PAR Forms Catalog Table of Contents Pennsylvania Association of Parealtor 2013-2026

Understanding the PAR Forms Catalog Table of Contents

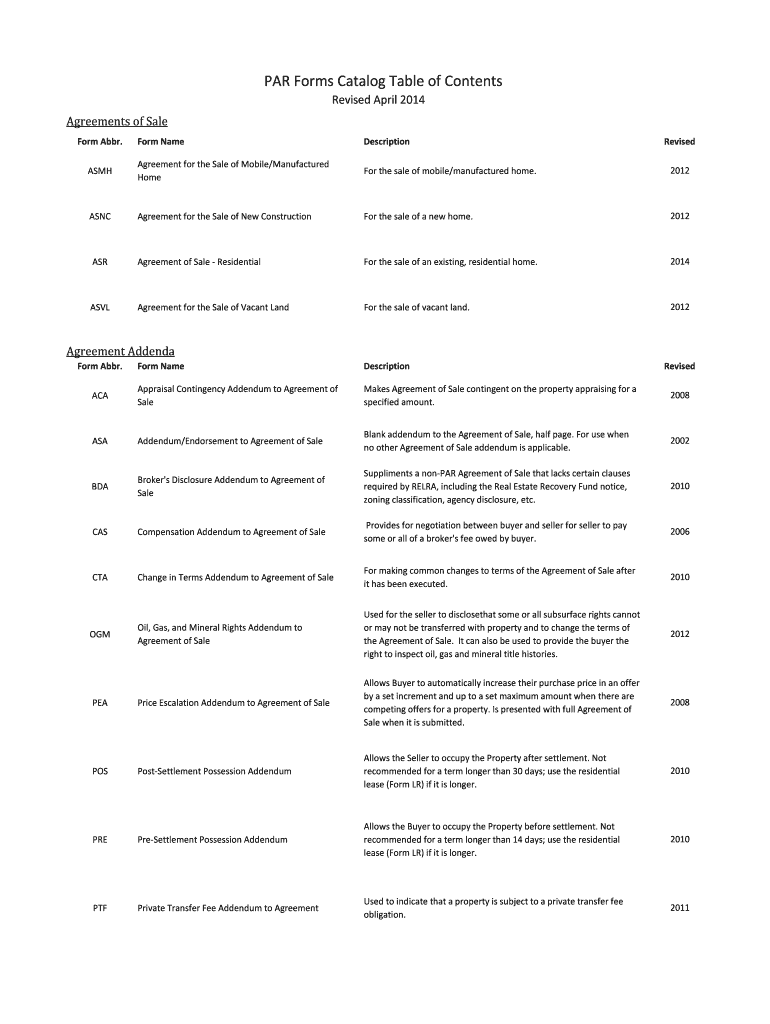

The PAR Forms Catalog Table of Contents serves as a comprehensive guide for real estate professionals in Pennsylvania. It lists all available forms used in real estate transactions, ensuring users can easily locate the necessary documents. This catalog includes various types of forms, such as agreements, disclosures, and applications, each tailored to meet specific needs in real estate dealings. By familiarizing yourself with this table of contents, you can streamline your workflow and ensure compliance with state regulations.

How to Use the PAR Forms Catalog Table of Contents

Utilizing the PAR Forms Catalog Table of Contents effectively involves several steps. First, identify the type of transaction you are involved in, whether it’s a purchase agreement, lease, or disclosure form. Next, refer to the catalog to find the corresponding form. Each entry typically includes a brief description, making it easier to determine which document suits your needs. Once you have selected the appropriate form, you can access it for download or printing, ensuring you have the latest version for your transaction.

Steps to Complete the PAR Forms Catalog Table of Contents

Completing the forms from the PAR Forms Catalog requires careful attention to detail. Start by downloading the desired form from the catalog. Fill in all required fields accurately, ensuring that all information is current and complete. Pay special attention to sections that require signatures or dates, as these are crucial for the document's validity. After completing the form, review it for any errors before submitting it to the relevant parties. This process helps maintain professionalism and ensures compliance with legal standards.

Legal Use of the PAR Forms Catalog Table of Contents

The legal use of forms from the PAR Forms Catalog is paramount in ensuring that real estate transactions are binding and enforceable. Each form is designed to comply with Pennsylvania real estate laws, which helps protect both buyers and sellers. It is essential to use the latest versions of these forms, as outdated documents may not meet current legal requirements. Additionally, when electronically signing these forms, ensure that you use a compliant eSignature solution to maintain their legal validity.

