518, Michigan Business Taxes Registration Book State of Michigan 2018

What is the 518, Michigan Business Taxes Registration Book State Of Michigan

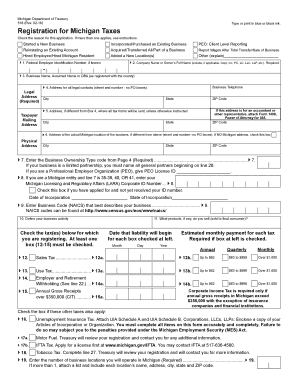

The 518, Michigan Business Taxes Registration Book is a crucial document for businesses operating in Michigan. It serves as a registration form for various state taxes, including sales tax, use tax, and withholding tax. This form is essential for both new and existing businesses to ensure compliance with state tax laws. By completing this form, businesses can obtain a tax identification number, which is necessary for filing tax returns and making tax payments.

How to use the 518, Michigan Business Taxes Registration Book State Of Michigan

Using the 518, Michigan Business Taxes Registration Book involves several steps. First, businesses should gather all necessary information, including business structure, ownership details, and estimated tax liability. Once the form is filled out, it can be submitted either online or via mail. It is important to ensure that all information is accurate and complete to avoid delays in processing. After submission, businesses will receive confirmation of their registration, which is essential for tax compliance.

Steps to complete the 518, Michigan Business Taxes Registration Book State Of Michigan

Completing the 518, Michigan Business Taxes Registration Book involves the following steps:

- Gather required information, such as business name, address, and type of business entity.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form online through the Michigan Department of Treasury website or mail it to the designated address.

- Keep a copy of the submitted form for your records.

Legal use of the 518, Michigan Business Taxes Registration Book State Of Michigan

The 518, Michigan Business Taxes Registration Book is legally binding once submitted to the state. It must be completed in accordance with Michigan tax laws to ensure its validity. The information provided on this form is used by the state to assess tax obligations and enforce compliance. Businesses are responsible for maintaining accurate records and ensuring that any changes in business status are reported to the state promptly.

Key elements of the 518, Michigan Business Taxes Registration Book State Of Michigan

Key elements of the 518, Michigan Business Taxes Registration Book include:

- Business identification details, such as name and address.

- Type of business entity (e.g., LLC, corporation, partnership).

- Tax types for which the business is registering (e.g., sales tax, withholding tax).

- Owner or responsible party information.

- Estimated tax liability and expected volume of sales.

Form Submission Methods (Online / Mail / In-Person)

The 518, Michigan Business Taxes Registration Book can be submitted through various methods. Businesses can complete the form online via the Michigan Department of Treasury's website, which is often the fastest option. Alternatively, the form can be printed and mailed to the appropriate state office. In-person submissions may also be possible at designated state offices, but it is advisable to check for specific guidelines and hours of operation.

Quick guide on how to complete 518 michigan business taxes registration book state of michigan

Prepare 518, Michigan Business Taxes Registration Book State Of Michigan effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Handle 518, Michigan Business Taxes Registration Book State Of Michigan on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign 518, Michigan Business Taxes Registration Book State Of Michigan with ease

- Find 518, Michigan Business Taxes Registration Book State Of Michigan and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you prefer to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign 518, Michigan Business Taxes Registration Book State Of Michigan and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 518 michigan business taxes registration book state of michigan

Create this form in 5 minutes!

How to create an eSignature for the 518 michigan business taxes registration book state of michigan

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 518, Michigan Business Taxes Registration Book State Of Michigan?

The 518, Michigan Business Taxes Registration Book State Of Michigan is a comprehensive guide that helps businesses understand and navigate their tax registration requirements in Michigan. This resource outlines the necessary forms and procedures for compliance, making it an essential tool for new and existing businesses.

-

How can I purchase the 518, Michigan Business Taxes Registration Book State Of Michigan?

You can purchase the 518, Michigan Business Taxes Registration Book State Of Michigan directly from our website. The document is available for immediate download after a one-time payment, ensuring you have instant access to crucial tax information for your business in Michigan.

-

What are the benefits of using the 518, Michigan Business Taxes Registration Book State Of Michigan?

Using the 518, Michigan Business Taxes Registration Book State Of Michigan provides several benefits, including clarity on tax obligations and streamlined registration processes. With this guide, businesses can save time and reduce errors in their tax filings, ultimately leading to more efficient operations.

-

Does the 518, Michigan Business Taxes Registration Book State Of Michigan include updates on tax laws?

Yes, the 518, Michigan Business Taxes Registration Book State Of Michigan is regularly updated to reflect the latest changes in tax laws. This ensures that businesses have access to the most current information, helping them stay compliant and avoid potential penalties.

-

Can the 518, Michigan Business Taxes Registration Book State Of Michigan be integrated with other business management tools?

The 518, Michigan Business Taxes Registration Book State Of Michigan is designed to complement various business management tools, including accounting and document management software. By integrating this guide with your existing systems, you can enhance efficiency and accuracy in tax registration and compliance.

-

What types of businesses benefit from the 518, Michigan Business Taxes Registration Book State Of Michigan?

The 518, Michigan Business Taxes Registration Book State Of Michigan is beneficial for all types of businesses operating in Michigan, whether small startups or larger corporations. It provides essential tax registration information that applies to various industries, ensuring all businesses are equipped to meet their obligations.

-

Is there customer support available for questions about the 518, Michigan Business Taxes Registration Book State Of Michigan?

Yes, we offer dedicated customer support for inquiries related to the 518, Michigan Business Taxes Registration Book State Of Michigan. Our team is available to assist you with any questions you may have, ensuring you get the most out of your purchase.

Get more for 518, Michigan Business Taxes Registration Book State Of Michigan

- Wwwtemplaterollercomtemplate2049547form ea fssa ampquotapplication for south dakota medicaidchip

- Trillium consent for release of member informationmanuals forms and resources trilliumprovider documents ampamp formstrillium

- Filliodeclaration and certification of financesfill declaration and certification of finances tulane form

- Dom information act report

- Median sale price reaches 500000 for single family homes form

- Virginia tuition assistance grant form

- Application duplicate title cab form

- Wwwellenbrotmanlawcomattorney discipline faqsyou receive a phone call from the office of disciplinary form

Find out other 518, Michigan Business Taxes Registration Book State Of Michigan

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter