E677 Cross Border Currency or Monetary Instruments Report 2021-2026

What is the E677 Cross Border Currency Or Monetary Instruments Report

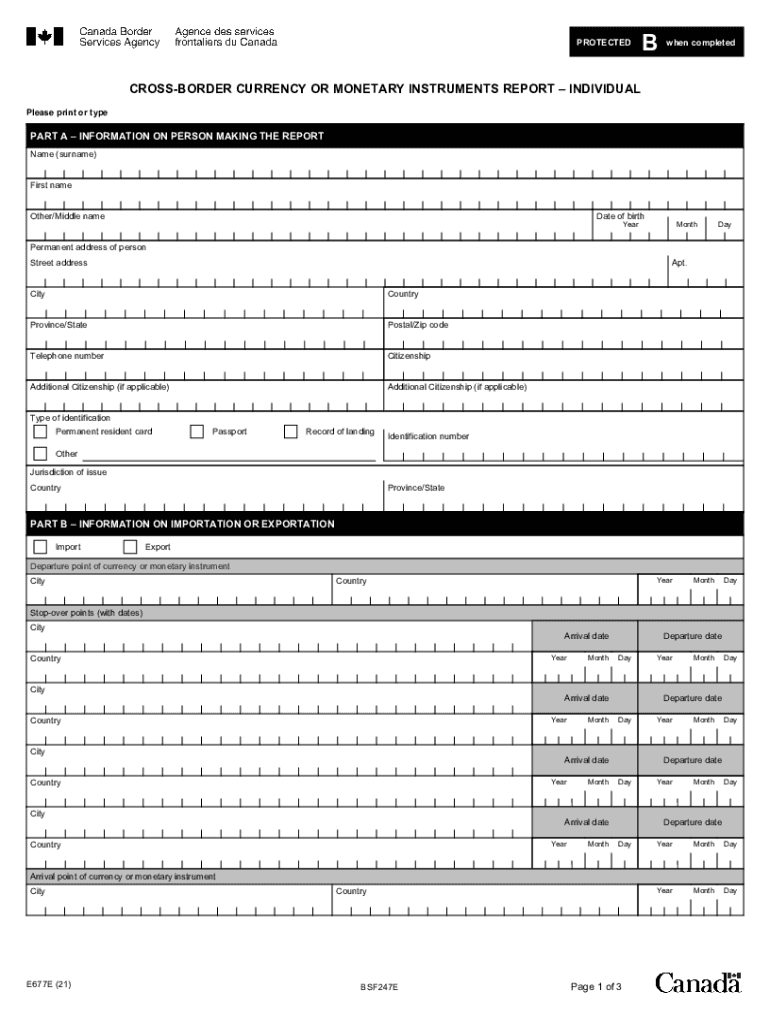

The E677 form, officially known as the Cross Border Currency or Monetary Instruments Report, is a crucial document required by U.S. authorities when individuals or entities transport currency or monetary instruments across the U.S. border. This form is designed to prevent money laundering and other financial crimes by ensuring that large amounts of cash or equivalent instruments are reported to the appropriate regulatory bodies. The E677 form must be completed accurately to provide information about the amount of currency being transported and the purpose of the transfer.

How to use the E677 Cross Border Currency Or Monetary Instruments Report

Using the E677 form involves several steps to ensure compliance with U.S. regulations. First, individuals must determine if they are carrying more than $10,000 in currency or monetary instruments, as this is the threshold for reporting. If the amount exceeds this limit, the individual must fill out the E677 form, providing details such as the amount, type of currency, and the traveler's identification information. It is essential to submit this form to customs officials upon entering or leaving the United States to avoid penalties.

Steps to complete the E677 Cross Border Currency Or Monetary Instruments Report

Completing the E677 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal identification and details about the currency being transported.

- Indicate the total amount of currency or monetary instruments being carried.

- Specify the type of currency, such as U.S. dollars, foreign currency, or traveler's checks.

- Provide the purpose of transporting the currency, whether for personal use, business, or other reasons.

- Review the completed form for accuracy before submission.

Legal use of the E677 Cross Border Currency Or Monetary Instruments Report

The E677 form is legally binding and must be used in accordance with U.S. laws governing the transportation of currency. Failing to report amounts exceeding the $10,000 threshold can lead to severe penalties, including confiscation of the funds and legal action. It is essential to understand that the form serves as a protective measure for both the traveler and the financial system, ensuring transparency in cross-border transactions.

Key elements of the E677 Cross Border Currency Or Monetary Instruments Report

Key elements of the E677 form include:

- Traveler Information: Name, address, and identification details of the individual transporting the currency.

- Currency Details: Total amount and type of currency or monetary instruments being carried.

- Purpose of Transport: A clear explanation of why the currency is being transported.

- Signature: The traveler must sign the form to certify the accuracy of the information provided.

Penalties for Non-Compliance

Non-compliance with the E677 reporting requirements can result in significant penalties. Individuals who fail to report amounts exceeding the $10,000 threshold may face fines, and the unreported funds may be seized by authorities. Additionally, individuals could face criminal charges for attempting to evade reporting requirements, which can lead to further legal consequences. It is crucial to adhere to these regulations to avoid such penalties.

Quick guide on how to complete e677 cross border currency or monetary instruments report

Handle E677 Cross Border Currency Or Monetary Instruments Report seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Manage E677 Cross Border Currency Or Monetary Instruments Report on any device with airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to modify and eSign E677 Cross Border Currency Or Monetary Instruments Report with ease

- Find E677 Cross Border Currency Or Monetary Instruments Report and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for these tasks.

- Generate your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a standard ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searches, or mistakes necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign E677 Cross Border Currency Or Monetary Instruments Report and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct e677 cross border currency or monetary instruments report

Create this form in 5 minutes!

How to create an eSignature for the e677 cross border currency or monetary instruments report

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is an e677 form?

The e677 form is a digital document used for various business processes, enabling seamless electronic signatures and data collection. With airSlate SignNow, you can create, manage, and send your e677 forms for quick processing and validation.

-

How can I electronically sign an e677 form using airSlate SignNow?

Using airSlate SignNow, signing an e677 form is simple and intuitive. You just need to upload the form, add the necessary fields for signatures, and send it to the intended parties for signing, all within a few clicks.

-

What are the costs associated with using airSlate SignNow for e677 forms?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. You can start with a free trial to explore the features related to the e677 form, and then choose a plan that fits your budget.

-

What features does airSlate SignNow offer for creating e677 forms?

airSlate SignNow provides a range of features for creating e677 forms, including customizable templates, drag-and-drop form builders, and automated workflows. These tools ensure efficient handling and distribution of your forms.

-

Can airSlate SignNow integrate with other applications for processing e677 forms?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage services. This allows you to manage your e677 forms alongside other business processes without hassle.

-

What are the benefits of using airSlate SignNow for e677 forms?

By using airSlate SignNow for your e677 forms, you benefit from enhanced speed, reduced paperwork, and improved accuracy in document handling. This leads to signNow time savings and operational efficiency for your business.

-

Is it secure to send e677 forms through airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security measures to ensure that your e677 forms are protected during transmission and storage. Your data remains confidential and secure.

Get more for E677 Cross Border Currency Or Monetary Instruments Report

- Motion and affidavit to modify custody visitation andor child form

- Dr 322 order re motion to continue support for 18 year old form

- Dr 361 motion to modify another states child support order form

- Dr 360 motion packet cover sheet state of alaska form

- Visitation mediation program form

- Dr 420 complaint for custody of minor children form

- Dr 425 default application child custody 4 12 domestic relations forms

- Dr 450 alaska court records state of alaska form fill out

Find out other E677 Cross Border Currency Or Monetary Instruments Report

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order