Reciprocity Exemption 2021

What is the Reciprocity Exemption

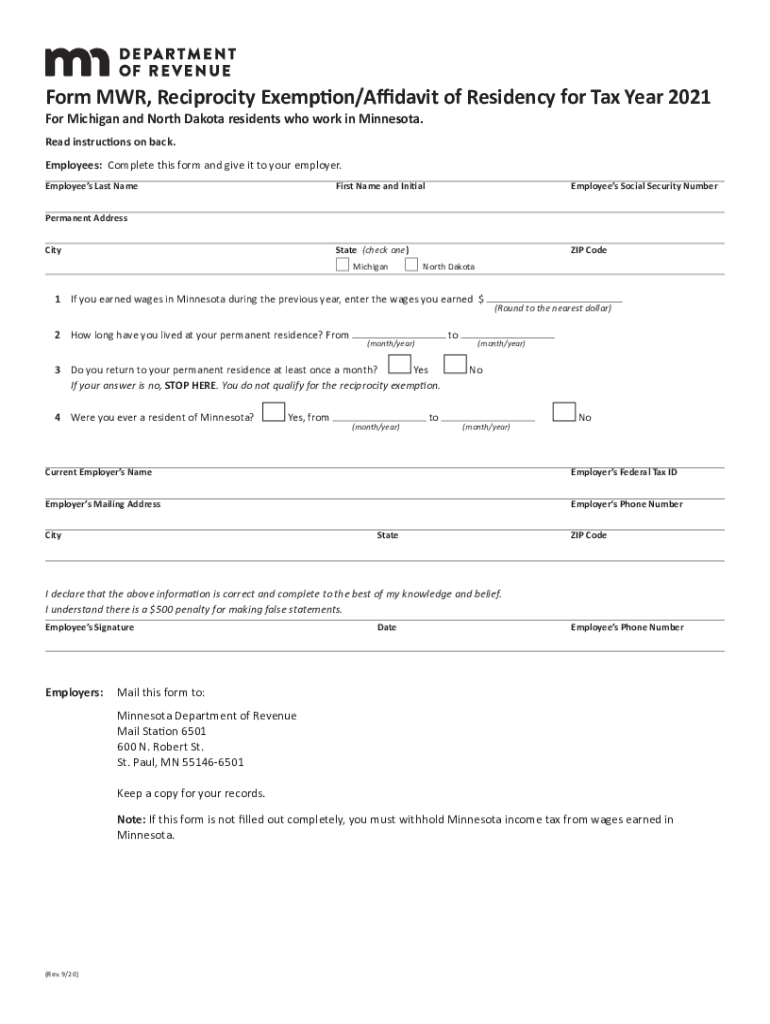

The reciprocity exemption in Minnesota allows residents of certain states to avoid double taxation on income earned in Minnesota. This exemption is particularly relevant for individuals who work in Minnesota but reside in another state that has a reciprocity agreement with Minnesota. By applying for this exemption, taxpayers can ensure that they are not taxed by both states on the same income, thus simplifying their tax obligations.

How to use the Reciprocity Exemption

To utilize the reciprocity exemption, individuals must complete the appropriate Minnesota reciprocity form. This form typically requires information about the taxpayer's residency, income sources, and the state of residence. Once completed, it should be submitted to the employer to ensure that Minnesota state taxes are not withheld from the employee's paycheck. It is important to keep a copy of the submitted form for personal records.

Steps to complete the Reciprocity Exemption

Completing the Minnesota reciprocity exemption involves several key steps:

- Obtain the Minnesota reciprocity form from the Minnesota Department of Revenue website or through your employer.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Indicate your state of residence and confirm that it has a reciprocity agreement with Minnesota.

- Submit the completed form to your employer to prevent state tax withholding.

Eligibility Criteria

To qualify for the Minnesota reciprocity exemption, individuals must meet specific criteria. They must be residents of a state that has a reciprocity agreement with Minnesota, such as Wisconsin, Iowa, or North Dakota. Additionally, the income earned in Minnesota must be subject to the exemption, and the taxpayer must not be a resident of Minnesota. Meeting these eligibility requirements ensures that individuals can benefit from the exemption and avoid double taxation.

Required Documents

When applying for the Minnesota reciprocity exemption, certain documents may be required. These typically include:

- A completed Minnesota reciprocity form.

- Proof of residency in the state that has a reciprocity agreement with Minnesota.

- Any additional documentation requested by the employer or the Minnesota Department of Revenue.

Legal use of the Reciprocity Exemption

The legal use of the Minnesota reciprocity exemption hinges on compliance with state tax laws. Taxpayers must accurately complete the required forms and submit them in a timely manner to their employers. Failure to do so may result in improper withholding of state taxes and potential penalties. It is essential to understand the legal framework surrounding the exemption to ensure proper adherence to all regulations.

Quick guide on how to complete reciprocity exemption

Complete Reciprocity Exemption effortlessly on any device

Web-based document management has gained immense popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without any hold-ups. Manage Reciprocity Exemption on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Reciprocity Exemption without any hassle

- Find Reciprocity Exemption and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the document or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Reciprocity Exemption and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reciprocity exemption

Create this form in 5 minutes!

People also ask

-

What is Minnesota reciprocity in relation to airSlate SignNow?

Minnesota reciprocity refers to the ability to recognize signatures and documents from other states as valid within Minnesota. With airSlate SignNow, businesses can seamlessly manage and validate documents signed outside of Minnesota, ensuring compliance and ease of use.

-

How does airSlate SignNow support Minnesota reciprocity for businesses?

airSlate SignNow provides businesses with tools to ensure that electronic signatures adhere to Minnesota reciprocity regulations. Our platform simplifies the document signing process while maintaining legal validity, making it a convenient choice for companies operating across state lines.

-

What are the pricing options for using airSlate SignNow with Minnesota reciprocity?

airSlate SignNow offers a variety of pricing plans tailored to meet the diverse needs of businesses leveraging Minnesota reciprocity. These plans ensure that you can choose an option that provides the total eSignature solution without compromising on budget.

-

What features does airSlate SignNow provide to enhance Minnesota reciprocity compliance?

airSlate SignNow includes features like advanced authentication, audit trails, and customizable templates, all contributing to Minnesota reciprocity compliance. These functionalities ensure that every electronic signature is secure, traceable, and legally binding.

-

How does airSlate SignNow integrate with other applications for Minnesota reciprocity?

airSlate SignNow offers seamless integrations with several applications to streamline workflows that involve Minnesota reciprocity. These integrations allow for automatic document management, making it easier to gather and validate signatures from clients or partners in and out of Minnesota.

-

What are the benefits of using airSlate SignNow for Minnesota reciprocity?

Using airSlate SignNow for Minnesota reciprocity enables businesses to enhance efficiency and reduce turnaround time for document signing. It also minimizes paperwork, saves costs, and ensures that your documents remain valid across state lines, allowing for smoother operations.

-

Is airSlate SignNow user-friendly for employees dealing with Minnesota reciprocity?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for employees to navigate the platform while handling Minnesota reciprocity. Its intuitive interface enables quick adaptation, ensuring that your team can focus on productivity rather than paperwork.

Get more for Reciprocity Exemption

- Of final account and form

- And acknowledgment and form

- 14 1401 copies of the order to personal representative and acknowledgment and information to heirs to the

- Arizona affidavit evidence termination of joint tenancy form

- Information to heirs

- Representative for approval of form

- Representative andor form

- The following inventory of property contains a true statement of all the property owned by decedent as form

Find out other Reciprocity Exemption

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors