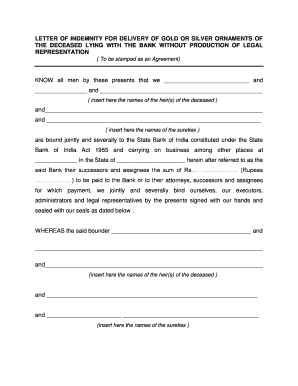

Letter of Indemnity Form

What is the letter of indemnity?

A letter of indemnity for bank is a legal document that protects one party from potential losses or damages that may arise from a specific transaction. It serves as a guarantee that the bank or financial institution will not hold the indemnified party responsible for any claims, losses, or damages resulting from the transaction. This document is often used in various banking scenarios, including shipping, financing, and loan agreements, to ensure that all parties are aware of their responsibilities and liabilities.

Key elements of the letter of indemnity

When drafting a letter of indemnity, several key elements must be included to ensure its effectiveness and legal validity:

- Parties involved: Clearly identify the indemnitor (the party providing the indemnity) and the indemnitee (the party receiving the indemnity).

- Description of the transaction: Provide a detailed description of the transaction or situation that necessitates the indemnity.

- Scope of indemnity: Specify the extent of the indemnity, including any limitations or exclusions.

- Duration: Indicate the time period during which the indemnity will be in effect.

- Governing law: State which jurisdiction's laws will govern the interpretation and enforcement of the letter.

Steps to complete the letter of indemnity

Completing a letter of indemnity involves several important steps to ensure that it is properly executed:

- Gather necessary information: Collect all relevant details about the transaction, including the names of the parties, transaction specifics, and any applicable laws.

- Draft the document: Use a clear and concise format to draft the letter, incorporating all key elements outlined previously.

- Review for accuracy: Carefully review the document to ensure that all information is correct and that it fully addresses the needs of both parties.

- Obtain signatures: Ensure that both parties sign the document, either electronically or in person, to make it legally binding.

- Distribute copies: Provide copies of the signed letter to all parties involved for their records.

How to use the letter of indemnity

The letter of indemnity can be used in various banking and financial transactions. It is particularly useful in scenarios where one party may be exposed to risks associated with the actions of another party. For example, in shipping, a bank may require a letter of indemnity to protect itself from claims related to lost or damaged goods. To use the letter effectively, ensure that it is tailored to the specific transaction and that all parties understand their rights and obligations as outlined in the document.

Legal use of the letter of indemnity

The legal use of a letter of indemnity is governed by contract law. It is essential for the document to meet the legal requirements of the jurisdiction in which it is executed. This includes ensuring that the letter is clear, unambiguous, and signed by authorized representatives of the parties involved. Additionally, the indemnity should not contravene any existing laws or regulations. When properly executed, a letter of indemnity can serve as a strong legal shield against potential claims and liabilities.

Examples of using the letter of indemnity

Letters of indemnity are utilized in various contexts within the banking and financial sectors. Some common examples include:

- Shipping transactions: A bank may issue a letter of indemnity to protect against claims arising from the loss or damage of goods during transit.

- Loan agreements: In financing scenarios, a letter of indemnity may be used to protect the lender against losses if the borrower defaults.

- Real estate transactions: A letter may be required to indemnify a buyer against unforeseen issues related to property titles or liens.

Quick guide on how to complete letter of indemnity

Complete Letter Of Indemnity effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it on the web. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files promptly and without interruptions. Handle Letter Of Indemnity on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Letter Of Indemnity effortlessly

- Locate Letter Of Indemnity and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a classic wet ink signature.

- Review all the details carefully and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Letter Of Indemnity and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter of indemnity for bank?

A letter of indemnity for bank is a document used to protect a bank from potential loss or damage during a transaction. It serves as a guarantee that the borrower will assume responsibility for any risks associated with the transaction, ensuring security for both parties involved.

-

How can airSlate SignNow help me create a letter of indemnity for bank?

airSlate SignNow offers an intuitive platform where you can easily create, edit, and sign a letter of indemnity for bank. With customizable templates and a user-friendly interface, you can streamline the document preparation process, ensuring accuracy and compliance.

-

Is there a cost associated with using airSlate SignNow for a letter of indemnity for bank?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. You can choose a plan that best fits your budget while benefiting from essential features for creating a letter of indemnity for bank.

-

What are the key features of airSlate SignNow relevant to the letter of indemnity for bank?

Key features include customizable templates, eSignature functionality, secure document storage, and real-time collaboration. These features make it easier for businesses to create and manage a letter of indemnity for bank efficiently.

-

Can airSlate SignNow integrate with my existing banking software for a letter of indemnity for bank?

Yes, airSlate SignNow offers seamless integrations with several popular banking and document management software. This allows you to work within your existing systems while easily generating and sending a letter of indemnity for bank.

-

What benefits does airSlate SignNow provide for businesses needing a letter of indemnity for bank?

Using airSlate SignNow to create a letter of indemnity for bank can signNowly enhance your workflow. It allows for faster processing times, reduces paper usage, and increases document security, helping you focus on your core business activities.

-

How does airSlate SignNow ensure the security of my letter of indemnity for bank?

airSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to protect your letter of indemnity for bank. These protections ensure that your sensitive information remains secure during the signing and storage process.

Get more for Letter Of Indemnity

Find out other Letter Of Indemnity

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement