Forms for Unemployment TaxArizona Department AZ DES

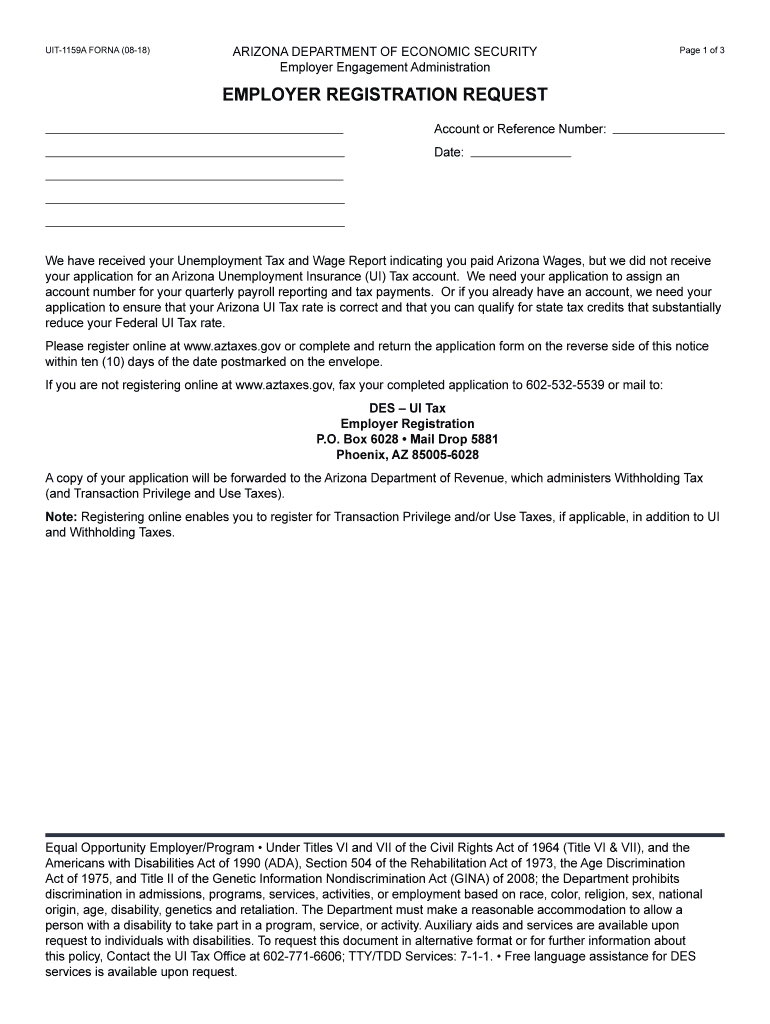

What is the uit 1159a form?

The uit 1159a form, also known as the Arizona unemployment tax form, is a crucial document used by employers in Arizona to report and pay unemployment insurance taxes. This form is essential for ensuring compliance with state regulations regarding unemployment benefits. Employers must accurately complete this form to maintain their standing with the Arizona Department of Economic Security (DES) and to contribute to the state's unemployment insurance fund.

Steps to complete the uit 1159a form

Completing the uit 1159a form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial records, including payroll information and employee details. Follow these steps:

- Enter your business information, including name, address, and employer identification number.

- Report total wages paid to employees during the reporting period.

- Calculate the unemployment tax due based on the reported wages.

- Review the form for accuracy before submission.

- Submit the form by the designated deadline to avoid penalties.

How to obtain the uit 1159a form

The uit 1159a form can be obtained directly from the Arizona Department of Economic Security's website. It is available in both printable and fillable formats, allowing employers to choose the method that best suits their needs. Additionally, employers can contact the DES for assistance or clarification on obtaining the form if needed.

Legal use of the uit 1159a form

The legal use of the uit 1159a form is governed by Arizona state law, which mandates that employers file this form to report unemployment taxes. Proper completion and timely submission of the form ensure that employers remain compliant with state regulations and avoid potential legal issues related to unemployment insurance. Failure to use the form correctly can result in penalties and interest on unpaid taxes.

Filing deadlines for the uit 1159a form

Employers must adhere to specific filing deadlines for the uit 1159a form to avoid penalties. Typically, the form is due quarterly, with deadlines set for the last day of the month following the end of each quarter. For instance, the deadlines are usually April 30, July 31, October 31, and January 31. It is essential for employers to mark these dates on their calendars to ensure timely submission.

Examples of using the uit 1159a form

Employers use the uit 1159a form in various scenarios, such as reporting wages for seasonal employees or calculating unemployment taxes for newly hired staff. For example, a small business that hires temporary workers during peak seasons must accurately report their wages using this form. Additionally, companies that experience layoffs must file the form to ensure they are contributing appropriately to the unemployment insurance fund.

Quick guide on how to complete forms for unemployment taxarizona department az des

Effortlessly Prepare Forms For Unemployment TaxArizona Department AZ DES on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing for easy access and secure online storage. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without hassles. Manage Forms For Unemployment TaxArizona Department AZ DES on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered task today.

Editing and eSigning Forms For Unemployment TaxArizona Department AZ DES Made Easy

- Obtain Forms For Unemployment TaxArizona Department AZ DES and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and eSign Forms For Unemployment TaxArizona Department AZ DES and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is uit 1159a and how does it relate to airSlate SignNow?

Uit 1159a refers to a specific regulation that can affect how businesses manage their document signing processes. airSlate SignNow provides a streamlined solution that enables companies to remain compliant with uit 1159a while ensuring efficient document handling. By utilizing our platform, businesses can easily create, send, and eSign documents securely.

-

How can airSlate SignNow help with compliance related to uit 1159a?

AirSlate SignNow is designed with compliance in mind, ensuring that all eSignatures and document management processes meet the necessary regulations, including uit 1159a. Our platform offers features that guide users through compliant practices, making it easier for businesses to adhere to legal requirements while signing documents electronically.

-

What are the pricing options for airSlate SignNow in relation to uit 1159a compliance?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it cost-effective to maintain compliance with uit 1159a. Each plan includes features that support secure and compliant document signing. You can choose from various subscriptions based on your business's needs, ensuring a suitable option for handling uit 1159a compliance.

-

What features does airSlate SignNow provide for managing documents under uit 1159a?

AirSlate SignNow provides essential features for document management, including customizable templates, signature workflows, and secure storage—all vital for compliance with uit 1159a. These features not only streamline the signing process but also help businesses maintain accurate records and audit trails, essential under uit 1159a regulations.

-

Can airSlate SignNow integrate with other applications to assist with uit 1159a?

Yes, airSlate SignNow offers a wide range of integrations with popular applications that can assist in maintaining compliance with uit 1159a. These integrations facilitate seamless workflows and help users manage their eSigning processes more efficiently. By connecting with other tools, businesses can enhance their document management practices while aligning with uit 1159a.

-

What are the benefits of using airSlate SignNow regarding uit 1159a?

Using airSlate SignNow provides numerous benefits for businesses looking to comply with uit 1159a, including increased efficiency, reduced processing times, and improved security measures for document management. Our platform automates various signing processes, which not only saves time but also decreases the chances of errors and increases compliance. Businesses can confidently manage their documents while adhering to uit 1159a regulations.

-

Is it easy to get started with airSlate SignNow for uit 1159a compliance?

Absolutely! Getting started with airSlate SignNow for uit 1159a compliance is simple and user-friendly. We provide step-by-step guidance, resources, and support to help businesses implement our eSigning solution quickly. Once set up, you'll be able to send and manage signed documents in accordance with uit 1159a effortlessly.

Get more for Forms For Unemployment TaxArizona Department AZ DES

- Serving notices during tenancy province of british columbia form

- Motion and order to recognize foreign judgments form

- Have passed until 20 form

- Notice to owner of obligation arising from conractcorporation form

- Installment agreement conservationtools form

- La rev stat94832 rs 94832cancellation of notice of form

- Know all men by these presents that as principal whose form

- 15th judicial district court parish of acadia form

Find out other Forms For Unemployment TaxArizona Department AZ DES

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe