form 8905 Rev January Internal Revenue Service and click Get Form to initiate the process.

- Utilize the available tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 8905 Rev January Internal Revenue Service and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8905 rev january 2012 internal revenue service

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the primary function of airSlate SignNow 8905?

The primary function of airSlate SignNow 8905 is to enable businesses to send and eSign documents seamlessly. With its user-friendly interface, airSlate SignNow 8905 simplifies the document signing process, making it accessible for everyone.

-

How does pricing work for airSlate SignNow 8905?

AirSlate SignNow 8905 offers competitive pricing plans designed to cater to businesses of all sizes. Each plan includes various features, ensuring you get the best value for your investment in document management and electronic signatures.

-

What features are included in airSlate SignNow 8905?

AirSlate SignNow 8905 includes a variety of features such as customizable templates, real-time tracking, and intuitive workflows. These features enhance efficiency, enabling users to manage documents effectively from anywhere.

-

What are the benefits of using airSlate SignNow 8905 for my business?

Using airSlate SignNow 8905 can signNowly streamline your document processes, reducing turnaround time and improving productivity. Its easy-to-use platform also ensures compliance and enhances customer satisfaction, which is crucial for business success.

-

Can airSlate SignNow 8905 integrate with other applications?

Yes, airSlate SignNow 8905 has multiple integrations with popular applications like Salesforce and Google Drive. These integrations help simplify your workflows by allowing you to manage all your documents from one central platform.

-

Is airSlate SignNow 8905 secure for signing documents?

Absolutely! AirSlate SignNow 8905 prioritizes security with features like secure encryption and compliance with regulations such as GDPR. You can confidently rely on airSlate SignNow 8905 to protect your sensitive documents during the signing process.

-

Who can benefit from using airSlate SignNow 8905?

AirSlate SignNow 8905 is beneficial for a wide range of users, including businesses, freelancers, and organizations looking for efficient document management solutions. Its versatility makes it suitable for any industry that requires document signing capabilities.

Get more for Form 8905 Rev January Internal Revenue Service

- Bph form 1076

- Nipsco rebate form 2021

- Prior authorization fax form health net

- Fleet safety program template form

- Spirit night contract form

- Va benefits claims employees in philadelphia and oakland say form

- Partnership complete and provide schedule kpc to each corporate or partnership partner form

- Subrecipient questionnaire form

Find out other Form 8905 Rev January Internal Revenue Service

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement