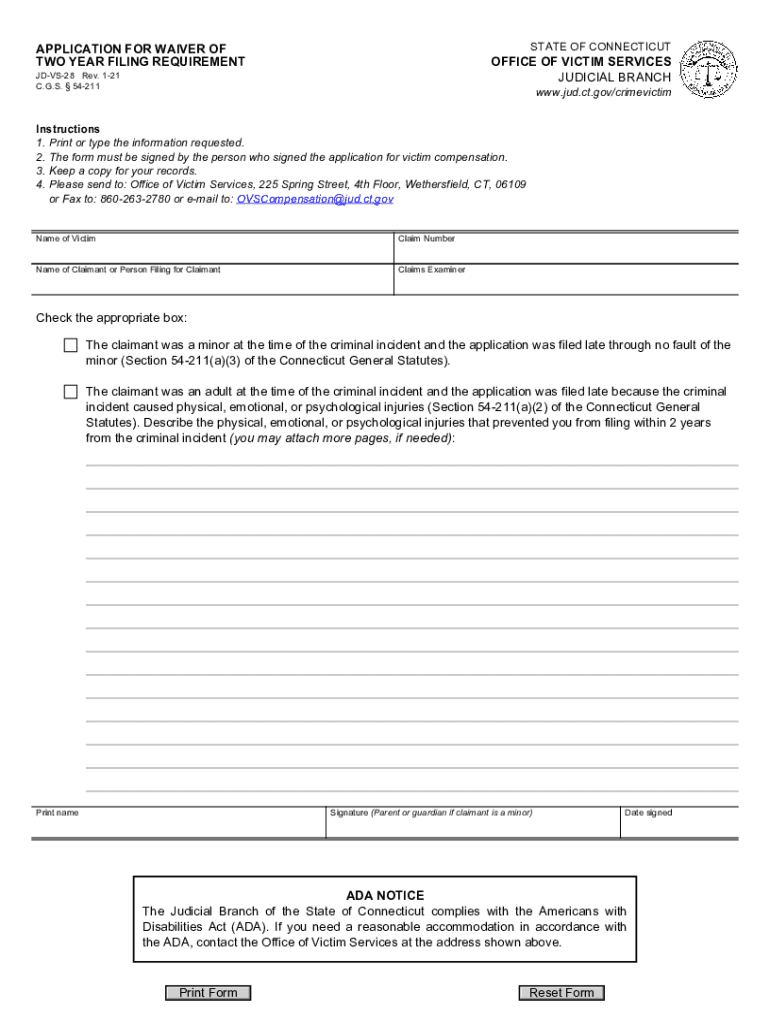

TWO YEAR FILING REQUIREMENT Form

What is the two year filing requirement?

The two year filing requirement is a specific legal stipulation that mandates certain documents, such as waivers, to be submitted within a two-year timeframe. This requirement is often associated with legal and administrative processes, ensuring that claims or rights are exercised within a designated period. Understanding this requirement is crucial for individuals and businesses to maintain compliance and avoid potential penalties.

Steps to complete the two year filing requirement

Completing the two year filing requirement involves several key steps to ensure that all necessary documentation is submitted correctly and on time. Here is a straightforward process to follow:

- Gather all relevant documents that pertain to the waiver or filing.

- Review the specific requirements for the waiver jud fill to ensure compliance with local and federal regulations.

- Complete the necessary forms accurately, ensuring all information is correct.

- Submit the forms through the appropriate channels, whether online, by mail, or in person.

- Keep copies of all submitted documents for your records.

Legal use of the two year filing requirement

The legal use of the two year filing requirement is significant in various contexts, particularly in legal proceedings and administrative actions. This requirement helps to establish timelines for claims and ensures that parties involved adhere to deadlines. Failure to comply can result in the loss of rights or claims, making it essential to understand how this requirement applies to your specific situation.

Filing deadlines / important dates

Filing deadlines associated with the two year filing requirement can vary based on the nature of the waiver or legal document. It is critical to be aware of these dates to avoid penalties or complications. Generally, the deadline is two years from the date of the event that triggers the filing requirement. Keeping a calendar or reminder system can help ensure that you meet these important deadlines.

Required documents

To fulfill the two year filing requirement, certain documents are typically required. These may include:

- The completed waiver jud fill form.

- Supporting documentation that validates the claims made in the waiver.

- Any additional forms specified by the relevant authority.

Ensuring that all required documents are submitted together can streamline the process and reduce the likelihood of delays.

Who issues the form?

The form associated with the two year filing requirement is typically issued by a relevant governmental or regulatory body. This could include state or federal agencies depending on the nature of the waiver. It is important to identify the correct issuing authority to obtain the most current version of the form and to ensure compliance with any specific instructions they may provide.

Quick guide on how to complete two year filing requirement

Prepare TWO YEAR FILING REQUIREMENT effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage TWO YEAR FILING REQUIREMENT on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign TWO YEAR FILING REQUIREMENT with ease

- Locate TWO YEAR FILING REQUIREMENT and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or redact personal information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign TWO YEAR FILING REQUIREMENT to guarantee excellent communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow used for with 'for waiver ct'?

airSlate SignNow is used for waiver ct to streamline the signing process of legal documents and waivers. This platform ensures that users can easily send, sign, and store waivers securely, making it an ideal solution for businesses needing efficient document management.

-

How does airSlate SignNow pricing work for waiver ct?

The pricing for airSlate SignNow is designed to be cost-effective for businesses needing a solution for waiver ct. There are various pricing plans available to suit different needs, and users can choose a plan based on the number of documents they process and additional features they require.

-

What features does airSlate SignNow offer for waiver ct?

airSlate SignNow provides a range of features for waiver ct, including customizable templates, real-time tracking, and automated reminders. These features enhance the efficiency of document processing and ensure that waivers are signed promptly and securely.

-

What are the benefits of using airSlate SignNow for waiver ct?

Using airSlate SignNow for waiver ct offers numerous benefits, including time savings and improved compliance with legal standards. The platform enables quick access to documents and facilitates easy sharing among team members, which ultimately boosts productivity.

-

Can airSlate SignNow integrate with other tools for waiver ct?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications, enhancing its functionality for waiver ct. This integration capability allows businesses to maintain their existing workflows while benefiting from efficient document management.

-

Is airSlate SignNow secure for sending documents for waiver ct?

airSlate SignNow ensures high-level security for sending documents for waiver ct by implementing encryption and secure access protocols. Users can trust that their sensitive information and signed documents are protected from unauthorized access.

-

How can I get started with airSlate SignNow for waiver ct?

Getting started with airSlate SignNow for waiver ct is simple. You can sign up for a free trial to explore the features and functionalities, followed by choosing a pricing plan that suits your business needs once you're ready to make a commitment.

Get more for TWO YEAR FILING REQUIREMENT

- Untitled wv secretary of state state of west virginia form

- County of state of arkansas and described as form

- Oath that form

- Loan modification in the united states wikipedia form

- Wills clinic arkansas legal services form

- Seal of office form

- Judgment and disposition order form

- Order for issuance of arrest warrant and summonsorder form

Find out other TWO YEAR FILING REQUIREMENT

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe