Ej156 2013

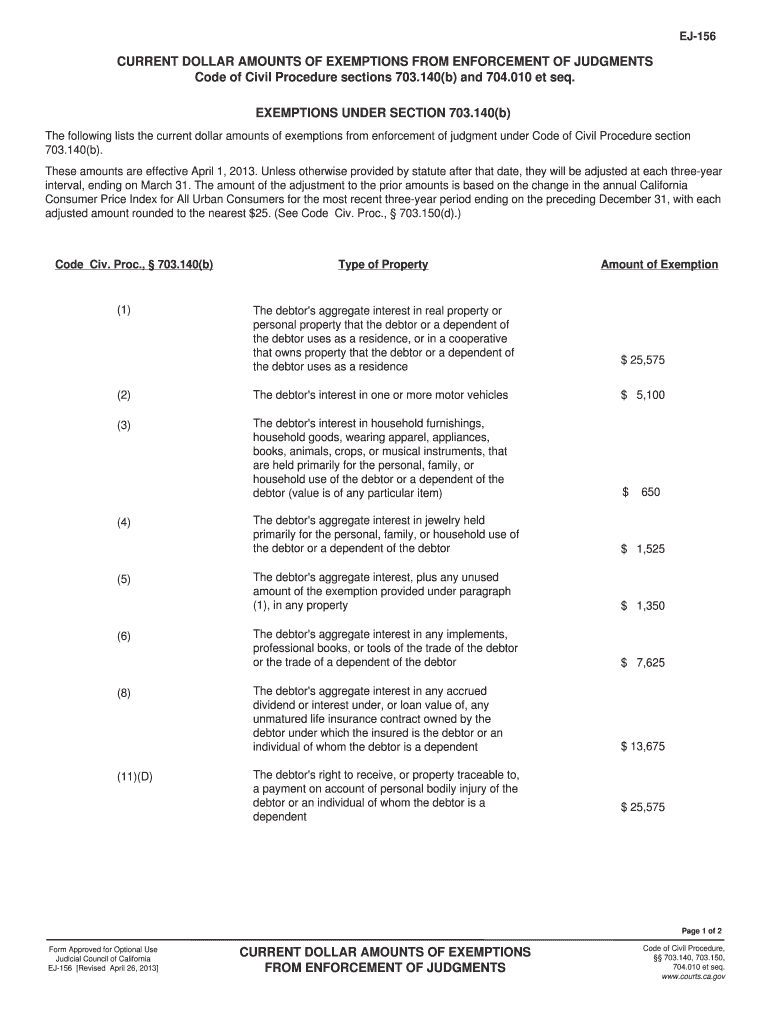

What is the EJ 156?

The EJ 156 is a specific form used for reporting current amounts exemptions in various financial and legal contexts. It serves as a formal declaration that outlines the exemptions applicable to certain dollar amounts, ensuring compliance with relevant regulations. This form is particularly important for individuals and businesses looking to clarify their financial obligations and rights under U.S. law.

How to Use the EJ 156

Using the EJ 156 involves several key steps. First, gather all necessary financial documents that support your claim for exemptions. Next, accurately fill out the form by entering the required information, including your personal details and the specific amounts you are claiming as exempt. After completing the form, review it for accuracy to avoid any potential issues. Finally, submit the form as directed, either electronically or through traditional mail, depending on the requirements set forth by the issuing authority.

Steps to Complete the EJ 156

Completing the EJ 156 requires a systematic approach:

- Collect all relevant financial documents.

- Provide your personal information in the designated fields.

- List the amounts you are claiming as exempt, ensuring clarity and accuracy.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission guidelines.

Legal Use of the EJ 156

The EJ 156 is legally recognized when completed correctly and submitted in accordance with applicable laws. It is essential to ensure that the information provided is truthful and supported by documentation. Misrepresentations or inaccuracies can lead to penalties or legal repercussions. Therefore, understanding the legal framework surrounding the use of this form is crucial for compliance and protection of rights.

Required Documents

When preparing to submit the EJ 156, certain documents are typically required. These may include:

- Proof of income or financial statements.

- Documentation supporting the claimed exemptions.

- Identification verification, such as a driver's license or Social Security number.

Having these documents ready will facilitate a smoother completion process and help ensure that your claims are substantiated.

Filing Deadlines / Important Dates

It is important to be aware of any filing deadlines associated with the EJ 156. These deadlines can vary based on state regulations and the specific context in which the form is being used. Generally, timely submission is crucial to avoid penalties or complications. Always check the latest guidelines from the relevant authorities to ensure compliance with all deadlines.

Examples of Using the EJ 156

The EJ 156 can be utilized in various scenarios, including:

- Individuals applying for exemptions on their income tax returns.

- Businesses seeking to clarify their financial obligations regarding specific transactions.

- Legal representatives filing on behalf of clients to assert exemptions in court cases.

These examples illustrate the versatility of the EJ 156 in addressing different financial and legal situations.

Quick guide on how to complete ej156

Complete Ej156 effortlessly on any gadget

Web-based document management has become a trend among companies and individuals. It offers an ideal eco-conscious substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without delays. Manage Ej156 on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Ej156 without hassle

- Obtain Ej156 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for this task.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Ej156 and ensure excellent communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ej156

Create this form in 5 minutes!

How to create an eSignature for the ej156

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the ej 156 and how does it work with airSlate SignNow?

The ej 156 is a unique document identifier used within airSlate SignNow to streamline the eSigning process. This identifier ensures that your documents are easily accessible and trackable throughout the signing workflow. By using ej 156, you can enhance the organization and efficiency of document management.

-

How much does it cost to use airSlate SignNow with ej 156 features?

airSlate SignNow offers competitive pricing plans that include comprehensive features such as the ej 156 functionality. Depending on your business needs, you can choose from different tiers to ensure you get the best value. Each plan provides essential tools for optimized document signing at an affordable price.

-

What are the key features of the airSlate SignNow platform related to ej 156?

With airSlate SignNow and the ej 156, you gain access to features like document templates, in-person signing, and advanced security options. The ej 156 enhances your capability to manage and automate document workflows efficiently. These features collectively improve productivity and reduce turnaround time.

-

How does using ej 156 improve the eSigning experience for users?

The ej 156 simplifies the eSigning process by providing a clear, robust framework for tracking documents. This ensures that users can easily locate and manage their signed documents without hassle. By leveraging the ej 156, your overall signing experience is enhanced, making it fast and user-friendly.

-

Can ej 156 be integrated with other software applications?

Yes, the ej 156 works seamlessly with various software applications through airSlate SignNow’s integration capabilities. This allows you to connect with tools like CRMs and project management software, enhancing the overall functionality of your business processes. Integrating ej 156 provides a cohesive experience across platforms.

-

What benefits does ej 156 offer for businesses?

The ej 156 offers numerous benefits for businesses, including improved document management, quicker signing processes, and enhanced collaboration among team members. By using ej 156, companies can streamline their operations and reduce administrative burden. This results in increased efficiency and a better focus on core business activities.

-

Is there customer support available for issues related to ej 156?

Yes, airSlate SignNow provides robust customer support to assist users with any issues related to the ej 156 functionality. Our support team is available through various channels to ensure timely assistance. Whether you have questions about setup or troubleshooting, help is just a signNow away.

Get more for Ej156

- Montessori progress reports pdf form

- Form 888 example

- 7 1 skills practice ratios and proportions form

- Work permit agoura high school form

- Fixtures fittings and contents form kevin lane amp company

- Flying dog enterprises form

- Brevard county property appraiser original application for ad valorem tax exemption form

- Physicians certification of total and permanent disability form

Find out other Ej156

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document