Key Elements of the PAR Forms Catalog Table of Contents

Key elements of the PAR Forms Catalog Table of Contents include the form name, a brief description of its purpose, and the specific use cases for each document. Understanding these elements is crucial for real estate professionals, as they guide the selection process. Furthermore, the catalog may also indicate any required attachments or additional documentation needed for each form, ensuring that users are fully prepared when submitting their paperwork.

State-Specific Rules for the PAR Forms Catalog Table of Contents

Each form in the PAR Forms Catalog adheres to state-specific rules and regulations that govern real estate transactions in Pennsylvania. These rules may dictate how forms must be completed, submitted, and retained. Familiarity with state-specific requirements helps real estate professionals avoid compliance issues and potential legal disputes. It is advisable to stay updated on any changes to these regulations, as they can impact the validity of the forms used in transactions.

Quick guide on how to complete par forms catalog table of contents pennsylvania association of parealtor

Ensure every detail is correct in the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor

Arranging agreements, managing listings, organizing calls, and conducting viewings—realtors and real estate professionals navigate a diverse array of tasks daily. Many of these responsibilities entail handling numerous documents, such as PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor, that need to be processed promptly and with maximum precision.

airSlate SignNow is a comprehensive solution that assists real estate professionals in alleviating the document load, enabling them to focus more on their clients' objectives throughout the negotiation phase and securing the most advantageous conditions for the transaction.

Steps to process PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor with airSlate SignNow:

- Access the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor page or utilize our library's search features to find the necessary document.

- Click on Get form—you will be promptly taken to the editor.

- Begin filling out the form by selecting fillable fields and entering your information.

- Add additional text and modify its settings as required.

- Choose the Sign option in the upper toolbar to create your signature.

- Explore other tools available for annotating and enhancing your form, such as drawing, highlighting, adding shapes, and more.

- Access the comments tab and include notes regarding your document.

- Conclude the process by downloading, sharing, or emailing your form to the relevant parties or organizations.

Bid farewell to paper permanently and simplify the homebuying experience with our user-friendly and effective solution. Experience enhanced convenience when signNowing PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

Create this form in 5 minutes!

How to create an eSignature for the par forms catalog table of contents pennsylvania association of parealtor

How to make an electronic signature for your Par Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor in the online mode

How to create an electronic signature for your Par Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor in Chrome

How to generate an eSignature for putting it on the Par Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor in Gmail

How to generate an eSignature for the Par Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor straight from your smart phone

How to generate an eSignature for the Par Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor on iOS

How to generate an electronic signature for the Par Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor on Android

People also ask

-

What is the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor?

The PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor is a comprehensive resource that organizes all forms used in real estate transactions within Pennsylvania. It provides easy access to essential documents needed for compliance and efficient processing of real estate deals. This catalog is invaluable for realtors looking to streamline their paperwork.

-

How can airSlate SignNow help me with the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor?

airSlate SignNow integrates seamlessly with the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor, allowing realtors to eSign and manage documents effortlessly. With our user-friendly interface, you can quickly access, fill out, and send necessary forms directly from the catalog. This enhances productivity and reduces turnaround times.

-

What are the pricing options for using airSlate SignNow with the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that complement the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor. Our plans are designed to be cost-effective while delivering exceptional value.

-

What features does airSlate SignNow provide for managing the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor?

With airSlate SignNow, you get features such as customizable templates, bulk sending, and advanced security options that enhance the management of the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor. These tools simplify the signing process, ensuring that all transactions are secure and compliant with state regulations.

-

Are there integrations available with airSlate SignNow and the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor?

Yes, airSlate SignNow offers a variety of integrations with popular CRM systems, cloud storage platforms, and other productivity tools that complement the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor. This connectivity allows for seamless workflows, ensuring that your documents are easily accessible and efficiently managed.

-

What benefits can I expect from using airSlate SignNow with the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor?

Using airSlate SignNow with the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor enhances efficiency and reduces the time spent on paperwork. You’ll benefit from accelerated document turnaround, improved accuracy, and a more organized approach to handling real estate forms. This ultimately leads to better client satisfaction and increased productivity.

-

Can I track the status of documents sent through the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents sent using the PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor. You’ll receive notifications when documents are viewed, signed, or require further action, allowing you to stay informed and manage your transactions efficiently.

Get more for PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor

Find out other PAR Forms Catalog Table Of Contents Pennsylvania Association Of Parealtor

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast