Form 933

What is the Form 933

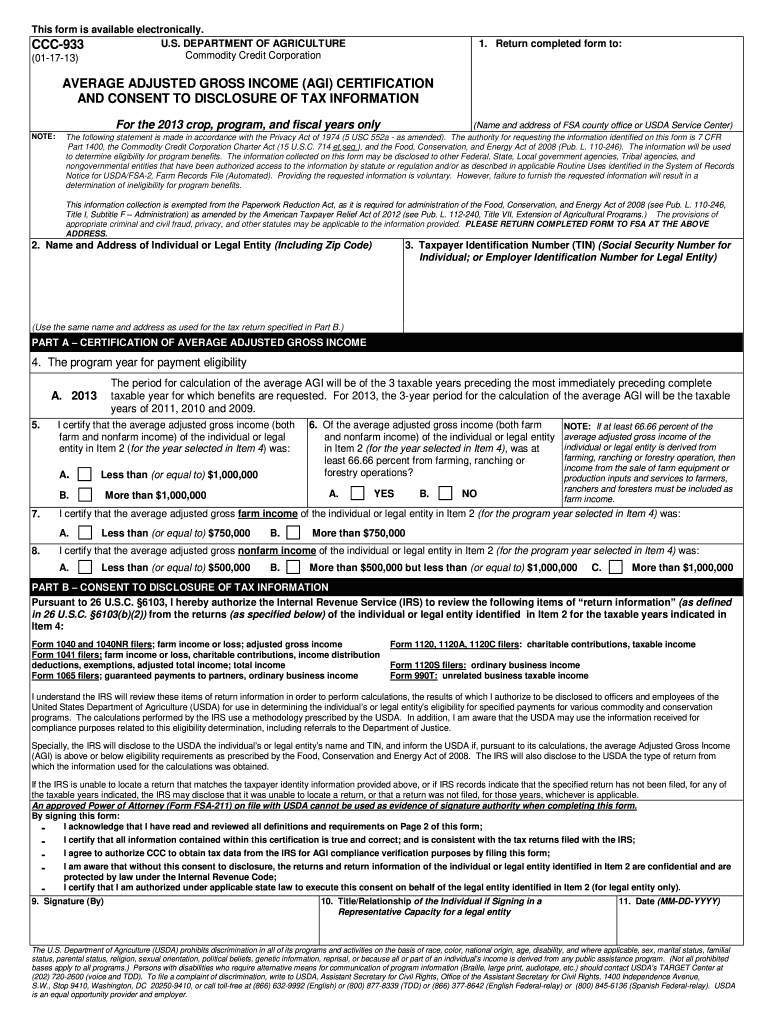

The IRS Form 933, officially known as the Income Averaging for Farmers and Fishermen, allows eligible taxpayers to average their income over a three-year period. This form is particularly beneficial for individuals whose income fluctuates significantly from year to year, such as those in agriculture or fishing industries. By using this form, taxpayers can potentially reduce their overall tax liability by spreading out their income, which may help them avoid higher tax brackets in any single year.

How to use the Form 933

To effectively use the IRS Form 933, taxpayers must first determine their eligibility based on their income sources. The form requires detailed reporting of income from the past three years, along with an explanation of how the income was earned. Taxpayers should gather all necessary documentation, including income statements and records of expenses, to ensure accurate reporting. Once completed, the form should be submitted alongside the taxpayer's annual return to the IRS.

Steps to complete the Form 933

Completing the IRS Form 933 involves several key steps:

- Gather all relevant income documents from the past three years.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your income for each of the three years, ensuring accuracy in calculations.

- Calculate the average income and determine any tax implications.

- Review the completed form for accuracy before submission.

It is advisable to consult with a tax professional if you have questions about any part of the process.

Legal use of the Form 933

The IRS Form 933 is legally recognized as a valid method for farmers and fishermen to report their income. To ensure compliance, taxpayers must adhere to IRS guidelines and accurately report their income. Using this form can provide significant tax benefits, but it is essential to maintain proper records and documentation to support the claims made on the form. Failure to comply with IRS regulations can lead to penalties or audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IRS Form 933. Typically, the form is due on the same date as the individual income tax return, which is usually April fifteenth. However, if taxpayers file for an extension, they must also ensure that Form 933 is submitted by the extended deadline. Keeping track of these dates is crucial to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 933 can be submitted in several ways, providing flexibility for taxpayers. Options include:

- Online: Taxpayers can use IRS e-file services if they are filing their tax return electronically.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person: Taxpayers may also choose to deliver their forms directly to local IRS offices, although this method is less common.

Quick guide on how to complete form 933

Effortlessly Prepare Form 933 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without hassle. Manage Form 933 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and Electronically Sign Form 933

- Obtain Form 933 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the specialized tools available through airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate additional printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 933 and facilitate effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 933

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is a ccc file usda and why is it important?

A ccc file usda is a specific file format used by the USDA that contains crucial information regarding commodity credit and other agricultural programs. It is important for farmers and businesses to keep their records accurate and organized for compliance and reporting purposes. Utilizing the airSlate SignNow platform makes it easy to manage and eSign these documents, ensuring you stay on top of your obligations.

-

How can airSlate SignNow help with ccc file usda management?

airSlate SignNow provides a seamless solution for managing ccc file usda documents by allowing you to easily upload, eSign, and send these files securely. Its user-friendly interface simplifies the process of handling multiple ccc files, ensuring you can focus on your agricultural business without worrying about paperwork. Plus, the platform is designed to optimize your workflow.

-

Is there a cost to use airSlate SignNow for ccc file usda documents?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs, including features tailored for managing ccc file usda documents. Pricing is competitive, and choosing the right plan can help you access the tools necessary for efficient document handling. You can always start with a free trial to assess how the service fits your needs.

-

What features does airSlate SignNow offer for handling ccc file usda?

AirSlate SignNow offers a range of features for handling ccc file usda, including easy eSigning, document templates, and automated workflows. These tools help streamline the process, minimize errors, and ensure that your files comply with USDA requirements. With these features, you can efficiently manage your agricultural documentation.

-

Can I integrate airSlate SignNow with other tools for managing ccc file usda?

Absolutely! airSlate SignNow integrates with various tools and platforms, enhancing your ability to manage ccc file usda effectively. You can connect with CRM systems, cloud storage solutions, and other business applications to create a seamless workflow. This integration helps save time and reduce manual work while handling your USDA-related documents.

-

What benefits can I expect from using airSlate SignNow for ccc file usda?

Using airSlate SignNow for ccc file usda comes with numerous benefits, including enhanced efficiency, improved document security, and easier compliance with USDA regulations. The platform allows for quick document turnaround and reduces the risk of errors, further optimizing your business processes in the agricultural sector. Overall, it empowers you to handle critical documentation with confidence.

-

Is airSlate SignNow secure for storing ccc file usda documents?

Yes, airSlate SignNow takes security seriously, ensuring that your ccc file usda documents are stored securely with advanced encryption. The platform adheres to industry standards for data protection, giving you peace of mind when managing sensitive agricultural records. This focus on security helps you comply with USDA regulations efficiently.

Get more for Form 933

- Sheboygan area school district time sheet form

- Form no 30b see rule 43 no objection certificate for a person incometaxindiapr gov

- Johns hopkins appointment request form

- Bc 1206 department of commerce osec doc form

- Warranty carter fence company form

- Construction sitework application form

- Funding opportunities for ports and near port communitiesfunding opportunities for ports and near port communitiesfunding form

Find out other Form 933

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free