Fillable Michigan Department of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi 2022-2026

Understanding the Michigan Business Tax Registration Form 518

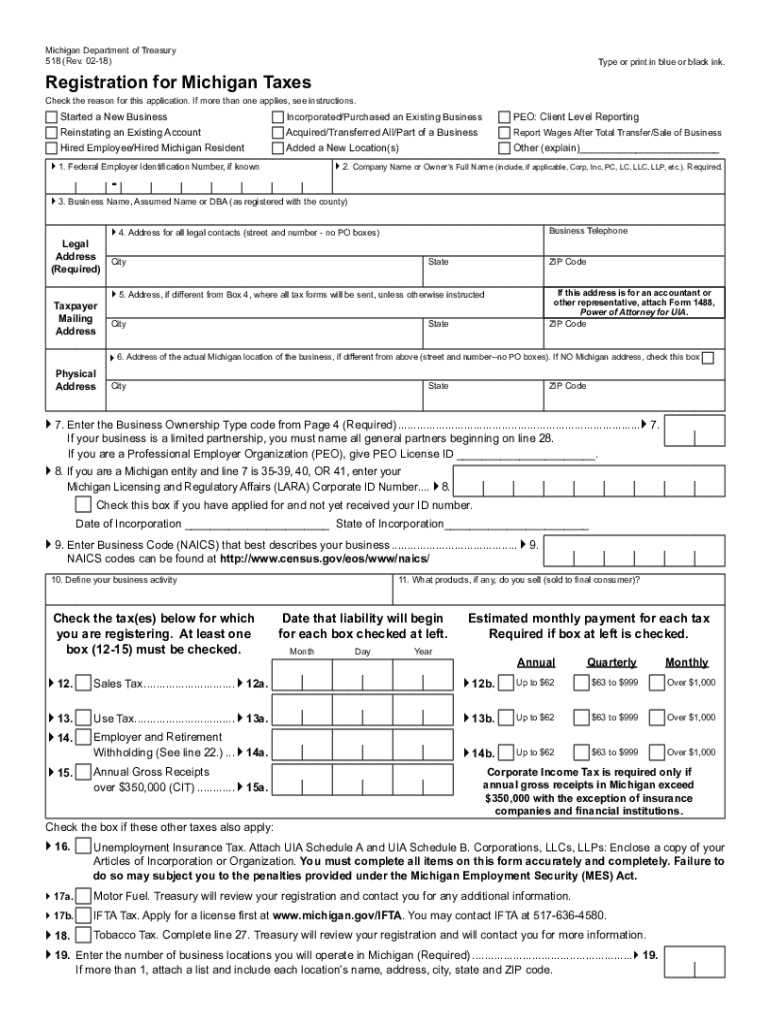

The Michigan Business Tax Registration Form 518 is essential for businesses operating in Michigan. This form is used to register for various taxes, including sales tax and corporate income tax. It is crucial for ensuring compliance with state tax regulations. Businesses must complete this form accurately to avoid penalties and ensure proper tax reporting.

The form gathers necessary information about the business, such as its legal name, address, and type of business entity. Additionally, it includes details regarding the owners and any relevant tax identification numbers. Completing this form is the first step toward fulfilling tax obligations in Michigan.

Steps to Complete the Michigan Form 518

Filling out the Michigan Form 518 involves several straightforward steps. First, gather all required information about your business, including ownership details and tax identification numbers. Next, access the fillable version of the form online, which allows for easy input of data.

Begin by entering your business name and address in the designated fields. Ensure accuracy to prevent delays in processing. Then, provide information about the business structure, such as whether it is a corporation, partnership, or sole proprietorship. After completing all sections, review the form for any errors before submission.

Legal Use of the Michigan Form 518

The Michigan Form 518 holds legal significance as it serves as an official document for business registration. When completed correctly, it establishes your business as a registered entity within the state. This registration is necessary for compliance with Michigan tax laws and regulations.

It is important to note that the form must be signed and submitted according to state guidelines. Failure to adhere to these requirements can result in penalties or delays in processing. Using a reliable electronic signature solution can enhance the security and legal validity of your submission.

Required Documents for Form 518 Submission

When preparing to submit the Michigan Form 518, certain documents may be required to support your application. These documents typically include proof of business identity, such as articles of incorporation or a partnership agreement. Additionally, you may need to provide a federal Employer Identification Number (EIN) if applicable.

Having these documents ready can streamline the registration process. Ensure that all information is current and accurately reflects your business structure. This preparation can help avoid unnecessary delays or complications with your registration.

Form Submission Methods for Michigan Form 518

The Michigan Form 518 can be submitted through various methods, providing flexibility for business owners. The most common method is online submission via the Michigan Department of Treasury's website. This method is efficient and allows for immediate processing.

Alternatively, businesses can submit the form by mail. If choosing this option, ensure that the form is printed clearly and all required signatures are included. In-person submission is also available at designated state offices, which may be beneficial for those needing assistance or clarification during the process.

Key Elements of the Michigan Form 518

Several key elements must be included when completing the Michigan Form 518. These elements ensure that the form is processed correctly and that your business is registered for the appropriate taxes. Key information includes the business name, address, business type, and the names of owners or partners.

Additionally, the form requires details about the nature of the business activities and any applicable tax identification numbers. Providing complete and accurate information in these sections is vital for successful registration and compliance with state tax laws.

Quick guide on how to complete fillable michigan department of treasury 518 rev 02 18 kallasleo michigan business tax registration online ampamp form

Complete Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi effortlessly on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi with ease

- Locate Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable michigan department of treasury 518 rev 02 18 kallasleo michigan business tax registration online ampamp form

Create this form in 5 minutes!

People also ask

-

What is the form 518 Michigan?

The form 518 Michigan is a tax form used by residents to report their Michigan income tax liability. It is essential for ensuring compliance with state tax regulations and helps individuals calculate their taxes owed. Understanding how to fill out the form 518 Michigan can streamline your tax preparation process.

-

How can airSlate SignNow help with submitting form 518 Michigan?

AirSlate SignNow simplifies the process of completing and electronically signing the form 518 Michigan. With its intuitive interface, users can easily fill out the form, add electronic signatures, and securely send it to the Michigan Department of Treasury. This makes tax submission efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for form 518 Michigan?

Using airSlate SignNow to handle your form 518 Michigan is budget-friendly, as the platform offers a range of pricing plans to suit different business needs. The pricing varies depending on the features and tools you require, making it a cost-effective option for individuals and businesses alike. Start with a trial to see how it fits your requirements.

-

What features does airSlate SignNow offer for handling form 518 Michigan?

AirSlate SignNow provides various features that facilitate the easy management of form 518 Michigan, including customizable templates, automated workflows, and secure document storage. Additionally, users can track the status of their forms and receive notifications upon completion. These features enhance efficiency and ensure regulatory compliance.

-

Can I integrate airSlate SignNow with other software for form 518 Michigan?

Yes, airSlate SignNow supports integrations with numerous applications, making it easier to manage your form 518 Michigan within your current workflow. You can connect with popular software platforms such as CRM, project management tools, and cloud storage services. This seamless integration enhances productivity by centralizing your document management.

-

What are the benefits of using airSlate SignNow for form 518 Michigan?

Using airSlate SignNow for form 518 Michigan offers numerous benefits, including time savings, increased accuracy, and improved compliance. The platform allows for easy collaboration among team members, leading to more efficient tax preparation. Additionally, it provides a secure environment to handle sensitive tax information.

-

Is airSlate SignNow secure for handling sensitive documents like form 518 Michigan?

Absolutely! AirSlate SignNow employs advanced security protocols to ensure that your documents, including the form 518 Michigan, are protected. The platform utilizes encryption and secure cloud storage to safeguard sensitive information, giving you peace of mind when managing your electronic signatures and documents.

Get more for Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi

- Minutes for organizational meeting north carolina north carolina form

- North carolina sample letter form

- Js 44 civil cover sheet federal district court north carolina form

- Lead based paint form

- Nc lead based disclosure form

- Notice of lease for recording north carolina form

- Sample cover letter for filing of llc articles or certificate with secretary of state north carolina form

- Nc residential form

Find out other Fillable Michigan Department Of Treasury 518 Rev 02 18 KallasLEO Michigan Business Tax Registration, Online & Form 518Mi

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document