Current Dollar Amounts of Exemptions from Enforcement of 2020

Understanding Current Dollar Amounts of Exemptions from Enforcement

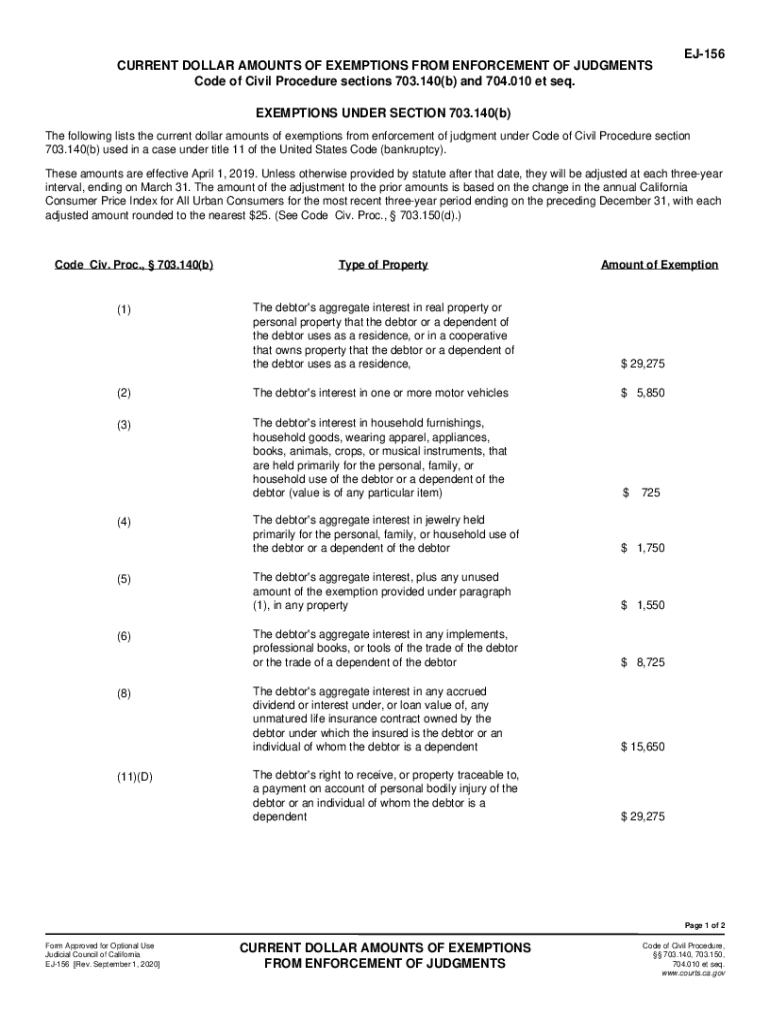

The Current Dollar Amounts of Exemptions from Enforcement provide essential guidelines for individuals facing legal judgments. These amounts determine the financial limits that protect certain assets from being seized by creditors. Understanding these exemptions is crucial for individuals navigating financial difficulties, as they can significantly impact the outcome of enforcement actions. Typically, these exemptions cover personal property, wages, and other financial resources, allowing individuals to maintain a basic standard of living despite legal challenges.

How to Utilize Current Dollar Amounts of Exemptions from Enforcement

Utilizing the Current Dollar Amounts of Exemptions from Enforcement involves understanding which assets are protected under state law. Individuals should first review their financial situation to identify which exemptions apply to them. This process often requires documentation of income, property ownership, and other relevant financial details. Once the applicable exemptions are identified, individuals can formally assert these exemptions during legal proceedings, ensuring that their protected assets remain intact.

Steps to Complete the Current Dollar Amounts of Exemptions from Enforcement

Completing the Current Dollar Amounts of Exemptions from Enforcement involves several key steps:

- Identify applicable exemptions: Review state-specific laws to determine which exemptions apply to your situation.

- Document your assets: Gather financial records that detail your income, property, and other relevant assets.

- File necessary forms: Complete and submit any required legal forms to assert your exemptions in court.

- Attend hearings: Be prepared to present your case during any court hearings related to enforcement actions.

Legal Use of Current Dollar Amounts of Exemptions from Enforcement

The legal use of Current Dollar Amounts of Exemptions from Enforcement ensures that individuals can protect their essential assets during debt recovery processes. These exemptions are grounded in state laws, which dictate the specific amounts and types of property that can be exempted from creditors. It is vital for individuals to consult legal resources or professionals to navigate these laws effectively and ensure compliance during legal proceedings.

State-Specific Rules for Current Dollar Amounts of Exemptions from Enforcement

State-specific rules play a significant role in determining the Current Dollar Amounts of Exemptions from Enforcement. Each state has its own set of laws that outline the exemptions available to residents. These rules can vary widely, impacting the types of assets that can be protected and the dollar amounts associated with those protections. Individuals should familiarize themselves with their state’s regulations to ensure they are fully aware of their rights and protections under the law.

Eligibility Criteria for Current Dollar Amounts of Exemptions from Enforcement

Eligibility criteria for the Current Dollar Amounts of Exemptions from Enforcement typically include residency requirements and financial thresholds. Individuals must be residents of the state in which they seek to claim exemptions. Additionally, certain financial conditions may apply, such as income limits or asset caps, which can affect the amount of property that can be exempted. Understanding these criteria is essential for individuals to effectively utilize their legal protections.

Quick guide on how to complete current dollar amounts of exemptions from enforcement of

Effortlessly prepare Current Dollar Amounts Of Exemptions From Enforcement Of on any device

Digital document management has gained popularity among both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Current Dollar Amounts Of Exemptions From Enforcement Of on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest method to modify and eSign Current Dollar Amounts Of Exemptions From Enforcement Of with ease

- Find Current Dollar Amounts Of Exemptions From Enforcement Of and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize critical sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Current Dollar Amounts Of Exemptions From Enforcement Of to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct current dollar amounts of exemptions from enforcement of

Create this form in 5 minutes!

How to create an eSignature for the current dollar amounts of exemptions from enforcement of

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is ej 156 in the context of airSlate SignNow?

The term ej 156 refers to a specific form or document often processed using airSlate SignNow. This platform enables users to easily manage and eSign such documents, streamlining the workflow and ensuring security.

-

How does airSlate SignNow help with ej 156 document management?

airSlate SignNow simplifies ej 156 document management by providing a user-friendly interface for uploading, signing, and sharing. Users can easily track the status of these documents, making collaboration efficient and organized.

-

Is there a cost associated with using airSlate SignNow for ej 156 documents?

Yes, there is a pricing structure in place for using airSlate SignNow to handle ej 156 documents. Depending on your business needs, you can choose from various plans that are cost-effective and tailored for different volumes and features.

-

What features does airSlate SignNow offer for ej 156 transactions?

airSlate SignNow offers several features for ej 156 transactions, including eSignatures, custom templates, and automated workflows. These features enhance user experience by providing flexibility and ensuring compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools when managing ej 156 forms?

Absolutely! airSlate SignNow allows for seamless integration with numerous applications, enhancing how you manage ej 156 forms. Popular integrations include CRM systems, cloud storage, and productivity tools, increasing efficiency across platforms.

-

What benefits does airSlate SignNow provide for eSigning ej 156 documents?

Using airSlate SignNow for eSigning ej 156 documents offers numerous benefits such as expedited signature collection, reduced paper usage, and enhanced security. This leads to faster turnaround times and a more efficient workflow overall.

-

Is airSlate SignNow secure for handling ej 156 documents?

Yes, airSlate SignNow is highly secure for handling ej 156 documents. The platform employs advanced encryption and complies with industry standards to protect sensitive information, ensuring peace of mind for users.

Get more for Current Dollar Amounts Of Exemptions From Enforcement Of

- Plugging and performance bond know all men by these

- Horse arena use release mofoxtrot form

- Notice of non responsibility individual form

- Control number co 06 77 form

- Real resumes for engineering jobs docsharetips form

- Owners information sheet 2018

- South platte independent 0630 by colorado community media form

- Authorization to obtain medical treatment for a minor child form

Find out other Current Dollar Amounts Of Exemptions From Enforcement Of

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document