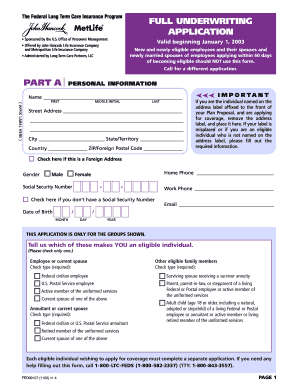

Underwriting Application Form

What is the underwriting application?

The underwriting application is a formal document used by individuals or businesses to request coverage from an insurance provider or lender. This application gathers essential information about the applicant, including personal details, financial history, and specific risks associated with the coverage being sought. Understanding the components of this application is crucial for ensuring a smooth underwriting process.

How to complete the underwriting application

Completing the underwriting application involves several key steps. First, gather all necessary documentation, such as identification, financial statements, and any relevant medical records. Next, fill out the application accurately, ensuring that all information is truthful and complete. After filling out the form, review it for any errors or omissions before submitting it. This attention to detail can significantly impact the approval process.

Key elements of the underwriting application

Several critical elements must be included in the underwriting application to facilitate proper evaluation. These elements typically consist of:

- Personal Information: Name, address, date of birth, and contact details.

- Financial Information: Income, assets, liabilities, and credit history.

- Coverage Details: Type of coverage requested, limits, and any specific conditions.

- Risk Factors: Information regarding health, lifestyle, and any previous claims.

Including these elements ensures that the underwriter has a comprehensive understanding of the applicant's profile.

Legal use of the underwriting application

The underwriting application is legally binding once submitted and signed. It is essential to comply with all relevant laws and regulations governing the underwriting process. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, making digital submissions valid. However, applicants should ensure that they are using a secure platform to protect their personal information.

Form submission methods

Submitting the underwriting application can be done through various methods. Applicants can choose to submit the form online, which is often the fastest and most efficient option. Alternatively, applications can be mailed directly to the insurance company or lender, or submitted in person at a local office. Each method may have different processing times, so it's important to consider the urgency of the application.

Eligibility criteria

Eligibility for coverage through the underwriting application varies based on the type of insurance or loan being requested. Common criteria include age, health status, financial stability, and the nature of the coverage sought. It is advisable for applicants to review these criteria carefully to determine their qualifications before completing the application.

Quick guide on how to complete underwriting application

Prepare Underwriting Application effortlessly on any device

Digital document management has gained popularity among enterprises and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents rapidly without delays. Manage Underwriting Application on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and eSign Underwriting Application with ease

- Locate Underwriting Application and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark essential sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and click on the Done button to preserve your adjustments.

- Select how you would like to share your form, either via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Underwriting Application and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the underwriting application

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is an underwriting application form and how does it work?

An underwriting application form is a document used by lenders and insurers to assess the eligibility of applicants for loans or insurance policies. With airSlate SignNow, you can easily create, send, and eSign underwriting application forms, streamlining the approval process and ensuring secure submissions.

-

How does airSlate SignNow ensure the security of my underwriting application form?

airSlate SignNow prioritizes security by employing encryption, secure cloud storage, and multi-factor authentication. This means your underwriting application forms are protected from unauthorized access while ensuring compliance with industry standards.

-

Can I customize my underwriting application form in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your underwriting application form to fit your specific needs. You can add fields, adjust layout, and include your branding, making it easier for applicants to complete and submit their forms.

-

What are the pricing options for using airSlate SignNow for underwriting application forms?

airSlate SignNow offers a range of pricing plans to suit different business sizes and needs. Whether you're a small startup or a large enterprise, you can find a plan that includes features for creating and managing underwriting application forms efficiently.

-

Can I integrate airSlate SignNow with other software for underwriting application forms?

Absolutely! airSlate SignNow supports integrations with various software solutions, including CRM and document management systems. This allows you to seamlessly incorporate your underwriting application forms into your existing workflows.

-

What are the benefits of using airSlate SignNow for my underwriting application forms?

Using airSlate SignNow for your underwriting application forms provides numerous benefits, including improved efficiency, reduced paper usage, and faster turnaround times. You can easily track submissions and manage documents all in one platform.

-

How can I track the status of my underwriting application forms sent via airSlate SignNow?

With airSlate SignNow, you can easily track the status of your underwriting application forms in real-time. Notifications will alert you when forms are viewed, signed, or completed, allowing you to stay informed throughout the process.

Get more for Underwriting Application

- Juvenile and concerning form

- Colorado judicial branch contact us by district form

- Colorado judicial branch contact us by county form

- Counterclaim cross claim or third party complaint form

- Colorado judicial branch self help forms appeals

- Petition and affidavit for temporary courtsstatecous form

- Justia alternative dispute resolution or court forms

- The petitionerplaintiffs andor co petitionerrespondentdefendantss requests an exemption from form

Find out other Underwriting Application

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement