Alberta Return Form

What is the Alberta Return

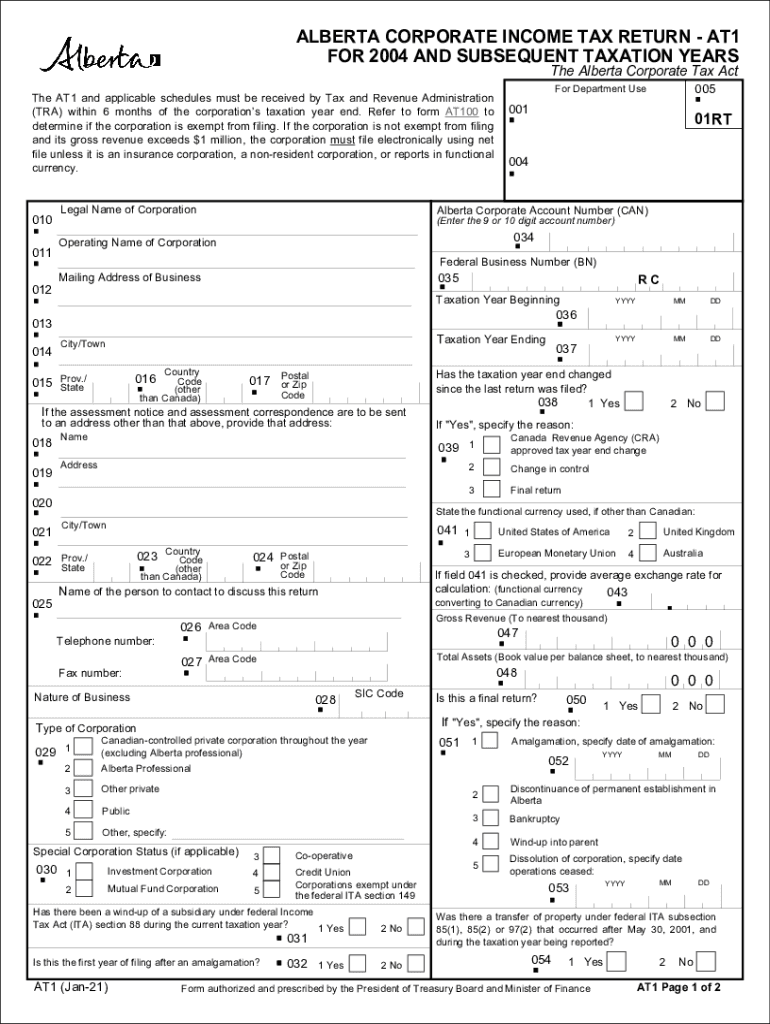

The Alberta Return, often referred to as the AT1 form, is a crucial document for businesses operating in Alberta, Canada. This form is used to report corporate income and calculate taxes owed to the province. It is essential for ensuring compliance with Alberta's corporate tax regulations. The AT1 form captures various financial details, including revenue, expenses, and deductions, allowing businesses to accurately determine their tax liabilities. Understanding the Alberta Return is vital for any corporation looking to maintain good standing with tax authorities.

How to use the Alberta Return

Using the Alberta Return involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, complete the AT1 form by entering the required information, such as total income, allowable deductions, and tax credits. Once the form is filled out, review it for accuracy to avoid any errors that could lead to penalties. Finally, submit the completed Alberta Return through the designated method, whether online or via mail.

Steps to complete the Alberta Return

Completing the Alberta Return requires careful attention to detail. Follow these steps for a smooth process:

- Collect financial records, including bank statements and invoices.

- Fill out the AT1 form with accurate income and expense figures.

- Calculate the total tax owed by applying the appropriate tax rates.

- Check for any eligible tax credits and deductions to reduce liability.

- Review the form for completeness and accuracy before submission.

- Submit the form by the specified deadline to avoid late fees.

Legal use of the Alberta Return

The Alberta Return is legally binding when completed and submitted in accordance with provincial regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to audits or penalties. The form must be signed by an authorized representative of the corporation, affirming that the information is correct. Compliance with the legal requirements surrounding the Alberta Return not only protects the corporation but also contributes to the integrity of the tax system.

Required Documents

To successfully complete the Alberta Return, certain documents are required. These include:

- Financial statements, including balance sheets and income statements.

- Records of all business expenses and receipts.

- Previous year’s tax returns for reference.

- Documentation for any tax credits or deductions being claimed.

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Filing Deadlines / Important Dates

Filing the Alberta Return on time is crucial to avoid penalties. The deadline for submitting the AT1 form typically falls within six months after the end of the corporation's fiscal year. It is important to mark this date on your calendar and prepare in advance to ensure timely submission. Additionally, keep an eye on any changes to deadlines that may arise due to legislative updates or special circumstances.

Quick guide on how to complete alberta return

Effortlessly Ready Alberta Return on Any Device

Digital document management has gained traction among both businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the desired form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Alberta Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Method to Modify and Electronically Sign Alberta Return Seamlessly

- Obtain Alberta Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Alberta Return and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for at1 corporation?

airSlate SignNow provides a variety of features tailored for at1 corporation, including secure eSigning, document templates, and real-time collaboration tools. These features help streamline your document workflows, making it easy for your team to manage contracts and agreements efficiently.

-

How does airSlate SignNow improve productivity for at1 corporation?

By utilizing airSlate SignNow, at1 corporation can signNowly enhance productivity through its automated document processes. This allows teams to focus on their core tasks rather than getting bogged down by manual paperwork, leading to faster decision-making and improved operational efficiency.

-

What is the pricing structure for airSlate SignNow for at1 corporation?

airSlate SignNow offers flexible pricing plans designed for businesses like at1 corporation. Whether you need a basic eSigning solution or advanced features with extensive integrations, you can find a plan that fits your budget and business requirements.

-

Can airSlate SignNow integrate with other tools used by at1 corporation?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used by at1 corporation, such as CRM systems and project management tools. These integrations enable streamlined operations and enhance the overall efficiency of your business processes.

-

What are the security features of airSlate SignNow for at1 corporation?

Security is a top priority for airSlate SignNow, especially for at1 corporation. The platform uses advanced encryption, secure access controls, and compliance with industry standards to ensure that your documents and data remain safe throughout the signing process.

-

How can at1 corporation benefit from using airSlate SignNow for document management?

By adopting airSlate SignNow, at1 corporation can simplify its document management processes. The solution allows you to create, send, and track documents electronically, reducing the time spent on administrative tasks and improving the accuracy of your records.

-

Is airSlate SignNow suitable for remote teams at at1 corporation?

Absolutely! airSlate SignNow is designed to support remote teams at at1 corporation by enabling secure eSigning and document management from anywhere. This flexibility helps ensure that all team members can collaborate effectively, regardless of their location.

Get more for Alberta Return

- Template letters tenant resource and advisory centre form

- This letter is to provide you with legal notice of the fact that there is insufficient heat in my form

- With limited warranties form

- Horses purchased the seller hereby agrees to sell and the buyer hereby agrees form

- Fourteen 14 days after service of this notice upon you you must pay in full to landlord the form

- Cb commercial industrial real estate lease multi tenant law insider form

- Of residential lease form

- Fillable online sponsorexhibitor registration bformb

Find out other Alberta Return

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF