Doh Self Declaration of Income Form 2010-2026

What is the Doh Self Declaration of Income Form

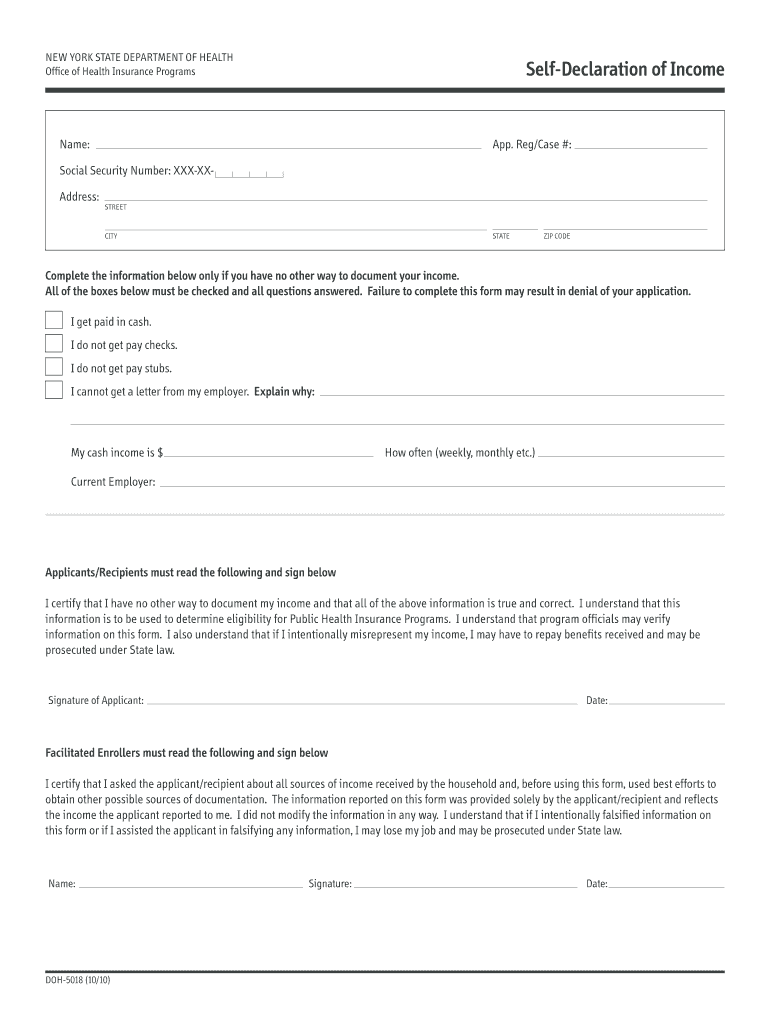

The Doh Self Declaration of Income Form is a crucial document used to declare an individual's income for various purposes, including tax assessments and eligibility for government programs. This form is particularly important for those who may not have traditional income documentation, such as self-employed individuals, freelancers, or those receiving non-standard income. By providing a clear and accurate declaration, individuals can ensure compliance with legal requirements and facilitate their financial interactions.

How to Use the Doh Self Declaration of Income Form

Using the Doh Self Declaration of Income Form involves several straightforward steps. First, gather all necessary information regarding your income sources, including any freelance work, investments, or other non-traditional earnings. Next, fill out the form accurately, ensuring that all figures reflect your actual income. Once completed, review the form for any errors or omissions before submitting it to the relevant authority or organization that requires the declaration.

Steps to Complete the Doh Self Declaration of Income Form

Completing the Doh Self Declaration of Income Form requires attention to detail. Follow these steps for a successful submission:

- Gather all income-related documents, including pay stubs, bank statements, and records of freelance work.

- Fill in personal information, such as your name, address, and Social Security number.

- Clearly state your income sources and amounts, ensuring accuracy.

- Sign and date the form to validate your declaration.

- Submit the form according to the instructions provided by the requesting agency.

Key Elements of the Doh Self Declaration of Income Form

Several critical elements must be included in the Doh Self Declaration of Income Form to ensure its validity. These elements typically include:

- Personal identification information, such as name and contact details.

- A detailed account of income sources, including amounts and frequency.

- Signature and date to affirm the accuracy of the information provided.

- Any additional documentation that may support the declared income.

Legal Use of the Doh Self Declaration of Income Form

The Doh Self Declaration of Income Form serves as a legally binding document when filled out correctly. It is essential to ensure that the information provided is truthful and accurate, as discrepancies can lead to legal repercussions. This form is often used in contexts such as applying for loans, government assistance, or fulfilling tax obligations, making its proper use critical for compliance with U.S. laws.

Form Submission Methods

The Doh Self Declaration of Income Form can be submitted through various methods, depending on the requirements of the requesting agency. Common submission methods include:

- Online submission through designated portals, where available.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at designated offices or agencies.

Quick guide on how to complete declaration of income form

Utilize the simpler technique to handle your Doh Self Declaration Of Income Form

The traditional methods of finalizing and authorizing documents consume an excessive amount of time in comparison to contemporary document management systems. Previously, you would look for suitable social forms, print them, fill out all the necessary details, and mail them via traditional post. Now, you can obtain, fill out, and sign your Doh Self Declaration Of Income Form all within a single browser tab using airSlate SignNow. Preparing your Doh Self Declaration Of Income Form has never been easier.

Steps to finalize your Doh Self Declaration Of Income Form with airSlate SignNow

- Access the relevant category page and locate your state-specific Doh Self Declaration Of Income Form. Alternatively, use the search function.

- Verify that the version of the form is correct by previewing it.

- Click Obtain form and enter editing mode.

- Fill out your document with the necessary information using the editing tools.

- Review the entered information and click the Sign option to authorize your form.

- Choose the most suitable method for creating your signature: generate it, sketch your signature, or upload an image of it.

- Click FINISHED to store your changes.

- Download the document to your device or proceed to Sharing preferences to send it digitally.

Efficient online services like airSlate SignNow streamline the process of completing and submitting your forms. Give it a try to realize just how brief the document management and approval processes should actually be. You'll save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

If I was at a Casino and lost over $20,000 in a slot machine before hitting a $10,000 jackpot, will I still have to fill out a tax form and declare that as income even thought I really lost $10,000?

There are two ways to handle slot winnings/losses. The “regular” way is that all winnings (whether you receive a W-2G or not) are reported on your 1040 as “other income”, and your losses that you can substantiate are deducted on your Schedule A (assuming that you itemize, etc.). Under that method, yes, you would report the $10K jackpot (plus any other winnings that came out of the machine(s)), and you would deduct your losses up to the amount of your reported winnings as an itemized deduction.The other way to do it is the technically correct way — and that is to net your slot results on a “session” basis. That is, from the time that you pull your first lever (or push your first “spin” button”) of the day until you stop playing the slots, other than short breaks — but not beyond midnight — you total your net winnings/losses, and that’s your winnings or losses for the “session” that are reportable on your tax return. That method, for example, enables you to take advantage of losses even if you don’t itemize deductions. Now, that’s not going to match up with any W-2G’s that you get, because the casinos don’t report on that basis (they don’t even report on the basis of a midnight-to-midnight day). But the IRS has ways in which you can indicate that on your return.So the answer to your question is, maybe. It depends on (i) when did you lose the $20K and win the $10K?, (ii) what kind of records do you have (a “players’ card” statement would be great), and (iii) what else did you win gambling?

-

How did your marriage end?

My ex husband and I married for over 10 years.When I first met him, he was too good to be true. Loving understanding, generous, kind and promised the world to me. His well respected cops admire by everyone at his town and colleagues. He was a hero to other. He was the first guy I’ve ever been with. I fully trusted him just like my parents relationship trusting, respect and always have your back. I always knew I’ll marry a good man, since I am a happy soul.I Left my life back home to start a new fresh life to a new land and new culture with the man I married. I was excited to start a new beginning.Few weeks after moving in to his place as a married couple I saw the very first red flag of the wonderful man I’ve thought, I found a bunch of naked photos he collected from different women, He gave me a beautiful re-assurance as to why he had those photos.. it’s believable he cried.I was young inexperience 19 y/o, living thousand miles across the country away from my family and friends, Naive enough to believe in everything he says, well I supposed to trust my husband he’s a lot older than me so I figured I’m safer, If he wasn’t a cop he would be a great life speaker. He has the skills to convince anyone to believed everything he said.Within the same year I got pregnant with a beautiful girl she’s a blessing to me. His cheating became evident. Calling names became his favorite word. He is a good player and a Dangerous one I felt bad for the women who fell into his lies. He used them to feed his ego.A part of his strategy is to make sure i know nothing about the world I’m living in, staying dumb and clueless is what he likes, he acts like Mr. Google and everyone is below him.He made sure that my name is no longer what my parents gave me, he granted me a new nick name(cunt, whore, dumb,ugly and more) I didn’t like it but he sure gets the joy out of it.From being happy and positive young person I am, I become isolated, sad and Angry. His negative words start to have power over me.He knows how to laugh…laugh at me, he has the needs to remind constantly that I should be well aware of my confidence should be diminish and not meant to flourish. His ego is huge when my confidence is low.Over time I developed anxiety due to his abusive behavior. Regular conversation become frightful. You never know what insult I’m a getting.One sunny day, he took me shopping I got too excited, yes, I have no access to our bank so I have to constantly ask money from him for my personal expense.I picked the cutest outfit, i’d love to think I have a good sense of style, but the excitement replace with embarrassment when he found out my cloths cost him a little over $60, he started belittling me in public, I put the cloths back, too embarrassed to continue shopping, I ran towards the car to hide my self from people staring at us. They felt bad, I felt worst, But those dress though..such a cute outfit that could add a little spice to my confident that’s slowly fading away.I started to make new friends and let me tell you how awesome that felt, I finally found someone to hang out with, well Ofcourse Mr. perfect man cannot handle the positive relationship around me so he has to Interfere, either ruin it or hook up with friends. i lost a lot of friends but few stick up for me and become a family.Years goes by my ex behavior become eradic, abusive, manipulative, he’s extreme pathological liar, and mentally ill. How did I manage to stay positive it was tough but I always knew I am better and stronger that his words.One day he told me to pack our belongings and we’re moving to different states, I don’t want to, I created a family( friends) to where I was and my daughter made a great friendship, but do I have a choice?We moved to another state no friends starting all over again not knowing he planned carefully to divorce me far from my good friends who consoled me. My suffering gives him satisfaction.Slowly regaining independency made him miserable, I fought to go back to school and learned how to drive (thanks to YouTube, no kidding). The more he isolate me the more I tried to become outgoing, I long for connection.It was a bitter sweet mistakes bringing me to the desert I met great new friends, I kept going against his will. I wasn’t scared anymore, I learned to endure his abusive behavior. He was furious to see how quickly I adjusted.He’s on the job to ruin my relationship to any of my friends. He reminds me of an alligator sitting quietly waiting/observing for its prey, All the lies he put out there to destroy my inner peace, this time he will not succeed. I figured out to make sure he know nothing about my new friends.I started working out,it was my to way to de-stress, yoga has been my favorite and outdoor Camping gave me an inner peace, I slowly gained all my confidence back, I spend less of my time or possibly no time at all with him. I made myself busy to help me get rid of the negative thoughts, I don’t want to entertain self pity. I deleted all sorts of social media to avoid comparing my self to other’s happiness and unrealistic lifestyles I couldn’t afford, rather, focus working on my own self progress.One day after I got out of school I went straight to work a gentle man came asking for my name and serve me the divorce paper,I felt a little embarrassed everyone at work knows my business.I had to hire a lawyer when Mr.Respected ex started to create lies and accusations to make sure the judge will favor towards him, his manipulative skills always benefit him, I wish I can speak like him. I don’t see the needs to speak poorly against him infront of the judge, all I wanted is a smooth process stating on the paper I’m no longer connected to him and Grant me my daughter’s custody, but he is born nasty, no compassion. I truly believed he was born heartless.Eventually, he gave up because guess what this little naive girl will never surrender my rights to my beautiful daughter!, even if it means I have to sleep 2 hrs a day to support my expensive lawyer.I work soo hard to make sure my daughter feel safe and do my best to provide all her needs, Its not an easy transition but I kept going, depression has no chance on me. I stayed strong and focus. I cried at times not because I’m depressed but it made me feel better afterwards.Finally, he came into terms, we both signed the divorce paper… I ran downstairs carried the biggest smile on my face and did my happy dance outside the court ( i created my own happy dance) it was the most happiest day of my life. I called my family about the awesome news.I was soo excited, I ran towards the homeless guy sitting on the bench and told him how happy I was, I don’t know him I just needed a friend and he’s kind enough to Listen to my happy ending. It was a beautiful emotional day for me. I used to just wish for this day to come and here I am In front of the court signing my way back to my freedom and peace.Words are powerful, before I left my old town, I told few of my friends marked my word I will be divorce before I turned 30 and if it won’t happen please come find me and slap me in the face, I said jokingly and here I am divorce before 30.I walk away without asking a penny from this man, I could use alimony but I just want peace and my daughter. I let him keep all his money.Hours after signing all the documents he called to say“ I still love you and our family and how sad I am to make a decisions because you have changed. I miss the old you, the way we used to be”.my daughter was sitting next to him so I just had to hold my tongue but I really wanted to tell him to “fuck Off” I wanted to puke with annoyance.I’ve never been soo excited to sign a paper like that in my life.. I could sign that paper all day long, every signatures is a sign of freedom and I made sure to carry extra pen with me Im afraid I will run out of ink.Tears of joy… joy that he will no longer have the power to hurt, belittle and abuse me. The marriage tittle gave him the right to destroy me but it’s over.I will do my best to Live happy and mentally healthy. We are not meant to live sad nor scared everyday, life is not supposed to be that way.Marriage should be a relationship where you feel safe, strong , accepted, and love.I am working progress to be the person I used to be and I wanted to be.I become wise, strong and unapologetic.He brings out the lion out of the cat in me..Life experienced truly mold me of who I am today.Got my own flat at the nicest safe neighborhood. my daughter goes to one of the best school in the states with her good friends, found a great job and happy with my freedom, Still working to finish my degree. Im traveling more often, It is safe to say I am strong attracted women who been through soo much but no one can break me.I never stop reminding my 10 year old daughter one day she’ll step into the real world and I’ll never want her to experience what I went through but a strong lesson to remind her about the values of self love and understanding what healthy relationships looks like.I want her to be happy,confident and strong educated women.Mr nightmare ex is heading to his 4th marriage this year. I wish I could tell him to re-evaluate himself before destroying around another soul. I felt bad for that young women, she doesn’t know what’s coming.

-

How do you declare your foreign assets in India and how will you be taxed on that?

If a personal (individual) is a resident and ordinarily resident in India needs to declare his foreign assets, if any, in the return of income. Note that if you are a resident and ordinarily resident your global income is taxed in India. ?? What needs to be reported? ALL foreign assets including the following - Immovable Property- Details of trusts created outside India in which you are settlor, beneficiary or trustee. - Bank account (You also need to declare the details of the bank account alongwith the peak balance) - Financial interest in any entity - Other aspects: Income generated or derived from the asset and the amount of income taxable in your hands and offered in the return is to be filled out under respective columns. Item G includes any other income which has been derived from any source outside India and which has not been included in the items A to F and under the head business of profession in the return. ?? How to report?An individual must file his return of income in India whether or not he has any taxable income. It is important to identify the correct form(s) for filing return of income; SAHAJ and SUGAM forms may not be applicable even if you have only salary income or interest income.

-

How do I get the educational loan for my higher studies?

MS applicants spend considerable time and resources preparing for the GRE, shortlisting and applying to schools, and choosing a final school (when lucky enough to receive multiple admits).The best idea is to gain an understanding of financing options while preparing applications and waiting for University responses. Knowing the options empowers MS aspirants to make the best decisions for the academic and financial futures.Type of Loans-Public sector banks: Collateral loansA number of banks offer education loans with collateral for MS studies abroad. Key features of such loan offers include:Up to 90% CoA cover. In some countries, the remaining 10% must be paid up front into the bank by the borrower; this is sometimes known as margin money.A variable interest rate of ~10.5%. In some cases, a discount may be applied for taking insurance against the loan. For, example, you may receive a 0.5% discount for such insurance although this is still an additional cost which factors into the total cost of a loan.In some countries, public sector banks require both collateral and a co-signer for loans. It’s important to be prepared for extensive paperwork and a long loan approval period.While it’s not a universal norm, the collateral requested in some countries requires a parental property to be put on the line - an option that isn’t available to everyone.Non-Banking Financial Corporation (NBFCs): co-signer loansNBFCs in some countries are enabled to provide financing for international education. Typical features of these loan offers include:An offer of up to 100% CoA cover, though a co-signer is always required, and collateral is often required for high-value loans.A proprietary interest rate which isn’t defined by a governing financial institute. It’s important to understand the full cost of any loan (including factors in hidden fees like loan sanction letter fee and currency conversion charges) to enable loan comparison.Loans might be assessed on the basis of co-signer credit score, as well as their salary and other credentials. This can be a real challenge for MS applicants whose co-signers are retired or have not built their credit histories.International lenders: No co-signer, collateral-free loansSome lenders, such as Prodigy Finance, provide loans to international students, often in the currency of the study destination country. Key features of such loan offers include:Loan cover up to 100% CoA without collateral or co-signers; these are merit-based loans provided on the basis of admission to a top-ranked international school.Customized interest rates that have a fixed component and a variable component – which is often the LIBOR rate of the loan currency.Online application processes that are often quicker than other loan providers - and typically more transparent as well.Prodigy Finance’s future earnings model assess your potential based on your post-masters income and career direction.In addition to no co-signer, collateral-free loans, Prodigy Finance borrowers are also eligible for value-added benefits like scholarships and careers support.Keep in mind that every loan offer has its own merits - and you should consider all of your options carefully. This quick guide is just a jumping off point to get you started. Education is an investment and study loans are a commitment; you’ll want to consider the future as well as the present because that acceptance letter is just the beginning.Want to see the terms Prodigy Finance can offer you?Applying for Prodigy Finance’s no-cosigner, collateral-free loans takes just 30 minutes. And, with no obligation to accept a provisional loan offer, there’s no reason to wait.Check more about Prodigy Finance- Prodigy Finance Answers your Top 10 Education-Loan Questions | YocketYou can decide about which type of Educational Loan you want as per your requirements.Share and upvote if helpful.

-

How do I reply to a U/S 143(1) notice from the Income Tax Department?

Under Section 143(1) the tax department completes the assessment without calling you to the department. Based on the return filed by you, the department checksThe arithmetical errors in the return orAny incorrect claim or deductions made.Incorrect brought forward Loss claimedMismatch of dis allowance of expenditure mentioned in audit report and income tax returnIncome appearing form 26AS, but not considering in return.[However, before making any such adjustments, an intimation of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961 shall be given to the assessee either in writing or through electronic mode requiring him to respond to such adjustments.The intimation u/s 143(1) will have two column, (a) the tax determined as per the return filed by you (b) the tax determined by the department after making any changes.Done by the computer –All intimations u/s 143(1) is processed by the computer without any human interface. The software is designed to detect arithmetical inaccuracies and inconsistencies in the return and such software is placed at Central Processing Centre (CPC)Stay cool –So, don’t get upset (and shout at your service provider!) if you get an intimation u/s 143(1) wherein as per the computation of Tax department, you are asked to pay any taxes. Generally, you will find that the Mismatch of taxes payable. We have to correct it by filing rectification.Intimation received under section143(1) of Income Tax ActIf the Intimation u/s 143(1) doesn’t show any difference (or mismatch), keep this document along with a copy of Income tax return filed by you as proof of completion of assessment.What should I do if no intimation is received?The intimation shall be sent within one year from the end of the financial year in which the return is made. (Means for the Financial Year ending March 2014, you will get intimation on or before March 2016). If you haven’t received any intimation within this period, consider ITR– V (acknowledgment) of the return as deemed intimation.What should be done in the case of mismatch?Intimation received under section 143(1) of Income Tax Act showing demand or refundFirst ascertain whether refund due to you computed or arrived as per your claim. If no refund is claimed by you, ensure that “Net Amount Payable” is Zero .If refund claimed by you matched with the income tax return filed by you or net amount payable is zero, no further action is required.You can follow the steps mentioned below if you found discrepancies–Step 1: compare two column, (a) As provided by Tax Payer in Return of Income (b) As computed under section 143(1) and check the difference, find out the reason for the difference.Step 2: File online rectification application u/s 154(1) correcting the mistake appearing in the intimation received u/s 143(1).Step 3: After filing rectification u/s 154(1) login to ePortal of the income tax department and file online response.Step 4: File online grievances if you are not satisfied with processing of your return/rectification return by Central Processing Center (CPC).I would be glad to know your doubts or queries. In case you need our assistance in relation to Intimation under section 143(1) of Income Tax Act 1961 , please feel free to post your query at anuraguppal9@gmail.com.

-

Can a spouse of someone holding a Japanese working visa work in Japan? Does working online considered as working in Japan?

The spouse of a person that is holding a Japanese Working visa should possess a dependent visa.If that's the case, the spouse can go to the Immigration Bureau and carry along certain required documents, and fill out documentation to request permission to work in Japan. The spouse will get a stamp in the passport.This limits working hours to a maximum of 28 hours per week.As Chan Liyanage, the spouse will be required to fill out an annual Tax Declaration form in which he/she states the income for the previous year, and though the work is online, I would think you would have to declare it. I know someone that has an online blog and she pays taxes on her income, but her blog is about Japan, so I'm not sure if that's the difference and she gets lots of earnings through it. The form does ask for any earnings, and they even ask how much money you receive from home, family, etc.Also, there is no limit to what the spouse can do (except for anything in the sex industry or anything that is illegal, but I'm sure that's not an option for you, anyway). There are lots of English teaching jobs, she can teach online on Learn a language online. Etc. The government gives a little monthly stipend for your child, that can help cover some very basic necessities, it can be quite useful.Instead of using private nurseries, apply as soon as the child is born for government nurseries, you pay 3-4X less.Also, note that hospital fees are nearly free for pre-natal care, you only pay when there are complications and you go outside of the appointments. But pre-natal care is nearly free, and when you give birth, the government may assist with hospital fees. We didn't pay anything at all when I gave birth. I feel lucky in that sense. The most important thing is to make sure that you pay your taxes and declare everything (this will apply for both spouses), and also that you have insurance (we have the national health insurance).

-

How much does a "million dollar" winner on a US game show net?

If the price is $1 million cash, the winner gets a check for $1 million, and is responsible for reporting that income to the IRS. It is simply part of the winner's income, and after deductions, is taxed at that person's income tax rate (typically 20-40%).However, some shows will say they offer a million-dollar grand prize, but that is in the form of cash and merchandise/trips. They calculate the value of those prizes at full retail (which nobody would really pay). I won a trip to Rome that was valued (on-air and on the tax receipt) at something crazy like $6500. I can tell you that if I had to buy two economy class airplane tickets and a week in a mid-level hotel, however, I could have done it for a whole lot less than $6500! This seems like a lousy situation for the winner, because they are taxed on the value of the non-cash prizes, but it turns out the secret is that you can make a case with the IRS that the market value of the prize is different from the retail value. That's what I did when my taxes came due: my accountant asked me the value of the Rome trip and I said "well, if I piece it together online, it's about $2000" and he said "okay, that's what you're paying taxes on." So the lesson here is, viewers and prize-winners shouldn't pay too much attention to the "retail value" of the prizes you hear announced on the show.And not to get too off-tangent, but you can often find people dumping their prizes won on The Price is Right here in Los Angeles. Just search L.A. Craigslist for "the price is right", and you'll see tons of ads for dirt cheap, brand-new TVs, jet skis, dishwashers, etc. I've been told that after the show is finished taping, people sometimes refuse to accept the prizes they won if it doesn't make any sense to keep-- either because of the tax burden, or because it just doesn't make sense (i.e. an elderly tourist visiting from Nebraska wins a 12' surfboard).

-

What is the ITR 3 form?

Income Tax Return Form-3ITR 3 form can be used by an individual or a Hindu Undivided Family (HUF) earning income from a business or a profession. ITR-3 is also required to be filed by a person whose income is chargeable to tax under “profits and gains of business or profession” in the nature of interest, salary, bonus, commission or remuneration.Form ITR 3 can’t be used by any person other than an individual or a HUF. Also, an individual or a HUF not earning any income from business or profession can’t use ITR.It is a type of Income Tax Return form to be used by individuals or HUF’s deriving income from proprietary business or profession. It is to be used for Assessment Year 2018–19 by the groups mentioned below to file their returns.ITR 3 is applicable for those Individuals and HUFs who have income from proprietary business or are carrying on any profession.The persons having income from following sources are eligible to file ITR 3:Carrying on a business or professionReturn may include income from House property, Salary/Pension and Income from other sourcesWho can file their income tax return on ITR-3?Income Tax Return is prepared on ITR-3 when:an individual or an HUF is a partner in a firm ANDwhere income chargeable to income-tax under the head “Profits or gains of business or profession” does not include any income except the income by way of any interest, salary, bonus, commission or remuneration, due to, or received by him from such firm.In case a partner in the firm does not have any income from the firm by way of interest, salary, etc. and has only exempt income by way of share in the profit of the firm, the assessee shall use this form only; not Form ITR-2.When to file ITR 3?ITR-3 form is to be used when the assessee has income that falls into the below category:Income from carrying on a professionIncome from Proprietary BusinessAlong with income from a profession or proprietary business, return may also include income from House property, Salary/Pension and Income from other sourcesStructure of the ITR-3 Form for AY 2018–19:ITR-3 is divided into:Part APart A-GEN: General information and Nature of BusinessPart A-BS: Balance Sheet as of March 31, 2018, of the Proprietary Business or ProfessionPart A-P&L: Profit and Loss for the Financial Year 2017–18Part A-OI: Other Information (optional in a case not liable for audit under Section 44AB)Part A-QD: Quantitative Details (optional in a case not liable for audit under Section 44AB)Part B: Outline of the total income and tax computation in respect of income chargeable total tax.VerificationTax Payments: Details of advance tax, TDS, self-assessment taxAfter this, there are the following schedules.Schedule-S: Computation of income under the head Salaries.Schedule-HP: Computation of income under the head Income from House PropertySchedule BP: Computation of income from business or professionSchedule-DPM: Computation of depreciation on plant and machinery under the Income-tax ActSchedule DOA: Computation of depreciation on other assets under the Income-tax ActSchedule DEP: Summary of depreciation on all the assets under the Income-tax ActSchedule DCG: Computation of deemed capital gains on the sale of depreciable assetsSchedule ESR: Deduction under section 35 (expenditure on scientific research)Schedule-CG: Computation of income under the head Capital gains.Schedule-OS: Computation of income under the head Income from other sources.Schedule-CYLA: Statement of income after set off of current year’s lossesSchedule BFLA: Statement of income after set off of unabsorbed loss brought forward from earlier years.Schedule CFL: Statement of losses to be carried forward to future years.Schedule- UD: Statement of unabsorbed depreciation.Schedule ICDS — Effect of Income Computation Disclosure Standards on ProfitSchedule- 10AA: Computation of deduction under section 10AA.Schedule 80G: Statement of donations entitled for deduction under section 80G.Schedule- 80IA: Computation of deduction under section 80IA.Schedule- 80IB: Computation of deduction under section 80IB.Schedule- 80IC/ 80-IE: Computation of deduction under section 80IC/ 80-IE.Schedule VIA: Statement of deductions (from total income) under Chapter VIA.Schedule AMT: Computation of Alternate Minimum Tax Payable under Section 115JCSchedule AMTC: Computation of tax credit under section 115JDSchedule SPI: Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of the assessee in Schedules-HP, BP, CG and OS.Schedule SI: Statement of income which is chargeable to tax at special ratesSchedule-IF: Information regarding partnership firms in which assessee is a partner.Schedule EI: Statement of Income not included in total income (exempt incomes)Schedule PTI: Pass through income details from a business trust or investment fund as per section 115UA, 115UBSchedule FSI: Details of income from outside India and tax reliefSchedule TR: Statement of tax relief claimed under section 90 or section 90A or section 91.Schedule FA: Statement of Foreign Assets.Schedule 5A: Information regarding apportionment of income between spouses governed by Portuguese Civil CodeSchedule AL: Asset and Liability at the end of the year(applicable where the total income exceeds Rs 50 lakhsHow to fill ITR-3 Form?Instructions for filling out ITR-3:If any schedule is not applicable score across as “ — NA — “.If any item is inapplicable, write “NA” against that item.Write “Nil” to denote nil figures.Except as provided in the form, for a negative figure/ figure of loss, write “-“ before such figure.All figures should be rounded off to the nearest one rupee. However, the figures for total income/ loss and tax payable be finally rounded off to the nearest multiple of ten rupees.Sequence for filling out parts and schedules:The Income Tax Department advises assesses to follow the sequence mentioned below while filling out the income tax return.1. Part A- General on page 12. Schedules3. Part B-TI and Part B-TTI4. VerificationMajor Changes in ITR 3Aadhaar NumberIt is necessary to quote the Aadhaar number in the return of income. If any person does not have the Aadhaar Number but he had applied so, then he can quote the Enrollment ID of Aadhaar Application Form in the ITR.Declaration of value of assets and liabilitiesIn 2016 taxpayers have to declare the value of assets and liabilities if the total income is more than Rs.50 lakhs but from now they have to declare also the description of movable assets and disclose the address of the immovable property.Disclosure of Cash deposits during DemonetisationIt is necessary to fill this new column which introduced in all ITR forms if the taxpayer has deposited Rs 2 lakh or more during the demonetization period.Disclosure of unexplained income and Dividend IncomeNew fields inserted in Schedule ‘OS’ to declare unexplained credit or investment and dividend received from domestic companies above Rs 10 lakhs. Such persons cannot opt for ITR 1 (Sahaj).Registration number of Chartered Accountant FirmIt is mandatory to mention the registration number of the firm of Chartered Accountant which has done the audit in ITR forms.Who is not eligible to file ITR 3?As, ITR-3 form is used for business returns, any individual filing his/her personal income tax return, i.e. Salaried employee or filing using ITR 1 form does not have to file ITR3.You can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

Create this form in 5 minutes!

How to create an eSignature for the declaration of income form

How to make an eSignature for your Declaration Of Income Form in the online mode

How to create an electronic signature for the Declaration Of Income Form in Chrome

How to create an electronic signature for putting it on the Declaration Of Income Form in Gmail

How to generate an electronic signature for the Declaration Of Income Form straight from your smartphone

How to make an eSignature for the Declaration Of Income Form on iOS

How to generate an electronic signature for the Declaration Of Income Form on Android OS

People also ask

-

What is the DOH self declaration of income form?

The DOH self declaration of income form is a vital document used by individuals to declare their annual income for health-related services. This form is essential for ensuring appropriate eligibility for various health programs. Using the airSlate SignNow platform makes filling out and submitting this form straightforward and efficient.

-

How can airSlate SignNow assist with filling out the DOH self declaration of income form?

airSlate SignNow streamlines the process of completing the DOH self declaration of income form by providing easy-to-use templates and a simple interface. Users can fill out the form digitally, ensuring accuracy and eliminating the hassle of paperwork. Additionally, our eSignature feature enables quick and secure signing directly within the platform.

-

Is there a cost associated with using airSlate SignNow for the DOH self declaration of income form?

Yes, there is a subscription fee for using airSlate SignNow, which is known for its cost-effective solutions. The pricing is tiered based on features and usage, catering to individuals and businesses alike. This investment can greatly simplify the process of managing forms like the DOH self declaration of income form.

-

What features does airSlate SignNow offer for the DOH self declaration of income form?

With airSlate SignNow, you can access templates specifically for the DOH self declaration of income form, eSignature capabilities, and cloud storage for easy document management. These features enhance the efficiency of document handling and ensure you never lose an important form. The platform also includes tracking and audit trails for added peace of mind.

-

Can I integrate airSlate SignNow with other tools for managing the DOH self declaration of income form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as Google Drive, Dropbox, and CRM systems. This integration allows you to manage the DOH self declaration of income form effortlessly alongside your other business processes, ensuring all your documents are synchronized and accessible in one place.

-

What are the benefits of using airSlate SignNow for the DOH self declaration of income form?

Using airSlate SignNow for the DOH self declaration of income form offers numerous benefits, including time savings, increased accuracy, and improved collaboration. The platform allows multiple parties to review and sign documents quickly, reducing delays. Additionally, you can access your forms anytime and from anywhere, making it ideal for busy professionals.

-

Is it secure to submit the DOH self declaration of income form through airSlate SignNow?

Yes, airSlate SignNow prioritizes security, providing encryption and secure storage for all your documents, including the DOH self declaration of income form. Our platform complies with industry standards to ensure your personal information is protected. You can submit and store your forms with confidence, knowing they are safe from unauthorized access.

Get more for Doh Self Declaration Of Income Form

- Washington state food stamp application 2013 form

- Wa state ebt mid review 2016 form

- Paternity testing form tulalip tribes tulaliptribes nsn

- Free or lowcost health care coverage from washington hca wa form

- Dshs review online 2011 form

- Doh chs 005 form

- Doctors release for work form

- Washington hca form

Find out other Doh Self Declaration Of Income Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer